Please use a PC Browser to access Register-Tadawul

Vicor (VICR) Is Up 6.3% After Surge in IP Licensing Revenue and Share Buyback Completion

Vicor Corporation VICR | 96.83 | +2.42% |

- In the third quarter of 2025, Vicor Corporation reported revenue of US$110.42 million and net income of US$28.29 million, up significantly from the same period last year, and completed a share buyback totaling 747,124 shares for US$33.82 million under its ongoing program.

- An interesting development is that much of Vicor’s exceptionally strong performance was driven by substantial intellectual property licensing revenues, with management highlighting potential for further growth in this area.

- We’ll now examine how this surge in IP licensing income could shape Vicor’s investment narrative and outlook for future earnings.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Vicor Investment Narrative Recap

To be a Vicor shareholder, you have to believe the company’s high-value patents and demand for advanced power delivery solutions can sustainably drive both licensing and product revenue, while navigating significant swings in quarterly results. The latest quarter’s surge in IP licensing brought substantial short-term earnings upside, but it also raises the importance of consistency in these infrequent income streams, so while this is a powerful catalyst right now, it amplifies Vicor’s biggest risk: earnings unpredictability tied to the timing and nature of licensing deals.

Of the recent developments, the completion of the US$33.82 million share buyback program stands out most this quarter, as it directly affects per-share earnings metrics amid Vicor’s exceptionally strong IP-driven results. While returning capital to shareholders may not address fundamental order volatility or long-term product revenue risks, buybacks can support near-term valuation during periods of inconsistent results linked to licensing swings.

But behind the upbeat headlines, investors should also be aware that results remain vulnerable to the timing of large, one-off IP deals and...

Vicor's narrative projects $523.8 million in revenue and $45.4 million in earnings by 2028. This requires 11.4% yearly revenue growth and a $20.1 million decrease in earnings from $65.5 million today.

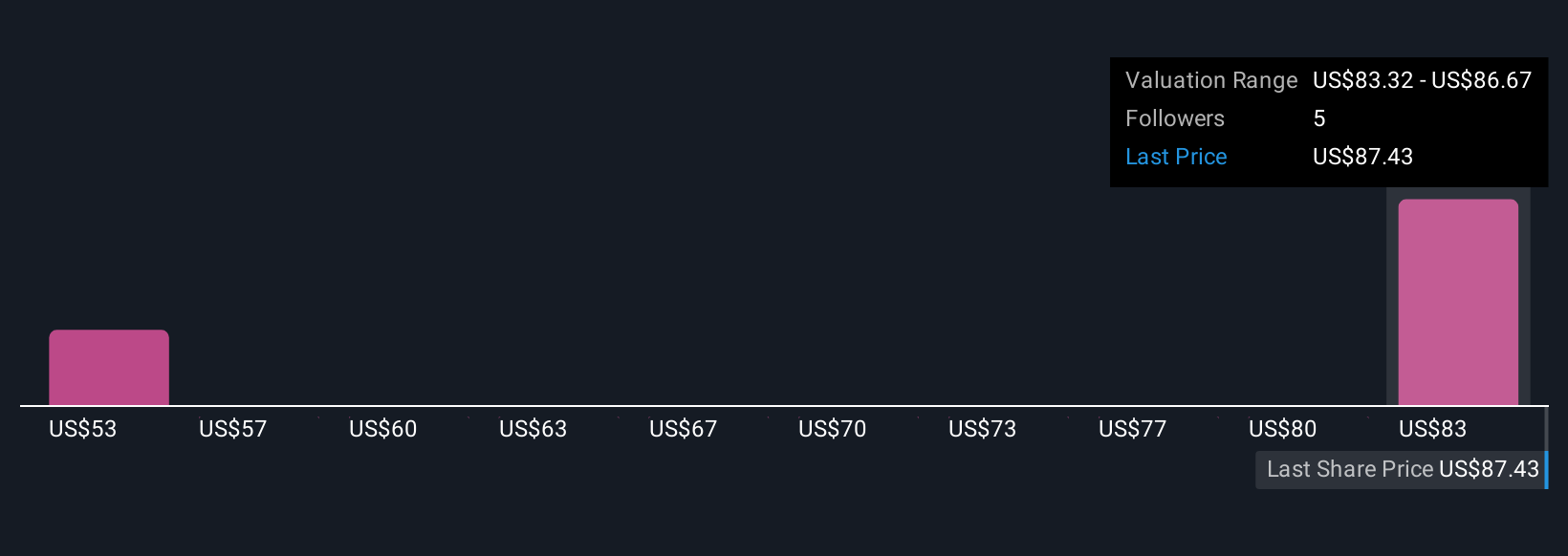

Uncover how Vicor's forecasts yield a $86.67 fair value, a 5% downside to its current price.

Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community range widely from US$42.89 to US$86.67 per share. While quarterly licensing gains have fueled recent results, this variability continues to shape the outlook, consider how differing views reflect the uncertainty around future earnings streams.

Explore 2 other fair value estimates on Vicor - why the stock might be worth less than half the current price!

Build Your Own Vicor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vicor research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Vicor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vicor's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.