Please use a PC Browser to access Register-Tadawul

Uncovering Middle East Gems Including Saudi Reinsurance and 2 Promising Small Caps

SAUDI RE 8200.SA | 28.30 | +1.43% |

As Gulf markets experience mixed performances amid investor caution ahead of crucial U.S. jobs data, the Middle East's economic landscape remains dynamic with key indices like Saudi Arabia's benchmark showing modest gains. This environment presents opportunities for discerning investors to uncover promising stocks, such as those in the reinsurance sector and small-cap companies that can thrive despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In The Middle East

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Al Wathba National Insurance Company PJSC | 10.97% | 10.37% | 3.14% | ★★★★★★ |

| Baazeem Trading | 8.48% | -1.74% | -2.37% | ★★★★★★ |

| Qassim Cement | NA | 0.78% | -14.90% | ★★★★★★ |

| Sure Global Tech | NA | 10.11% | 15.42% | ★★★★★★ |

| Saudi Azm for Communication and Information Technology | 1.94% | 16.33% | 21.26% | ★★★★★★ |

| Nofoth Food Products | NA | 15.49% | 26.47% | ★★★★★★ |

| MOBI Industry | 18.09% | 6.66% | 22.02% | ★★★★★★ |

| Najran Cement | 14.76% | -3.67% | -26.79% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.58% | 25.09% | ★★★★★☆ |

| Etihad Atheeb Telecommunication | 0.97% | 37.69% | 60.25% | ★★★★★☆ |

Underneath we present a selection of stocks filtered out by our screen.

Saudi Reinsurance (SASE:8200)

