Please use a PC Browser to access Register-Tadawul

The Bull Case For Compañía de Minas BuenaventuraA (BVN) Could Change Following 22.6% Earnings Estimate Upgrade

Compania de Minas Buenaventura SAA Sponsored ADR BVN | 25.25 | -0.24% |

- In the past quarter, Compañía de Minas BuenaventuraA's full-year earnings estimates have been revised upward by 22.6%, outpacing the average for other Basic Materials stocks. This strong shift in earnings expectations highlights renewed investor focus on Buenaventura as it leads its sector in analyst support.

- We'll examine how these positive revisions to earnings estimates may influence Buenaventura's investment outlook and future performance narrative.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Compañía de Minas BuenaventuraA Investment Narrative Recap

Being a shareholder in Compañía de Minas BuenaventuraA means believing in its potential to capture value from rising gold, silver, and copper production, supported by projects like San Gabriel and strong operational momentum. The recent sharp upward revision in earnings estimates is encouraging, but as the company pushes for higher output, the largest short-term catalyst remains the successful ramp-up of San Gabriel, while ongoing cost and operational risks could temper near-term optimism if not managed carefully. Among recent announcements, Buenaventura’s full redemption of its 5.500 percent Senior Notes due 2026 stands out as highly relevant. Reducing near-term debt obligations not only improves financial flexibility, but could also support funding for project ramp-ups like San Gabriel and potentially reduce liquidity concerns in the face of fluctuating commodity prices. However, against these positives, investors should not overlook the pressure that sustained cost inflation or production disruptions could put on cash flows and capital spending if...

Compañía de Minas BuenaventuraA is projected to reach $1.4 billion in revenue and $490.9 million in earnings by 2028. This outlook assumes a 2.8% annual revenue growth rate and reflects a decrease in earnings of $15.5 million from the current $506.4 million.

Uncover how Compañía de Minas BuenaventuraA's forecasts yield a $17.82 fair value, a 28% downside to its current price.

Exploring Other Perspectives

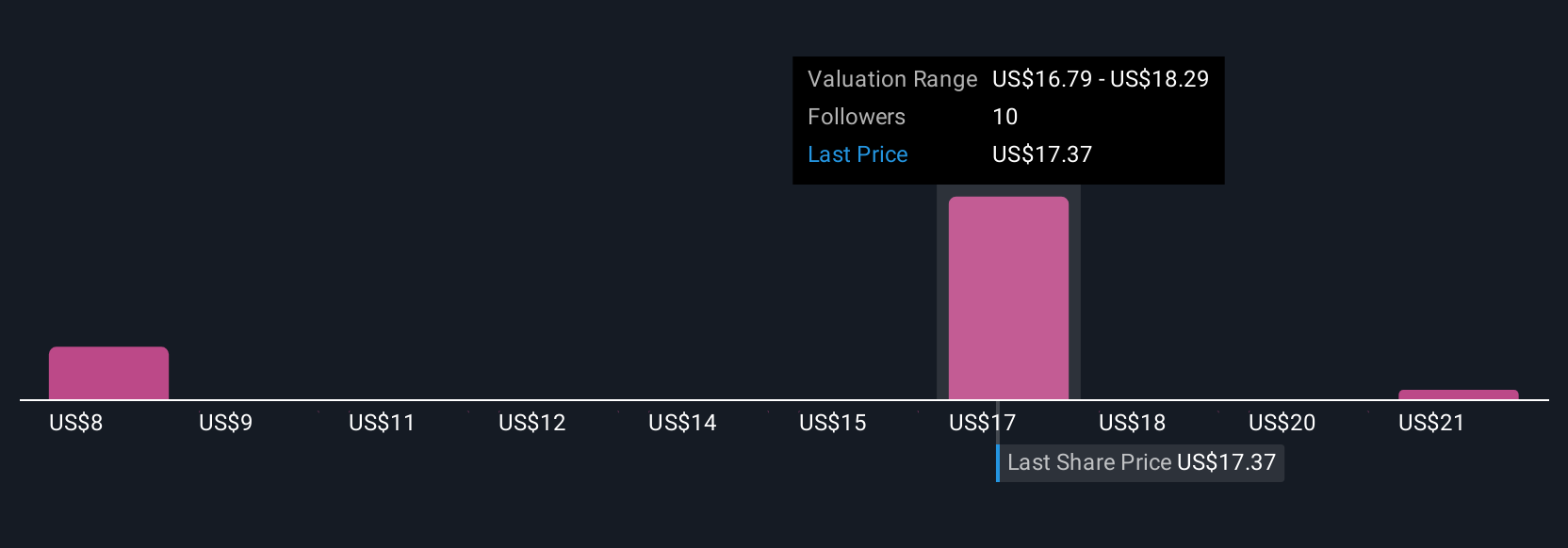

Fair value estimates from five Simply Wall St Community members span a wide range, from US$7.73 to US$22.78 per share. With such varied opinions, it’s clear that uncertainty around cost inflation and project execution remains top of mind for many market participants, and readers are encouraged to compare several viewpoints before making decisions.

Explore 5 other fair value estimates on Compañía de Minas BuenaventuraA - why the stock might be worth as much as $22.78!

Build Your Own Compañía de Minas BuenaventuraA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Compañía de Minas BuenaventuraA research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Compañía de Minas BuenaventuraA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Compañía de Minas BuenaventuraA's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.