Please use a PC Browser to access Register-Tadawul

Undervalued Small Caps With Insider Action Across Global Markets

THRYV HOLDINGS INC THRY | 5.91 | +2.78% |

As major U.S. stock indices reach record highs, driven by expectations of Federal Reserve interest rate cuts amid a weakening labor market, small-cap stocks are drawing attention for their potential opportunities in this dynamic environment. In such a climate, identifying promising small-cap stocks often involves looking at those with strong fundamentals and strategic insider actions that align with broader economic trends.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Angel Oak Mortgage REIT | 6.3x | 4.0x | 32.08% | ★★★★★★ |

| PCB Bancorp | 10.0x | 3.0x | 32.28% | ★★★★★☆ |

| Peoples Bancorp | 10.4x | 1.9x | 42.36% | ★★★★★☆ |

| Tandem Diabetes Care | NA | 0.8x | 49.87% | ★★★★★☆ |

| Citizens & Northern | 11.6x | 2.9x | 39.96% | ★★★★☆☆ |

| Limbach Holdings | 34.0x | 2.2x | 42.56% | ★★★★☆☆ |

| Thryv Holdings | NA | 0.8x | 27.85% | ★★★★☆☆ |

| Tilray Brands | NA | 1.5x | 4.97% | ★★★★☆☆ |

| Industrial Logistics Properties Trust | NA | 0.9x | 17.64% | ★★★★☆☆ |

| Shore Bancshares | 10.5x | 2.7x | -90.03% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