Simply Wall St Value Rating: ★★★★☆☆

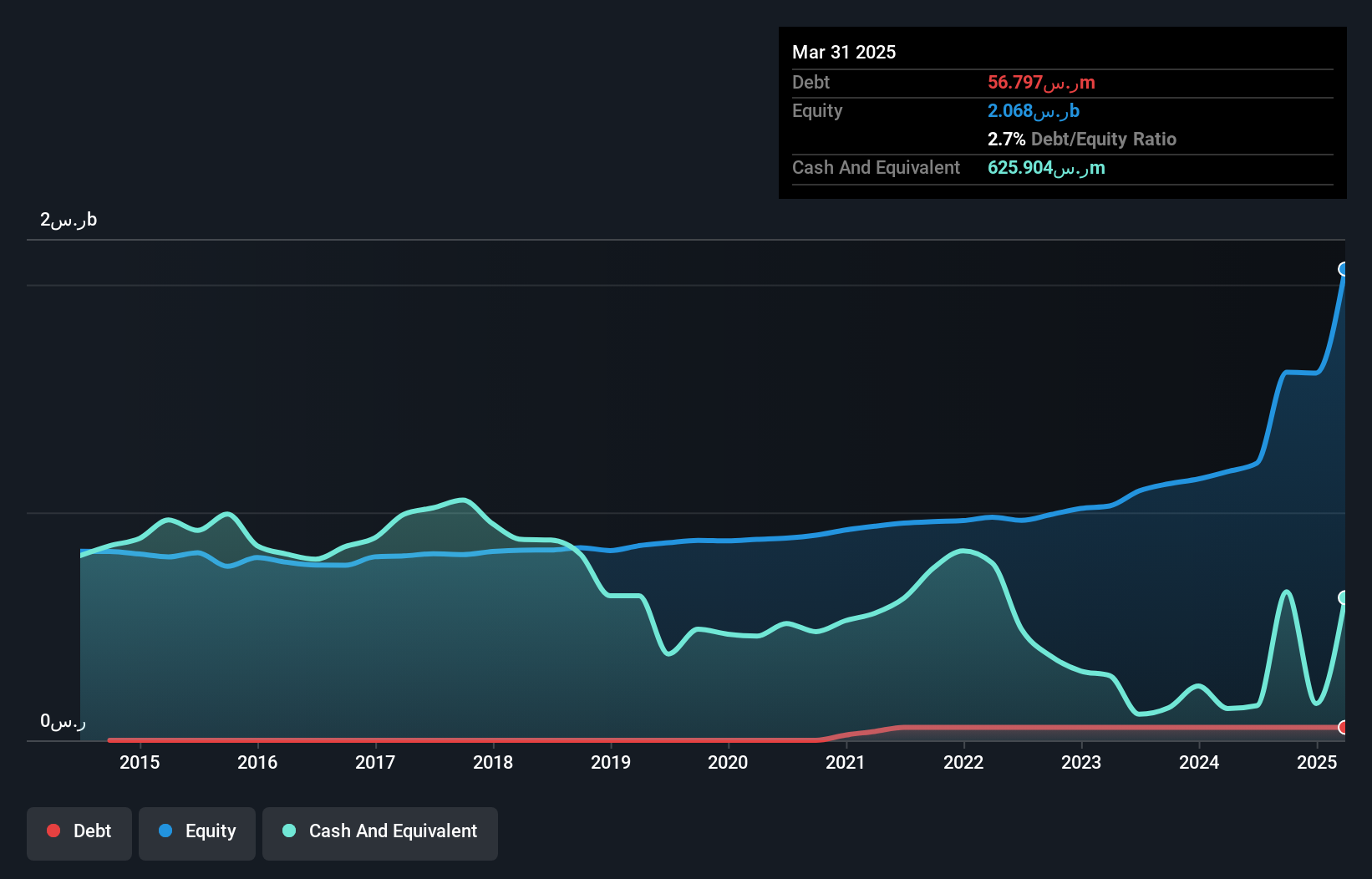

Overview: Saudi Reinsurance Company offers a range of reinsurance products across Saudi Arabia, the Middle East, Africa, Asia, and globally, with a market capitalization of SAR5.18 billion.

Operations: The company's primary revenue streams include Property and Casualty, generating SAR1.28 billion, and Life and Health at SAR48.85 million. Notably, the net income from financial investments measured at fair value contributes SAR34.70 million to its financials.

Saudi Re has shown remarkable earnings growth of 279% over the past year, significantly outpacing the insurance industry's -19%. Trading at a price-to-earnings ratio of 10.7x, it offers good value compared to the SA market average of 20.1x. The company recently signed a reinsurance contract with Tawuniya Insurance, expected to boost revenue by over 5%. Despite recent shareholder dilution, Saudi Re remains profitable with strong interest coverage at 46.8 times EBIT and more cash than total debt, suggesting financial resilience amidst forecasts for earnings decline in coming years.

Ayalon Insurance (TASE:AYAL)

