Please use a PC Browser to access Register-Tadawul

Undiscovered Gems In The US Market For October 2025

L. B. Foster Company FSTR | 27.01 | +0.93% |

As the U.S. market navigates a wave of earnings reports, with key indices like the Dow Jones and S&P 500 experiencing slight declines, investors are keenly observing how small-cap stocks might offer unique opportunities amid broader economic uncertainties. In this environment, identifying undiscovered gems requires a focus on companies that demonstrate resilience and potential for growth despite prevailing market challenges.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 75.89% | 1.93% | -1.42% | ★★★★★★ |

| Sound Financial Bancorp | 34.70% | 2.11% | -11.08% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Metalpha Technology Holding | NA | 75.66% | 28.60% | ★★★★★★ |

| NameSilo Technologies | 14.73% | 14.50% | -1.32% | ★★★★★☆ |

| Valhi | 44.30% | 1.10% | -1.40% | ★★★★★☆ |

| FRMO | 0.10% | 42.87% | 47.51% | ★★★★★☆ |

| Linkhome Holdings | 7.03% | 215.05% | 239.56% | ★★★★★☆ |

| Gulf Island Fabrication | 20.48% | 3.25% | 43.31% | ★★★★★☆ |

| Greenfire Resources | 35.48% | -1.31% | -25.79% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

L.B. Foster (FSTR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: L.B. Foster Company specializes in providing engineered and manufactured products and services for infrastructure development across the United States, Canada, the United Kingdom, and internationally, with a market capitalization of $281.37 million.

Operations: The company generates revenue through two primary segments: Infrastructure Solutions, contributing $218.36 million, and Rail, Technologies, and Services, contributing $288.64 million.

