Please use a PC Browser to access Register-Tadawul

Should Twilio's (TWLO) Vodafone Spain RCS Deal Signal a Turning Point for Its Global Expansion?

Twilio, Inc. Class A TWLO | 127.32 | +1.68% |

- Earlier this month, Vodafone Spain announced an expanded partnership with Twilio to bring Rich Communication Services (RCS) messaging to Spanish businesses, empowering them to deliver interactive, secure, and personalized customer communications leveraging Twilio’s global expertise.

- With 81% of consumers preferring RCS over SMS according to Twilio’s State of Customer Engagement 2025 report, this collaboration signals a shift toward more impactful and measurable business messaging standards in the Spanish market.

- We’ll now explore how Twilio’s RCS rollout with Vodafone Spain shapes its investment outlook and supports the company’s focus on global expansion.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Twilio Investment Narrative Recap

To be a Twilio shareholder today, you need conviction that enterprises will keep adopting richer communication channels, like RCS, to drive customer engagement, and that Twilio can balance global expansion with improving gross margins. While the Vodafone Spain announcement strengthens Twilio’s international footprint and brings advanced messaging features to a large new market, its impact on margin pressures, the most important short-term catalyst, and on the biggest risk, ongoing margin compression from messaging mix, seems incremental rather than transformational for now.

Among Twilio’s recent actions, the August 2025 launch of global RCS messaging is particularly relevant here, showcasing that Vodafone Spain is one of several international carriers integrating this new channel. These product and carrier partnerships directly support Twilio’s push to drive omnichannel customer engagement, reinforcing the narrative that incremental innovation and international expansion remain key near-term drivers for both growth and gross margin improvements.

However, as Twilio expands messaging options and enters lower-margin regions, investors should be aware that pressing margin headwinds could...

Twilio's narrative projects $5.9 billion revenue and $449.9 million earnings by 2028. This requires 7.9% yearly revenue growth and a $429.7 million earnings increase from $20.2 million today.

Uncover how Twilio's forecasts yield a $130.88 fair value, a 17% upside to its current price.

Exploring Other Perspectives

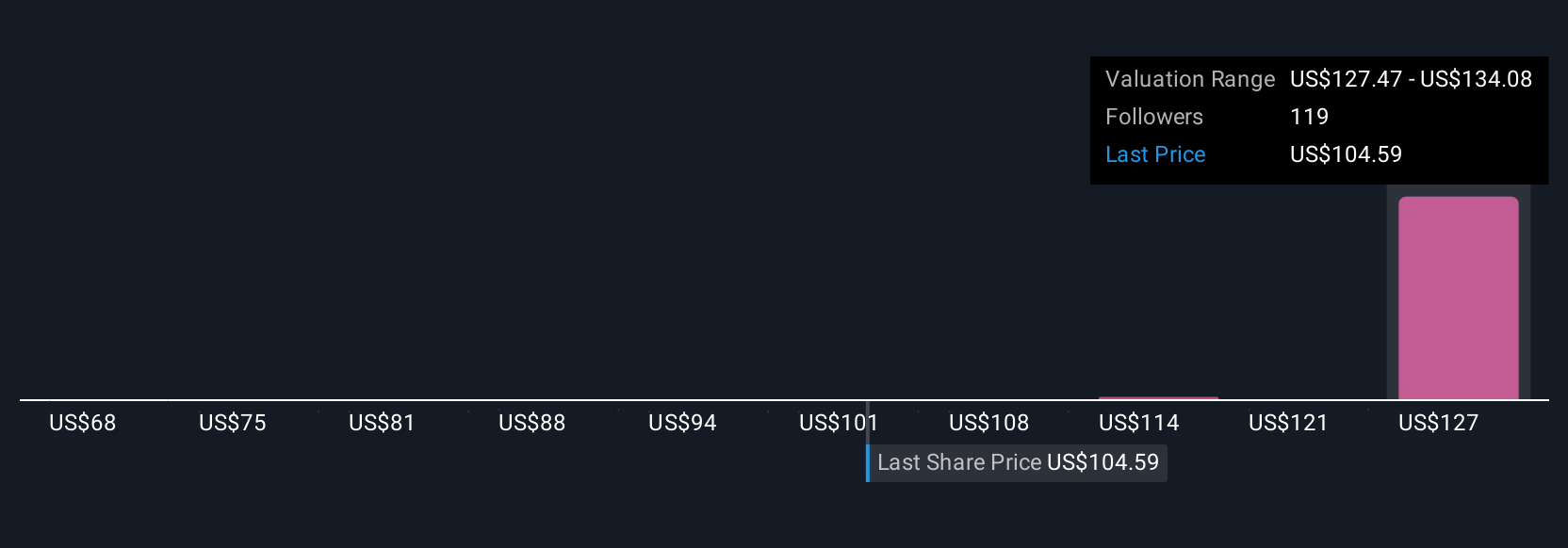

Six private investors in the Simply Wall St Community estimate Twilio’s fair value between US$68 and US$131.38 per share. With gross margin improvement still the main focus after international agreements, it’s clear opinions on future performance are diverse, explore the range of views and what could influence outcomes.

Explore 6 other fair value estimates on Twilio - why the stock might be worth 39% less than the current price!

Build Your Own Twilio Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Twilio research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Twilio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Twilio's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.