Please use a PC Browser to access Register-Tadawul

Tutor Perini (TPC): Evaluating Valuation After Major $182 Million U.S. Defense Contract Win in Guam

Tutor Perini Corporation TPC | 67.82 | -1.19% |

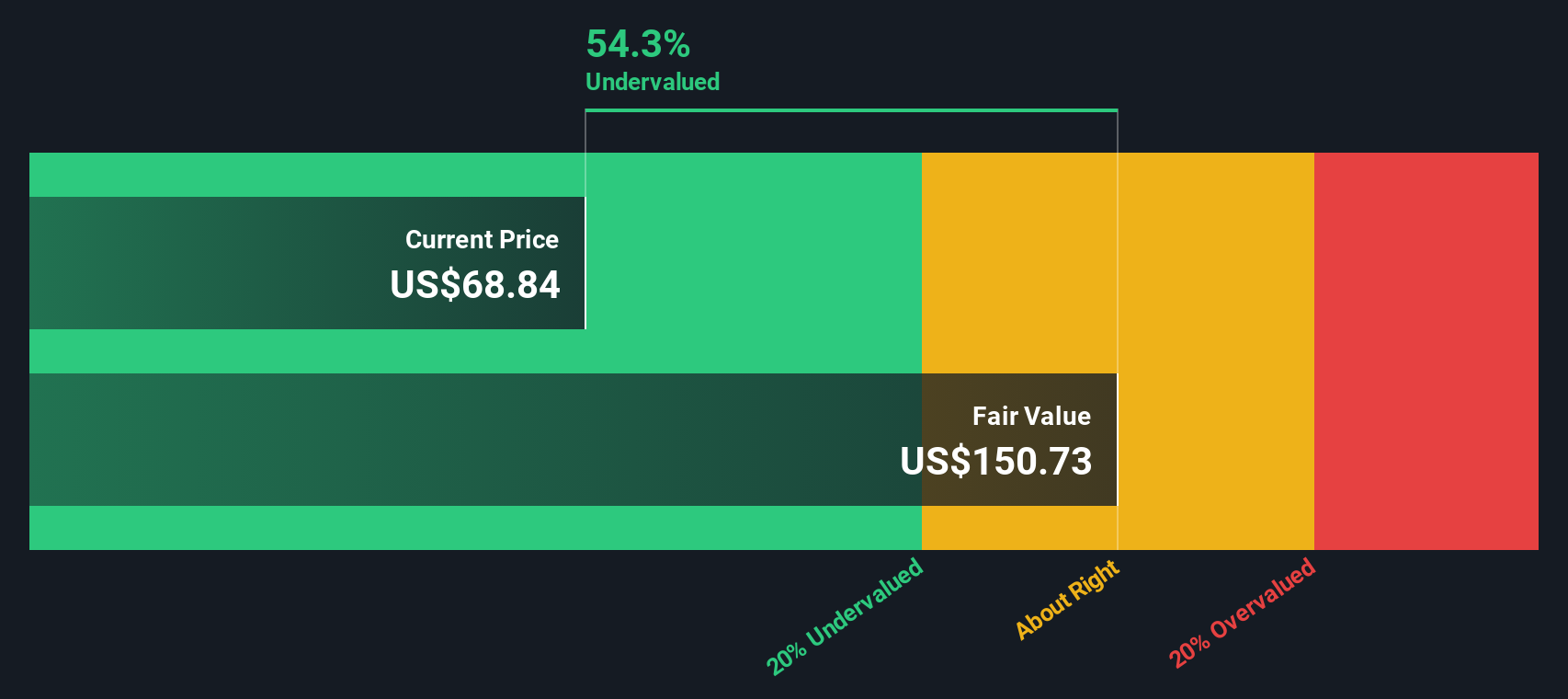

When Tutor Perini (TPC) reveals a major new contract win from the U.S. Defense Department, long-time shareholders pay attention. The company’s joint venture was just awarded a $181.8 million order for enhanced air and missile defense construction in Guam. This project adds immediate heft to its future backlog and signals confidence from a key government client. While the work will not kick off until early 2026, news like this tends to prompt fresh debates about future earnings and valuation, leaving investors wondering how much is already being priced into the stock.

This defense deal caps a year that has seen Tutor Perini shares rise sharply, with the stock climbing over 170% in the past year and over 440% in the past 3 months alone. Momentum has built up as the story has shifted from concerns over losses to strong revenue and profit growth, with recent contract wins offering a clear boost. Against the backdrop of multi-year outperformance, events like this contract award appear even more relevant to the company’s growth narrative and to the ongoing discussion over whether investors are now giving it too much credit in the price.

Are investors getting ahead of themselves, or does Tutor Perini still represent a unique opportunity at current levels? Let’s dig into the numbers and see if there is real value left on the table.

Most Popular Narrative: 19.4% Undervalued

The most widely followed valuation narrative suggests that Tutor Perini is trading at a notable discount to fair value, implying material upside if bullish assumptions play out.

Record backlog growth, now at an all-time high of $21.1 billion (up 102% year over year), provides strong visibility and multi-year revenue predictability, as a series of major projects ramp up over the next several years.

Curious how this construction giant is projected to leap so far ahead? The narrative rests on a rare mix of recurring revenues, higher future margins, and a profitability turnaround few dared to forecast. Want to see which bold projections are powering this target? The full story explores the ambitious trajectory and the precise numbers behind this valuation.

Result: Fair Value of $75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent cost overruns or setbacks on large-scale projects could quickly undermine the bullish outlook and pose real challenges for Tutor Perini’s future performance.

Find out about the key risks to this Tutor Perini narrative.Another View: Our DCF Model Paints a Sharper Picture

Looking at Tutor Perini through the lens of our DCF model, the story is even more striking. The results suggest the shares remain undervalued based on projected cash flows. Could there be more to the upside?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Tutor Perini Narrative

If you have a different perspective or want to dive deeper into the details yourself, it only takes a few minutes to craft your own outlook. Do it your way.

A great starting point for your Tutor Perini research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let today’s opportunity be tomorrow’s regret. Expand your horizons and tap into top-performing stocks and emerging trends with our powerful stock screener tools.

- Supercharge your income stream by targeting companies offering generous yields with dividend stocks with yields > 3%.

- Spot undervalued gems ready for potential breakout growth through undervalued stocks based on cash flows.

- Ride the AI revolution early by tracking innovative companies transforming business and technology with AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.