Please use a PC Browser to access Register-Tadawul

Qorvo (QRVO) Returns to Profitability, But One-Off Loss Challenges Reliability of Earnings Recovery

Qorvo, Inc. QRVO | 89.40 89.40 | -0.62% 0.00% Pre |

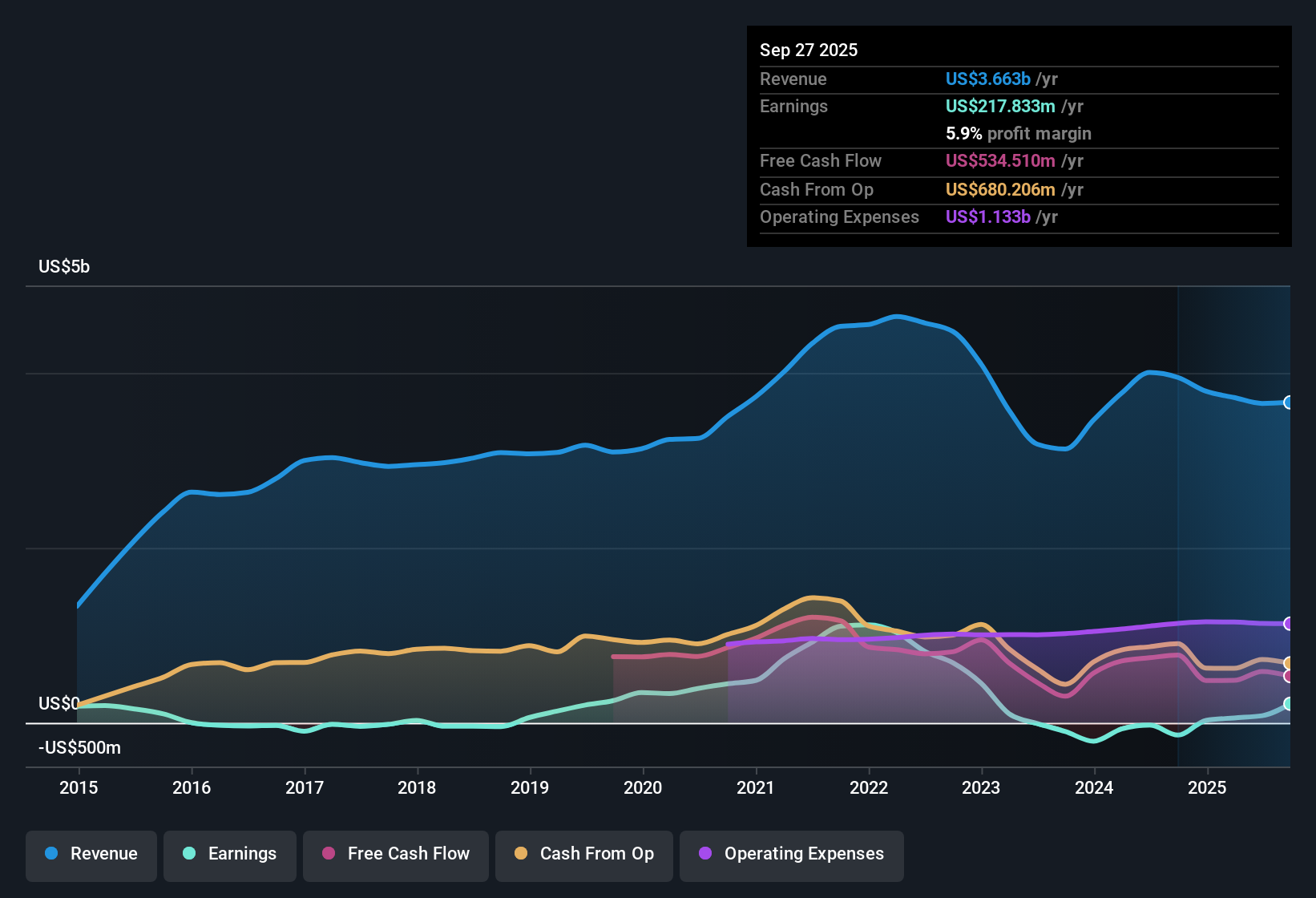

Qorvo (QRVO) just returned to profitability, but the company’s earnings have declined by 49.9% per year over the last five years. Looking ahead, analysts expect annual earnings growth of 20.2%, outpacing the projected 16% for the broader US market, while revenue is forecast to rise by a slower 3.8% per year compared to the market’s 10.5%. Despite improved margins as profits came back, a one-off $166.9 million loss still weighs on the quality of recent results. Investors are left to balance the potential for strong projected growth with ongoing concerns about earnings consistency.

See our full analysis for Qorvo.Next, we’ll see how these headline numbers measure up to the key narratives shaping market expectations. Some long-held views may be reinforced, while others could be in for a challenge.

Margins Rebound as Profitability Returns

- Profit margins have increased from 2.2% now to an estimate of 11.6% in three years, despite a recent $166.9 million one-off loss impacting reported results.

- According to the analysts' consensus view, several structural changes underpin margin expansion:

- Efforts such as exiting low-margin Android businesses and closing underutilized manufacturing sites are projected to drive lasting cost savings and support higher margins starting late fiscal 2027.

- Broader adoption of 5G and growth in high-margin defense and wireless infrastructure is expected to diversify revenue and enhance margin resilience. This reinforces the consensus expectation for sustained margin gains even as near-term volatility remains.

- For investors weighing these improvements, the latest earnings support—but do not guarantee—the consensus case for healthier margins ahead.

What could nudge Qorvo’s margin expansion story off track or supercharge it? Analysts dig deeper in their full consensus narrative for Qorvo: 📊 Read the full Qorvo Consensus Narrative.

Customer Concentration Heightens Volatility Risk

- Qorvo’s largest customer accounted for 41% of revenue this quarter, exposing the company to significant concentration risk.

- The consensus narrative stresses that this heavy dependence makes Qorvo vulnerable:

- Any slowdown in demand or changes in supplier relationships with this customer could trigger sharp swings in revenue and earnings, especially as legacy Android revenues drop and diversification is still underway.

- Furthermore, global trade tensions and regulatory shifts have already led to some customer demand reductions and production delays, which could keep margins under pressure if disruptions persist.

Valuation Sits Between Discount and Premium

- The current share price of $87.54 trades below DCF fair value of $96.10, but Qorvo’s price-to-earnings ratio of 37.1x remains above the semiconductor industry average of 36.6x and peer average of 30.2x.

- In the analysts' consensus view, this pricing presents a nuanced picture:

- While shares appear undervalued relative to DCF fair value, the above-average PE ratio suggests investors are already pricing in much of the expected earnings growth, especially compared to industry peers.

- The consensus expectation is that Qorvo’s multiple could move closer to 24.0x by 2028 if earnings targets are met, so ongoing delivery on growth and margin expansion remains critical to avoid further derating.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Qorvo on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Think you have a unique take on the figures? Share your perspective and shape a fresh narrative in just minutes: Do it your way

A great starting point for your Qorvo research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Qorvo’s high customer concentration and below-industry revenue growth make its results more volatile and less reliable compared to stable growth peers.

If you want more certainty and steadier fundamentals, use our stable growth stocks screener (2084 results) to pinpoint companies that keep delivering consistent growth year after year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.