Simply Wall St Value Rating: ★★★★★☆

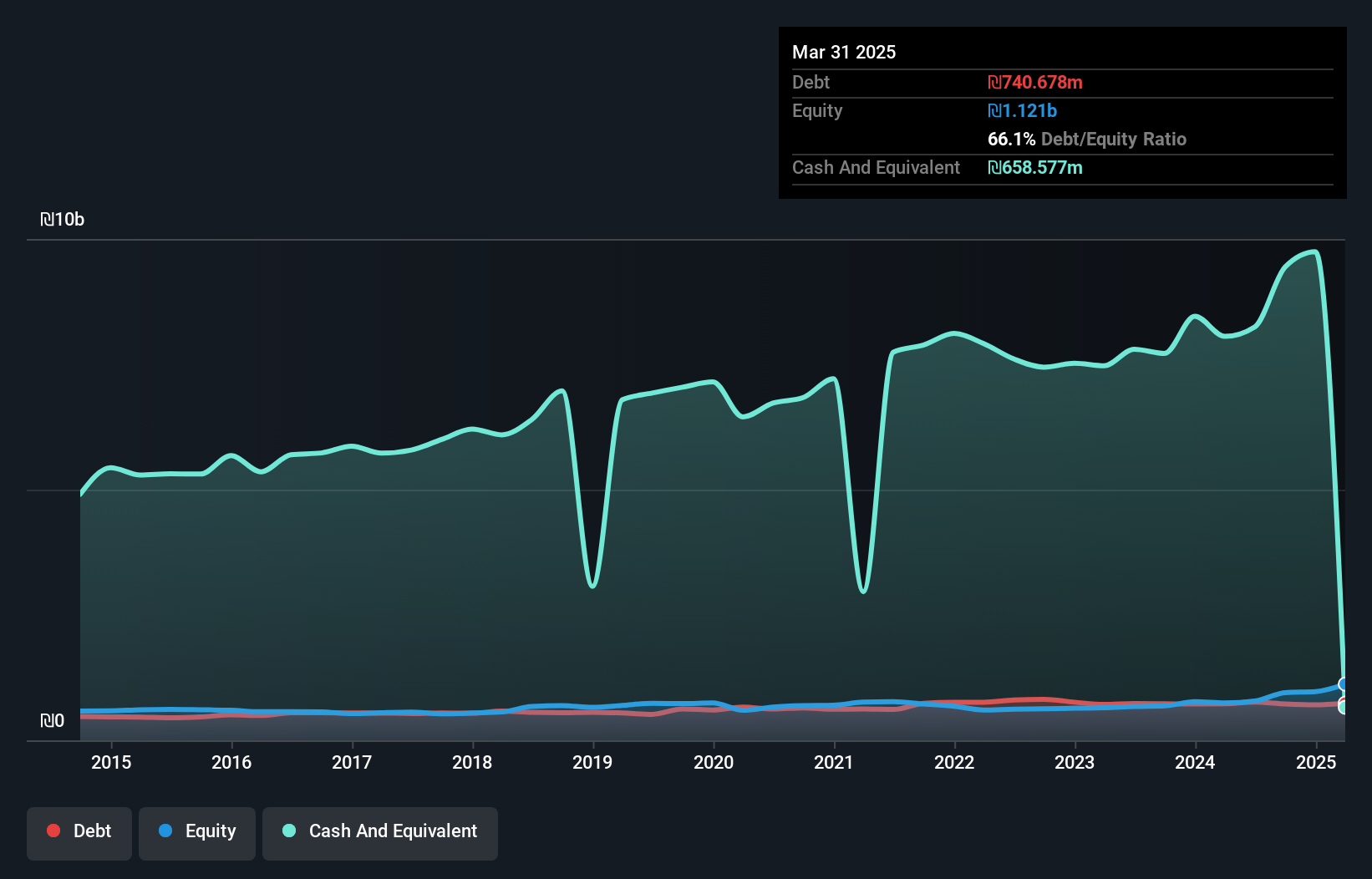

Overview: Ayalon Insurance Company Ltd, with a market cap of ₪1.79 billion, operates in Israel offering a range of insurance products through its subsidiaries.

Operations: Ayalon Insurance generates revenue primarily from life insurance and long-term savings, which contributed ₪1.19 billion, and general insurance segments like automobile property insurance at ₪704.65 million. The company also earns significant income from health insurance amounting to ₪638.15 million and compulsory vehicle insurance totaling ₪335.99 million.

Ayalon Insurance, a nimble player in the insurance sector, is trading at 39.7% below its estimated fair value, suggesting potential for gains. The company boasts high-quality earnings with a robust growth rate of 34.8% over the past year, outpacing the industry average of 34.4%. Ayalon's financial health is underscored by its debt-to-equity ratio reduction from 94% to 54.4% over five years and interest coverage of 6.1x EBIT on debt payments. Recent financial highlights include net income rising to ILS 144 million for Q2, up from ILS 74 million last year, alongside an annual dividend announcement of ILS 3 per share payable in September.

More Provident Funds (TASE:MPP)

