Please use a PC Browser to access Register-Tadawul

Should You Take a Fresh Look at Freeport-McMoRan After Its 8% Price Rebound?

Freeport-McMoRan, Inc. FCX | 45.20 | +1.32% |

Thinking about what to do with your Freeport-McMoRan shares? You are definitely not alone. With a stock price that rebounded 8.6% in the last week after a tough 13.0% dip over the past month, plenty of investors are weighing if now is a moment of renewed promise, or simply a pause on a bumpy road. Longer-horizon holders have seen quite a ride, too: Freeport-McMoRan is still up 44.0% over three years and a whopping 155.4% in five. The past year, however, has reminded everyone of risk, with a 19.4% drop stinging even after factoring in a modest 6.4% gain since the start of this year.

So, what is really happening under the hood? Much of the recent shift in sentiment ties back to changes in global copper demand and shifting commodity market expectations. Investors are now recalibrating growth potential as well as potential risks tied to cyclical swings and emerging market pressures. That kind of background is exactly why a clear look at valuation matters more than ever right now.

Measured in six different ways, Freeport-McMoRan scores a 3, meaning the company checks the box for undervaluation in half of the classic approaches analysts often debate. But just how convincing is that score, and are there nuances hidden beneath the headline numbers? Next, we will dig into the details of each valuation approach. After that, I will show you an even more insightful lens to judge whether Freeport-McMoRan is really a deal at today’s price.

Approach 1: Freeport-McMoRan Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model projects a company’s future cash flows and then discounts them back to today’s value. This approach estimates what the business is truly worth by looking at how much cash it can generate, rather than just its profits or assets.

