Please use a PC Browser to access Register-Tadawul

We Think Shareholders May Want To Consider A Review Of Scholastic Corporation's (NASDAQ:SCHL) CEO Compensation Package

Scholastic Corporation SCHL | 28.41 | +0.64% |

Key Insights

- Scholastic's Annual General Meeting to take place on 17th of September

- Total pay for CEO Peter Warwick includes US$1.00m salary

- Total compensation is similar to the industry average

- Over the past three years, Scholastic's EPS fell by 57% and over the past three years, the total loss to shareholders 36%

Scholastic Corporation (NASDAQ:SCHL) has not performed well recently and CEO Peter Warwick will probably need to up their game. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 17th of September. This will be also be a chance where they can challenge the board on company direction and vote on resolutions such as executive remuneration. We present the case why we think CEO compensation is out of sync with company performance.

How Does Total Compensation For Peter Warwick Compare With Other Companies In The Industry?

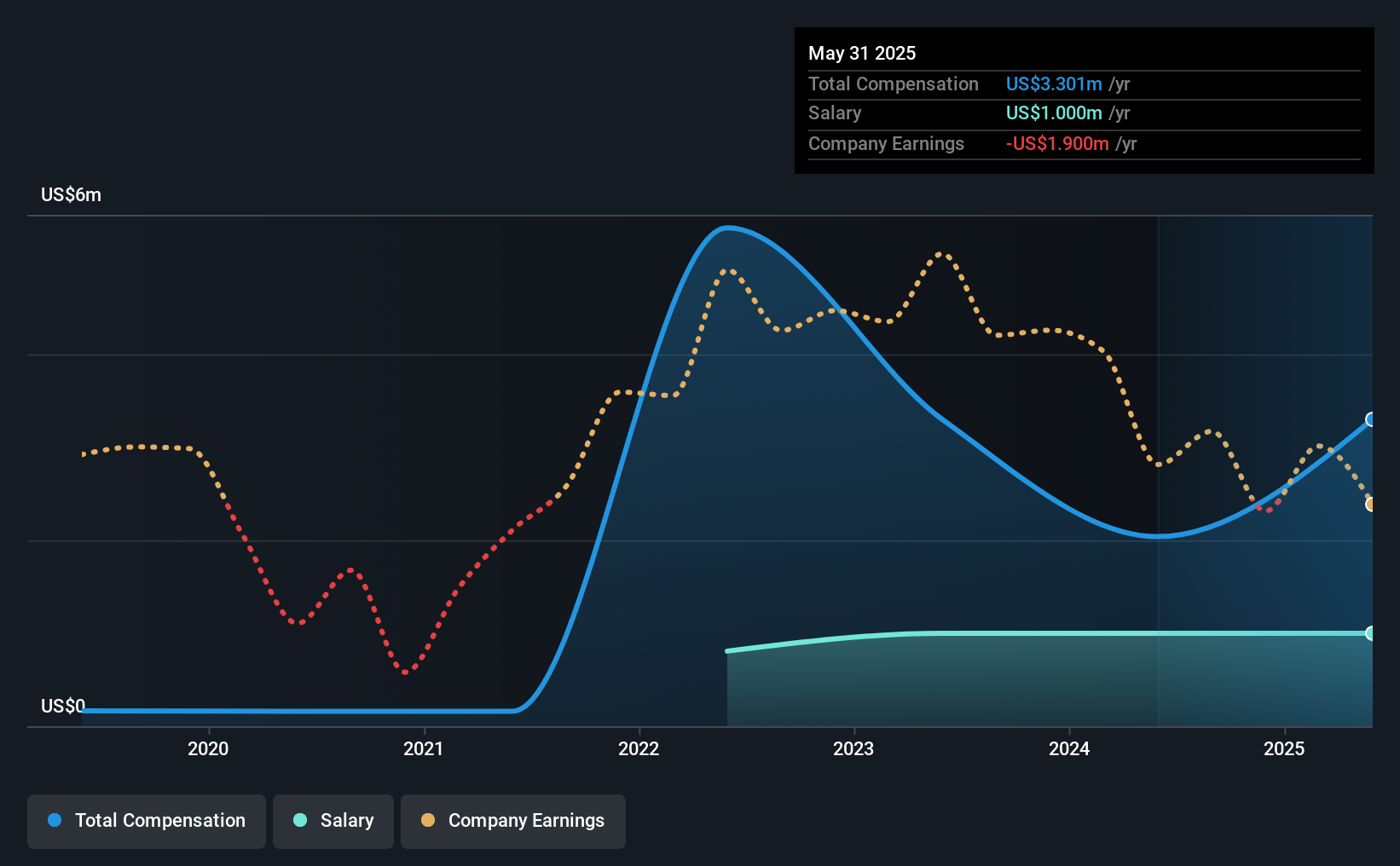

According to our data, Scholastic Corporation has a market capitalization of US$656m, and paid its CEO total annual compensation worth US$3.3m over the year to May 2025. Notably, that's an increase of 62% over the year before. We think total compensation is more important but our data shows that the CEO salary is lower, at US$1.0m.

On comparing similar companies from the American Media industry with market caps ranging from US$400m to US$1.6b, we found that the median CEO total compensation was US$4.5m. This suggests that Scholastic remunerates its CEO largely in line with the industry average. What's more, Peter Warwick holds US$2.5m worth of shares in the company in their own name.

| Component | 2025 | 2024 | Proportion (2025) |

| Salary | US$1.0m | US$1.0m | 30% |

| Other | US$2.3m | US$1.0m | 70% |

| Total Compensation | US$3.3m | US$2.0m | 100% |

Speaking on an industry level, nearly 30% of total compensation represents salary, while the remainder of 70% is other remuneration. Our data reveals that Scholastic allocates salary more or less in line with the wider market. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

A Look at Scholastic Corporation's Growth Numbers

Over the last three years, Scholastic Corporation has shrunk its earnings per share by 57% per year. Its revenue is up 2.3% over the last year.

Overall this is not a very positive result for shareholders. And the modest revenue growth over 12 months isn't much comfort against the reduced EPS. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Scholastic Corporation Been A Good Investment?

With a total shareholder return of -36% over three years, Scholastic Corporation shareholders would by and large be disappointed. So shareholders would probably want the company to be less generous with CEO compensation.

In Summary...

Not only have shareholders not seen a favorable return on their investment, but the business hasn't performed well either. Few shareholders would be willing to award the CEO with a pay raise. At the upcoming AGM, management will get a chance to explain how they plan to get the business back on track and address the concerns from investors.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance.

Switching gears from Scholastic, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.