Please use a PC Browser to access Register-Tadawul

Why Dollar Tree (DLTR) Is Up 9.3% After Raising 2026 Guidance and Expanding Buybacks

Dollar Tree, Inc. DLTR | 122.44 | +5.67% |

- In October 2025, Dollar Tree announced a high teens percentage earnings per share growth outlook for fiscal 2026, reported 3.8% comparable same-store sales growth for the third quarter-to-date, and completed a US$271 million buyback tranche while advancing distribution center expansions following tornado-related damage.

- Amid these operational updates, investors remain focused on Dollar Tree’s proactive pricing and brand strategy shifts to address both tariff pressures and evolving customer demographics.

- We'll assess how Dollar Tree's robust earnings guidance and expansion initiatives may reshape its investment narrative, particularly regarding profit margin resilience.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Dollar Tree Investment Narrative Recap

To hold Dollar Tree stock, investors need to believe in the sustained appeal of value shopping and multi-price point strategies, despite challenges from tariffs and evolving consumer behavior. The latest high-teens EPS growth guidance for fiscal 2026 may underpin investor confidence in profit margin resilience, but the possibility of ongoing tariff headwinds remains the most material risk. Recent operational updates do not materially alter these key catalysts and risks in the short term.

Of the company’s recent news, the October completion of a US$271 million buyback tranche stands out as especially relevant, highlighting continued shareholder returns even as Dollar Tree copes with cost inflation and supply chain challenges. This action may support the investment story, especially as supply chain efficiency and capital allocation are critical to the company’s ability to sustain both expansion and profitability.

Yet, in contrast, investors should also pay close attention to the risk of...

Dollar Tree's narrative projects $22.1 billion revenue and $1.4 billion earnings by 2028. This requires 6.0% yearly revenue growth and a $0.3 billion increase in earnings from the current $1.1 billion.

Uncover how Dollar Tree's forecasts yield a $109.91 fair value, a 15% upside to its current price.

Exploring Other Perspectives

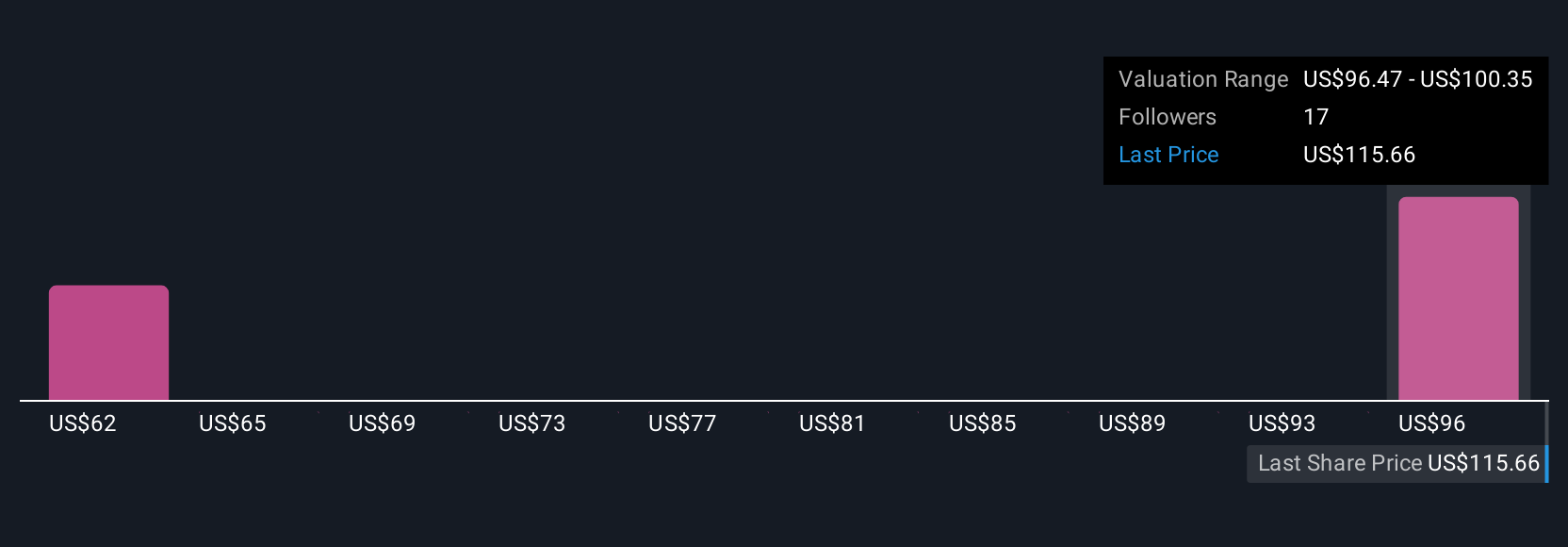

Simply Wall St Community fair value estimates for Dollar Tree span from US$58.08 to US$109.91 based on three distinct analyses. While some anticipate growth from increased consumer value focus, the risk of tariff volatility may still weigh on the company’s profit outlook; your view could differ significantly from others in the market.

Explore 3 other fair value estimates on Dollar Tree - why the stock might be worth 39% less than the current price!

Build Your Own Dollar Tree Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Dollar Tree research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Dollar Tree research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Dollar Tree's overall financial health at a glance.

Contemplating Other Strategies?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 39 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.