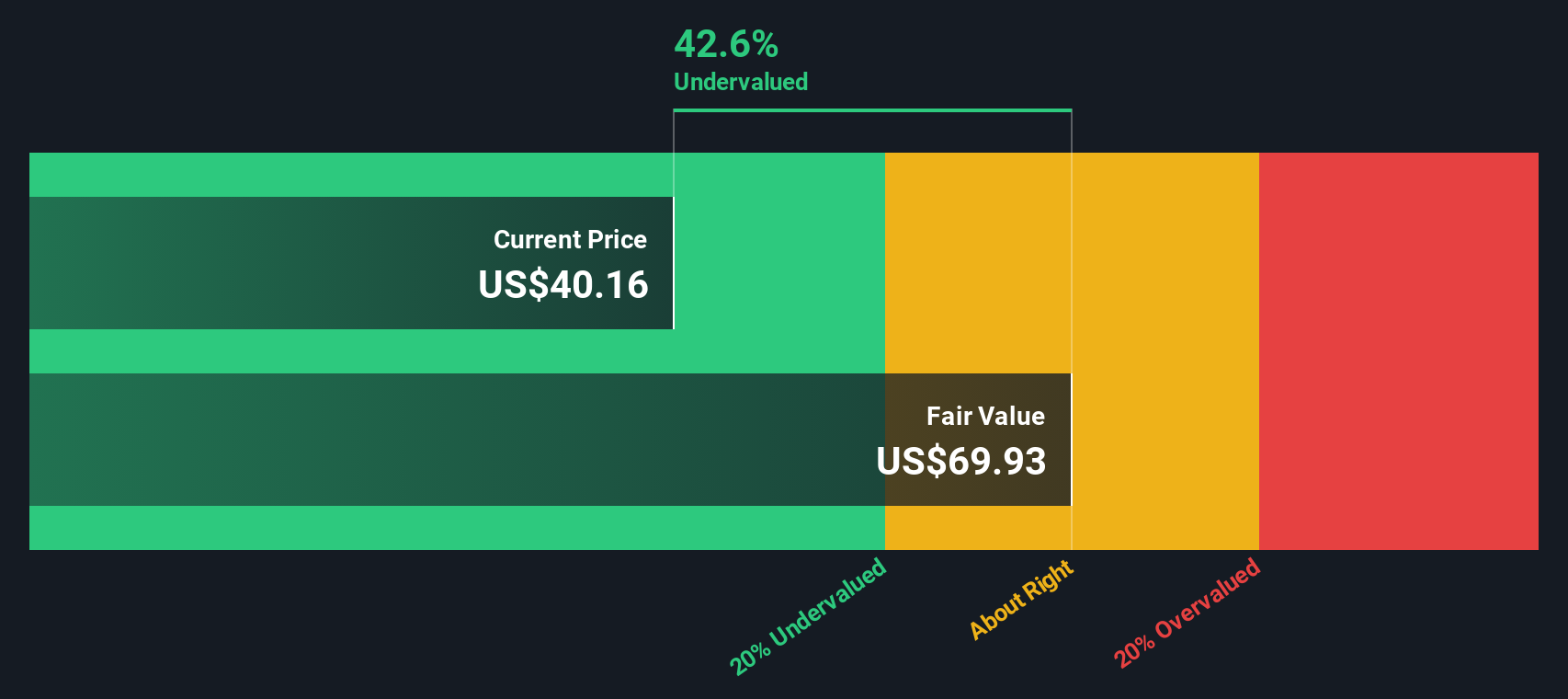

For Freeport-McMoRan, the current free cash flow is around $1.59 billion. Analysts forecast substantial growth, with annual free cash flow projected to reach approximately $5.30 billion by 2029. It is important to note that while analyst estimates are available for the next five years, further projections are extrapolated by Simply Wall St. This offers a longer view into a potentially evolving global metals and mining environment.

Based on these forecasts, the DCF analysis sets Freeport-McMoRan’s estimated intrinsic value at $59.71 per share. When compared to its recent trading price, this means the stock is trading at a 32.5% discount to what the cash flows suggest it is worth.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Freeport-McMoRan is undervalued by 32.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Freeport-McMoRan Price vs Earnings

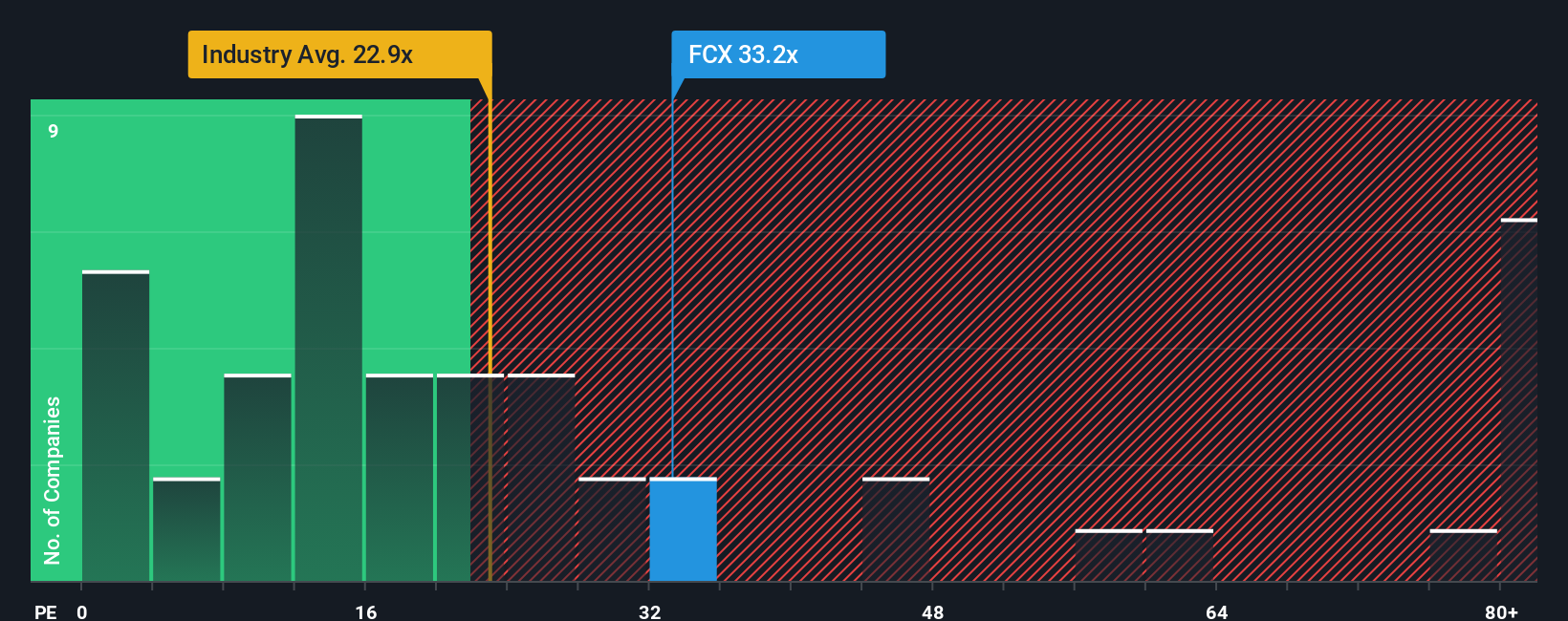

The Price-to-Earnings (PE) ratio is a go-to valuation metric for profitable companies like Freeport-McMoRan because it quickly tells investors how much they are paying for each dollar of earnings. Generally, a higher PE suggests investors are willing to pay a premium for growth, quality, or stability, while a lower PE can flag either an undervalued stock or a riskier business.