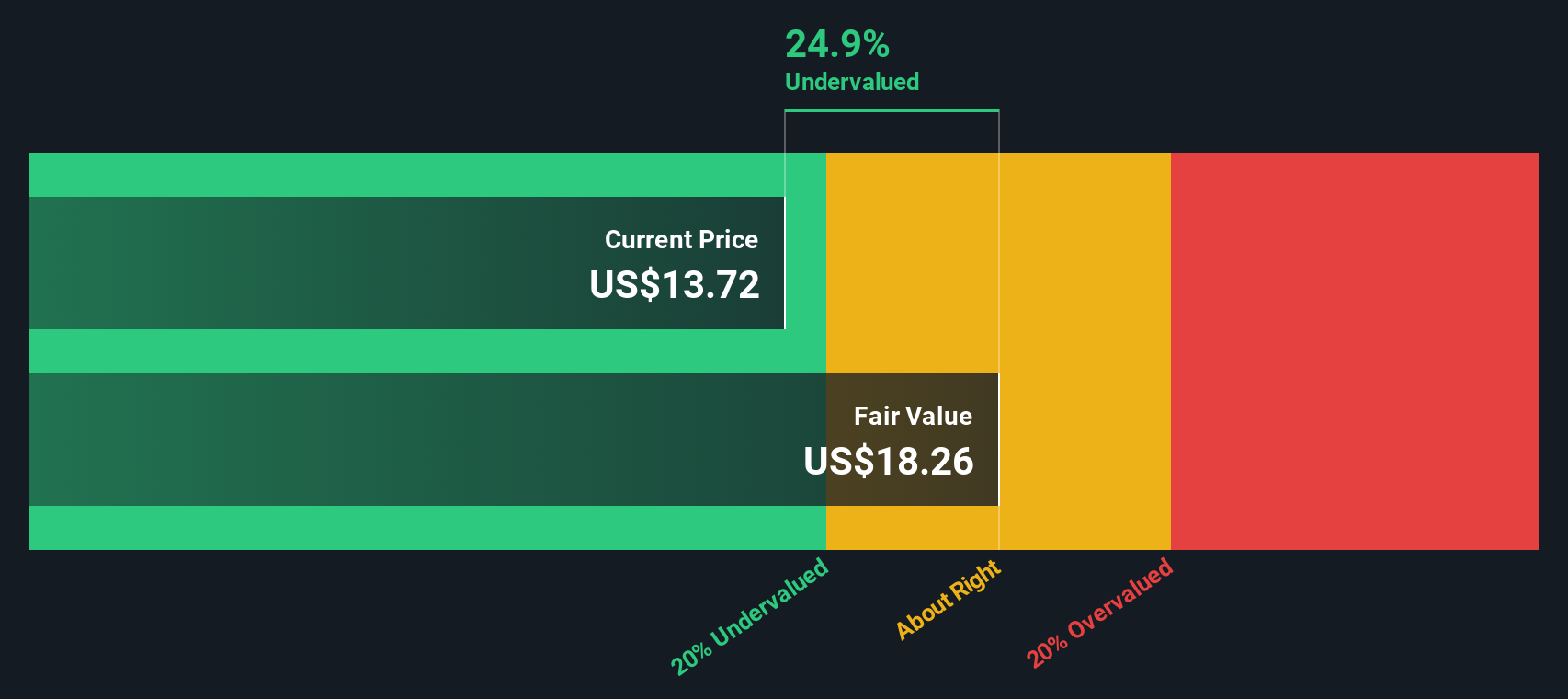

Thryv Holdings (THRY)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Thryv Holdings is a company that provides small to medium-sized businesses with software-as-a-service (SaaS) solutions and marketing services, with a market capitalization of approximately $0.92 billion.

Operations: Thryv Holdings generates revenue primarily from its SaaS and Marketing Services segments, with the former contributing $417.49 million and the latter $340.80 million. Over time, the company has experienced fluctuations in its gross profit margin, which was 66.06% as of June 2025. Operating expenses are significant, with sales and marketing being a major component. The company has faced periods of negative net income margins, indicating challenges in achieving profitability consistently across different quarters.

PE: -6.8x

Thryv Holdings, a company with a focus on SaaS for small businesses, has shown potential as an undervalued investment. Despite recent shareholder dilution and reliance on external borrowing, the company anticipates significant earnings growth of 141.53% annually. Insider confidence is evident with Joseph Walsh purchasing 8,000 shares in August 2025 for US$103,200. Thryv's innovative offerings like the Workforce Center and HVAC solutions highlight its adaptability in niche markets. With projected revenue between US$460 million to US$465 million for 2025, future prospects appear promising amidst current challenges.

