Please use a PC Browser to access Register-Tadawul

The Bull Case for Seadrill (SDRL) Could Change Following Q3 Loss and Updated Revenue Guidance

Seadrill Ltd. SDRL | 31.51 31.51 | -1.53% 0.00% Pre |

- Seadrill Limited recently announced its third quarter 2025 financial results, reporting sales of US$289 million and a net loss of US$11 million, alongside narrowing and raising its full-year operating revenue guidance to a range of US$1.36 billion to US$1.39 billion.

- While revenue improved year-over-year, the shift to a quarterly net loss and loss per share marks a significant turn from the previous year's profitability.

- We'll explore how Seadrill's updated revenue guidance and third quarter earnings impact its longer-term investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Seadrill Investment Narrative Recap

To own Seadrill stock, investors need to believe that improving revenue guidance can offset near-term earnings pressure from softer offshore drilling demand and rising competition. The third quarter net loss and shrinking profit margins reinforce that utilization and dayrate recovery remain the most important short-term catalyst, while the largest immediate risk continues to be the impact of underutilized assets and volatile contract approvals in core markets. This latest update doesn’t fundamentally alter the key risks or catalysts, but does narrow expectations for financial performance in the near term.

Among recent announcements, Seadrill’s decision to revise and raise its full-year operating revenue guidance is most relevant, as it signals management’s confidence in current backlog conversion despite persistent margin pressure. While this guidance lift reflects stronger contract execution, it does not diminish the need to monitor utilization rates and keep an eye on unresolved regulatory and legal issues that could impact future cash flow. In contrast, investors should be aware of how ongoing administrative and political delays in regions like Angola could...

Seadrill's narrative projects $1.6 billion in revenue and $231.6 million in earnings by 2028. This requires 7.2% yearly revenue growth and a $154.6 million earnings increase from $77.0 million currently.

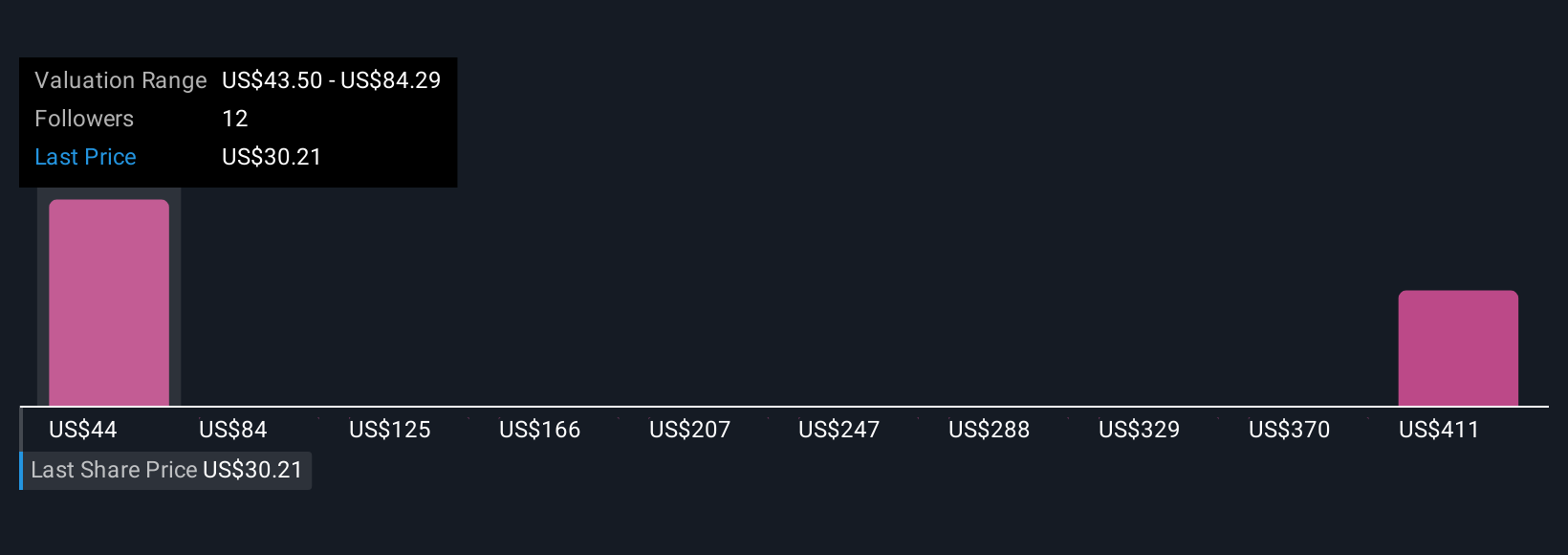

Uncover how Seadrill's forecasts yield a $43.50 fair value, a 38% upside to its current price.

Exploring Other Perspectives

Five private investors in the Simply Wall St Community see fair values for Seadrill ranging from US$42.86 to US$453.19 per share. With near-term revenue guidance now narrowed, it is clear that opinions around Seadrill's recovery potential differ widely, consider taking a closer look at why expectations for utilization and competition matter so much for future performance.

Explore 5 other fair value estimates on Seadrill - why the stock might be a potential multi-bagger!

Build Your Own Seadrill Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Seadrill research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Seadrill research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Seadrill's overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.