What makes a “normal” or “fair” PE ratio is not just about current profits. It reflects expectations around future earnings growth, consistency of those earnings, company-specific risks, and the going rate for similar stocks in the same sector. So, it is important to look at Freeport-McMoRan’s PE of 30.2x in context. Both the peer average (23.7x) and the broader metals and mining industry average (24.1x) come in lower than Freeport’s current level, which could suggest the stock is a bit on the expensive side compared to its peers and the wider industry.

This is where Simply Wall St’s “Fair Ratio” comes into play. The Fair Ratio represents the PE you would reasonably expect given Freeport-McMoRan’s growth outlook, profit margins, market cap, industry environment, and risks. It provides a tailored benchmark that goes beyond simple peer or industry comparisons. For Freeport-McMoRan, the Fair Ratio is calculated at 30.3x. Since this is almost identical to the company’s actual PE, it means the current stock price closely matches what would be considered fair value given all those factors combined.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Freeport-McMoRan Narrative

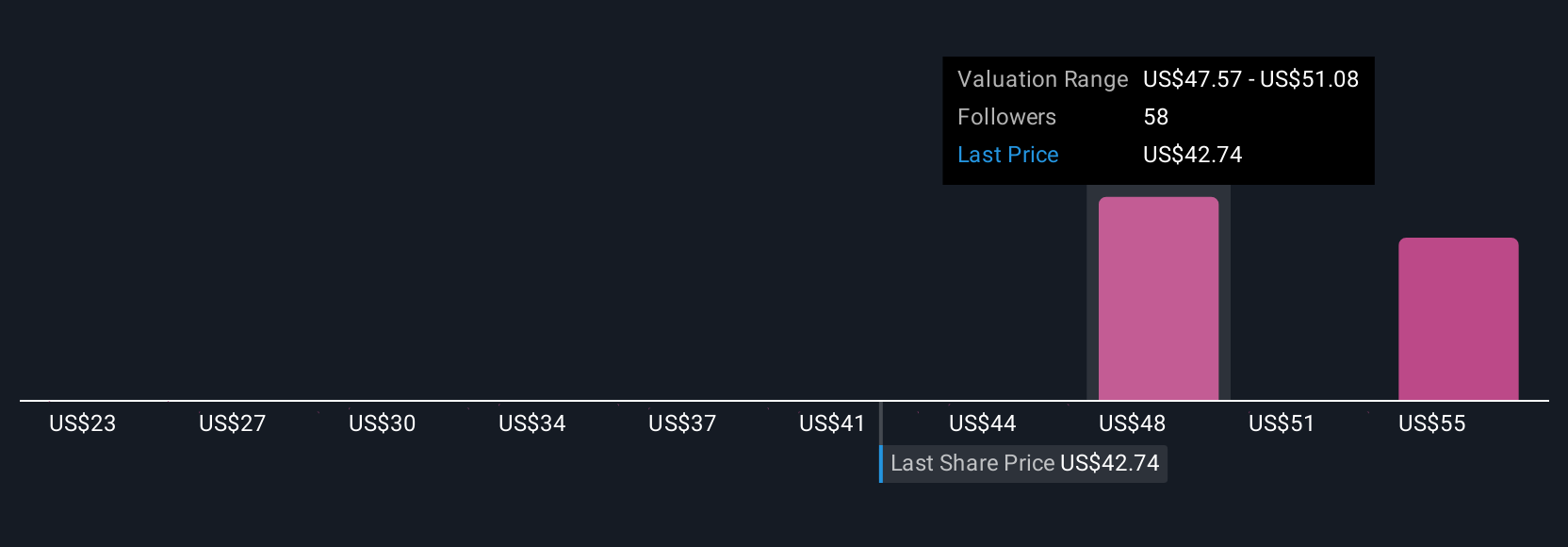

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story behind the numbers. It is a way to express your unique expectations for a company’s future revenue, earnings, and profit margins, and then see how those assumptions drive your personal fair value alongside the current price.

Unlike just relying on static ratios or average forecasts, Narratives connect a company’s big-picture story directly to a financial forecast and automatically estimate what a fair value should be. This tool is available right on Simply Wall St’s Community page, used by millions of investors. It is accessible to anyone seeking a tailored view beyond consensus numbers.

Narratives help investors make more confident decisions about when to buy or sell by clearly showing if their personalized fair value is above or below today’s market price. They update automatically as market news, results, or analyst forecasts change, keeping your view fresh and relevant.

For example, with Freeport-McMoRan, some investors may build bullish Narratives around growth from the new Indonesian smelter and premium U.S. copper pricing, producing high fair values near $57 per share. Others may focus on risks like Grasberg production disruptions or regulatory pressures, producing more cautious fair values closer to $27 per share.

Do you think there's more to the story for Freeport-McMoRan? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.