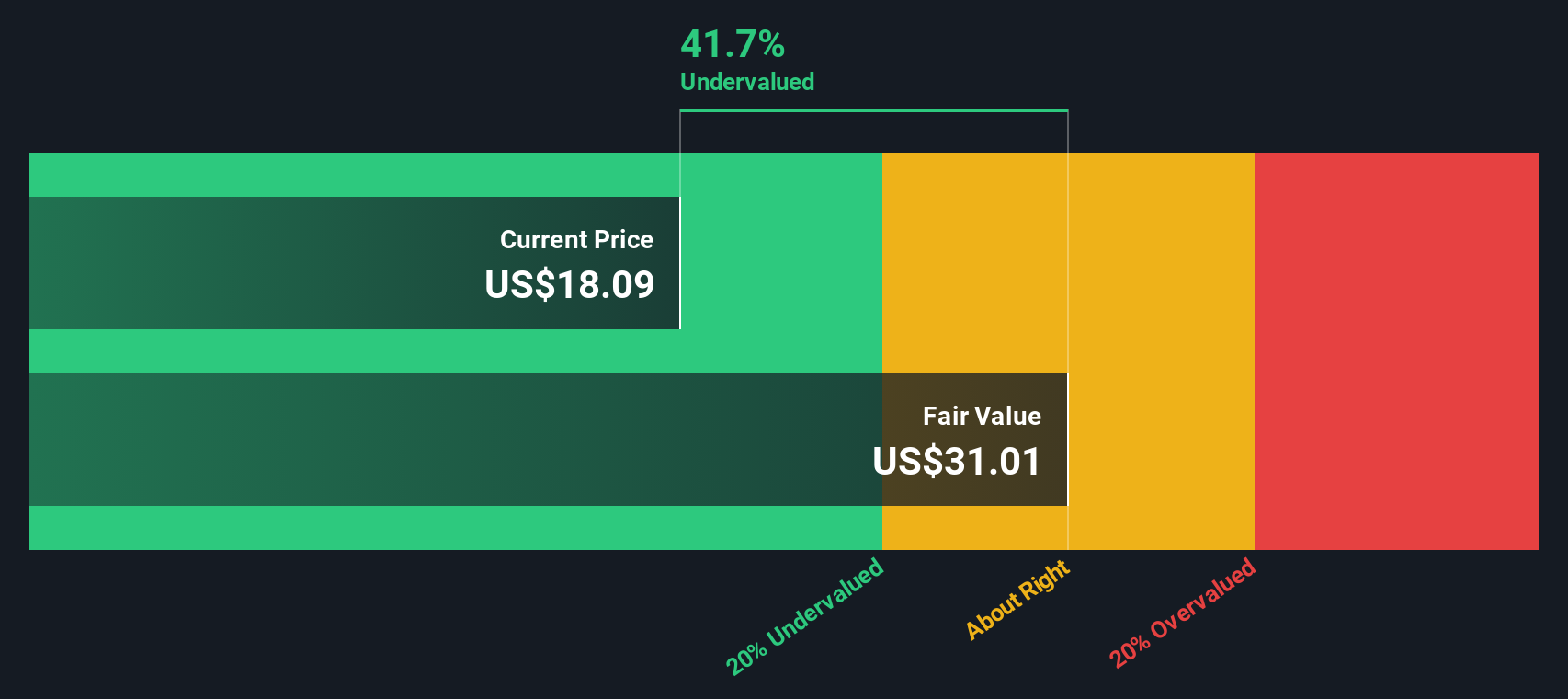

FinWise Bancorp (FINW)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: FinWise Bancorp is a financial institution primarily engaged in banking operations, with a focus on providing various banking services and products.

Operations: The company generates revenue primarily from its banking segment, reporting $74.99 million recently. Operating expenses have shown an upward trend, reaching $56.83 million in the latest period, with general and administrative expenses accounting for $47.22 million of this amount. The net income margin has seen a decline over recent periods, standing at 18.35% as of the most recent report.

PE: 19.0x

FinWise Bancorp, a smaller financial entity in the U.S., is gaining traction despite challenges. With net income rising to US$4.1 million from US$3.18 million year-over-year, it showcases potential growth. However, its high bad loans ratio at 7.4% and low allowance for these loans at 41% pose risks. The company's recent addition to multiple Russell indices highlights market recognition, while insider confidence remains evident through share purchases within the last year, suggesting optimism about future performance prospects.

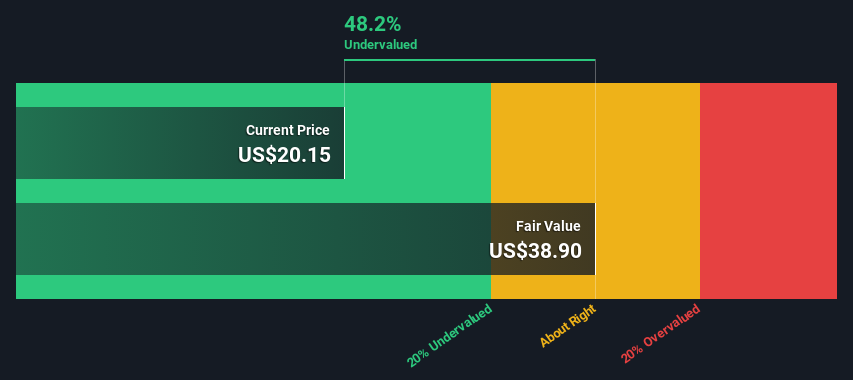

PCB Bancorp (PCB)

Simply Wall St Value Rating: ★★★★★☆

Overview: PCB Bancorp operates in the banking industry, providing a range of financial services with a market capitalization of approximately $0.25 billion.

Operations: The company's revenue primarily stems from its operations in the banking industry, with a recent figure of $102.26 million. Over time, operating expenses have shown variability but remain a significant component of costs, with general and administrative expenses consistently being the largest portion. The net income margin has fluctuated across periods, with a recent value of 29.99%.

PE: 10.0x

PCB Bancorp, a small financial institution, demonstrates potential value through recent financial results and strategic actions. For the second quarter ending June 30, 2025, net interest income rose to US$26 million from US$21.74 million a year earlier, while net income increased to US$9.07 million from US$6.28 million. Insider confidence is evident as the Independent Chairman acquired 18,200 shares for approximately US$390K between April and July 2025. The company also repurchased shares worth US$1.77 million during this period and extended its buyback plan until July 2026, indicating commitment to shareholder value enhancement amidst expected earnings growth of over 10% annually.

Make It Happen

- Navigate through the entire inventory of 79 Undervalued US Small Caps With Insider Buying here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.