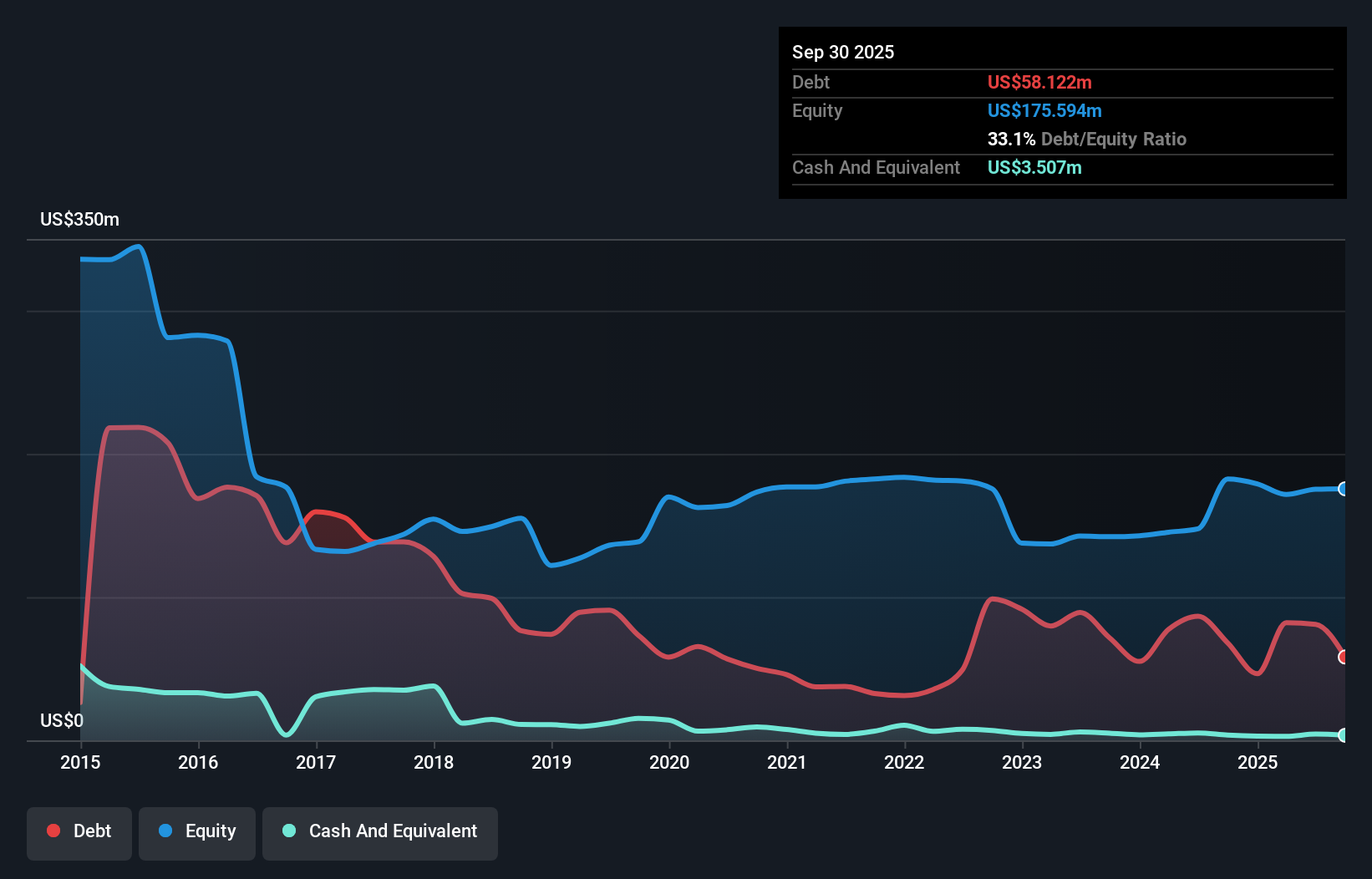

L.B. Foster, a smaller player in the infrastructure sector, is trading at 38.1% below its estimated fair value and has been impacted by a $4.5M one-off loss over the past year. Despite a high net debt to equity ratio of 43.7%, its interest payments are well covered by EBIT at 3.8 times. The company repurchased 108,020 shares for $2.16M between April and June 2025. While earnings grew by 394.5% last year, future earnings are forecasted to decline by 34.5% annually over the next three years. Recent executive changes and government funding support its strategic focus on infrastructure projects.

Legacy Housing (LEGH)

Simply Wall St Value Rating: ★★★★★★

Overview: Legacy Housing Corporation focuses on the construction, sale, and financing of manufactured homes and tiny houses, primarily serving the southern United States, with a market capitalization of $543.01 million.

Operations: Legacy Housing generates revenue primarily from the sale of manufactured buildings, amounting to $184.28 million. The company's financial performance is reflected in its net profit margin, which is 23.41%.

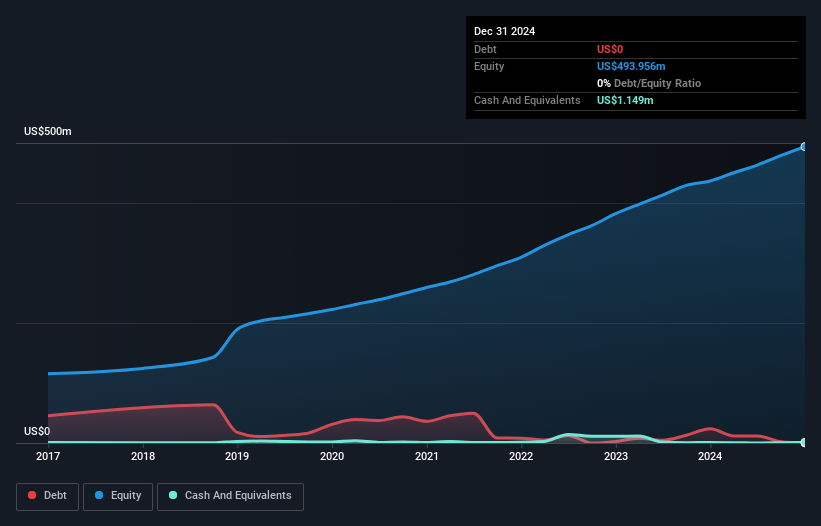

Legacy Housing is carving out a niche in the manufactured homes sector, capitalizing on affordability issues and demographic shifts. The company has reduced its debt to equity ratio from 15.7 to 0.03 over five years, reflecting a strong financial position. Despite a net income of US$14.7 million in Q2 2025, slightly down from US$16.19 million the previous year, Legacy's earnings growth of 1.5% surpassed the industry average of -7.2%. Recent executive changes and product innovations, like the Legacy Ultimate Series, underscore a commitment to growth and adaptation, while share buybacks totaling US$11.2 million signal confidence in future prospects.

Safety Insurance Group (SAFT)

Simply Wall St Value Rating: ★★★★★☆

Overview: Safety Insurance Group, Inc. operates in the United States offering private passenger and commercial automobile, as well as homeowner insurance, with a market capitalization of approximately $1.04 billion.