Simply Wall St Value Rating: ★★★★☆☆

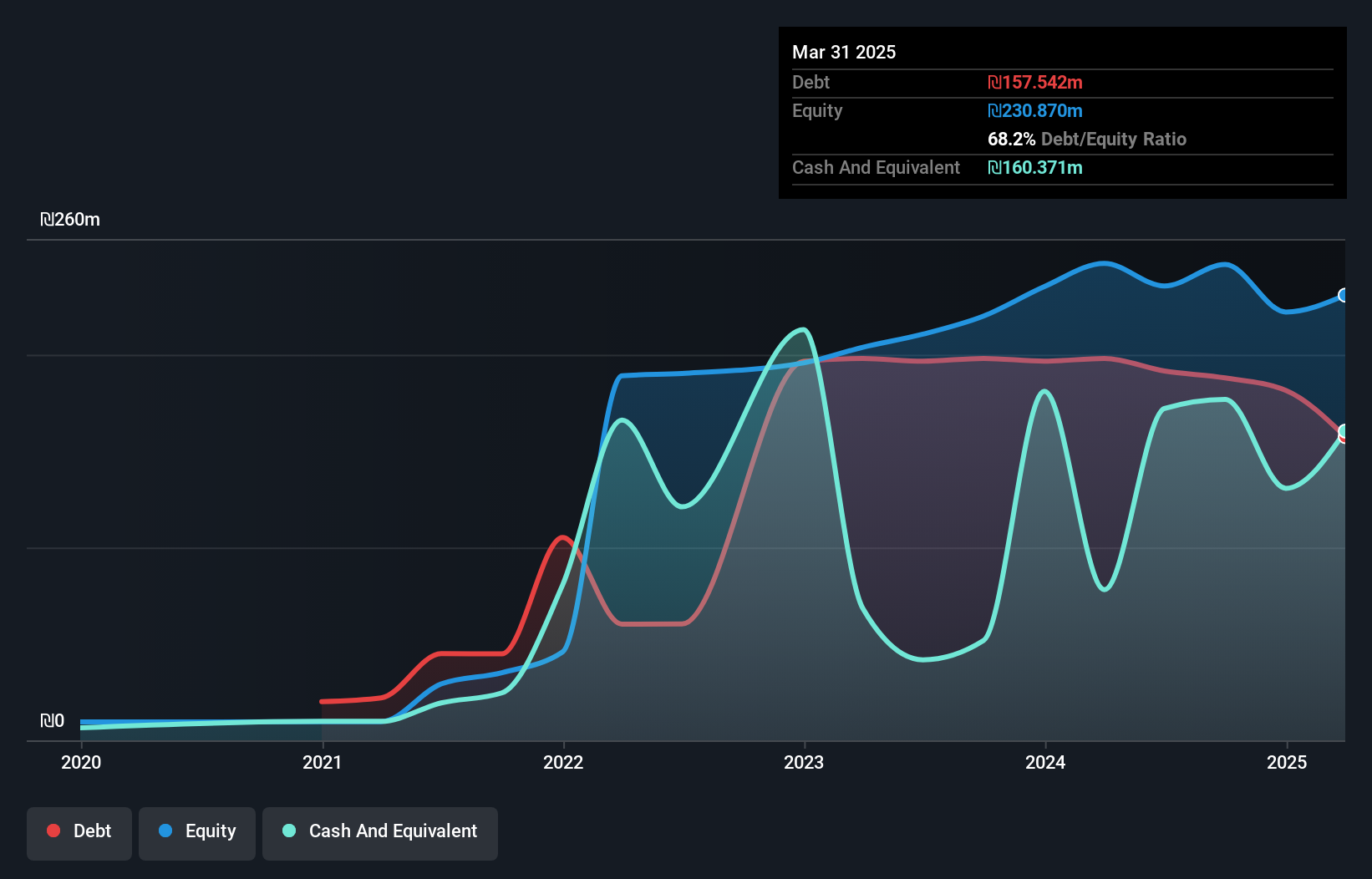

Overview: More Provident Funds Ltd. manages provident and pension funds in Israel with a market capitalization of ₪1.74 billion.

Operations: The company generates revenue primarily from its provident sector, contributing ₪539.64 million, followed by the pension segment at ₪31.73 million. The net profit margin is not provided in the data available for analysis.

More Provident Funds, a relatively smaller player in the Middle East financial landscape, has shown impressive growth with earnings up 42% over the past year, outpacing the industry average. Recent reports indicate a significant increase in net income to ILS 16.71 million for Q2 2025 from ILS 8.27 million last year, reflecting strong operational performance. The debt to equity ratio improved from 104% to 70% over five years, indicating better financial health and stability. With EBIT covering interest payments by a factor of 13.5x and satisfactory net debt levels at 19%, MPP seems well-positioned within its sector despite recent share price volatility.

Seize The Opportunity

- Unlock more gems! Our Middle Eastern Undiscovered Gems With Strong Fundamentals screener has unearthed 196 more companies for you to explore.Click here to unveil our expertly curated list of 199 Middle Eastern Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.