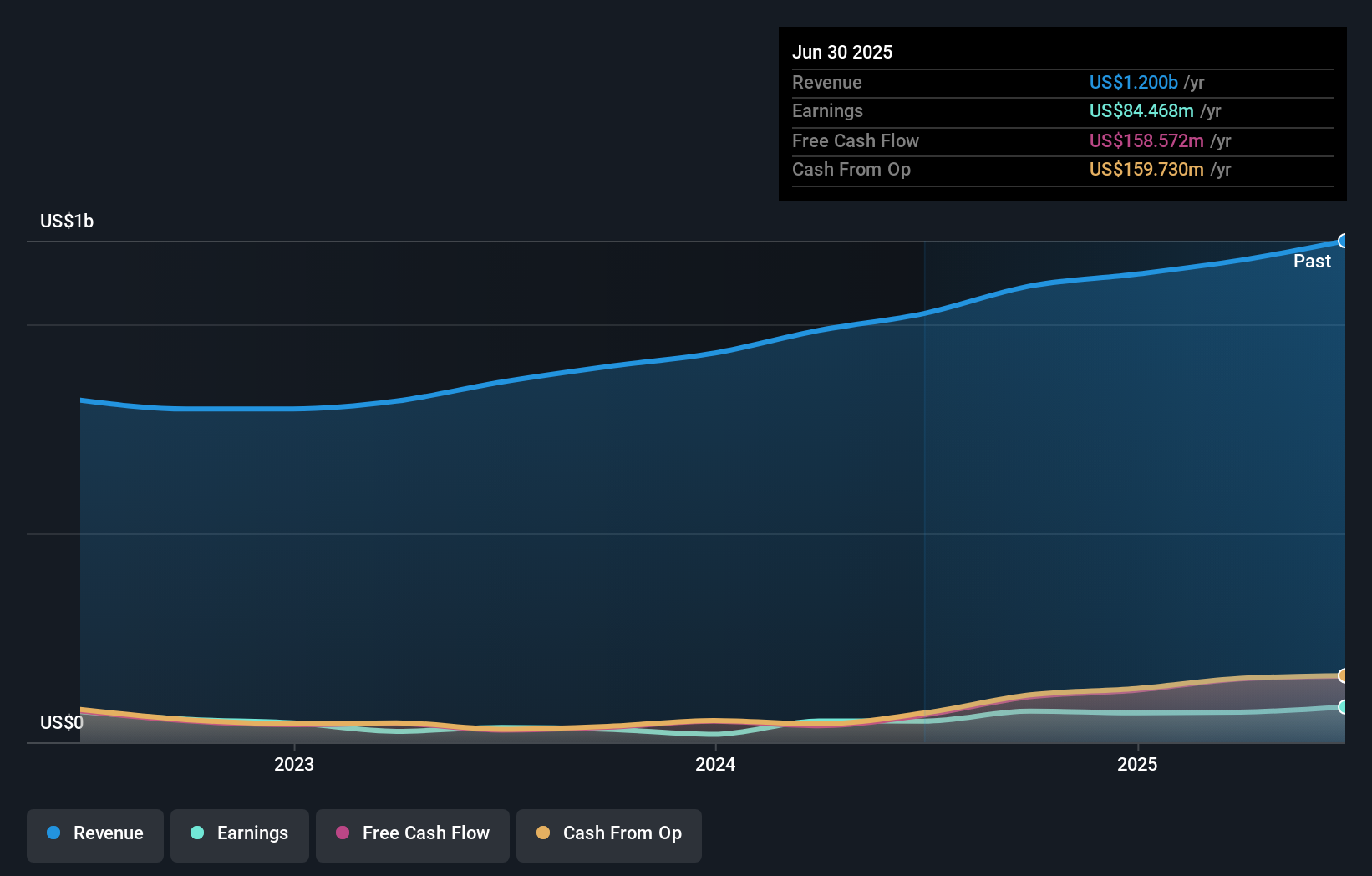

Operations: Revenue from property and casualty insurance operations totals $1.20 billion. The company's net profit margin shows interesting trends over recent periods, reflecting its financial performance dynamics.

Safety Insurance Group, a smaller player in the insurance sector, has shown impressive earnings growth of 66.6% over the past year, outpacing the industry average of 6%. With a price-to-earnings ratio of 12.3x, it presents a potential value opportunity compared to the broader US market's 18.7x. The company's debt-to-equity ratio has decreased from 3.7% to 3.4% over five years, indicating a stronger financial position. Recent quarterly results highlighted a revenue increase to US$316 million and net income rising to US$28.94 million, underscoring its robust performance and potential for continued growth in the insurance market.

Seize The Opportunity

- Navigate through the entire inventory of 290 US Undiscovered Gems With Strong Fundamentals here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.