Please use a PC Browser to access Register-Tadawul

Will Expanded Retail Access to Private Markets Change StepStone Group's (STEP) Investment Narrative?

StepStone Group Inc. STEP | 62.85 | +0.71% |

- StepStone Group recently expanded its private market investment offerings, traditionally limited to institutional clients, to individual investors and advisers in Europe, introducing new semi-liquid, evergreen funds with lower minimum commitments.

- This shift opens institutional-grade investment opportunities to a broader wealth management audience, reflecting rising demand for private markets and easing common barriers to entry.

- We'll explore how increased accessibility to private market investments could shape StepStone Group's investment narrative going forward.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is StepStone Group's Investment Narrative?

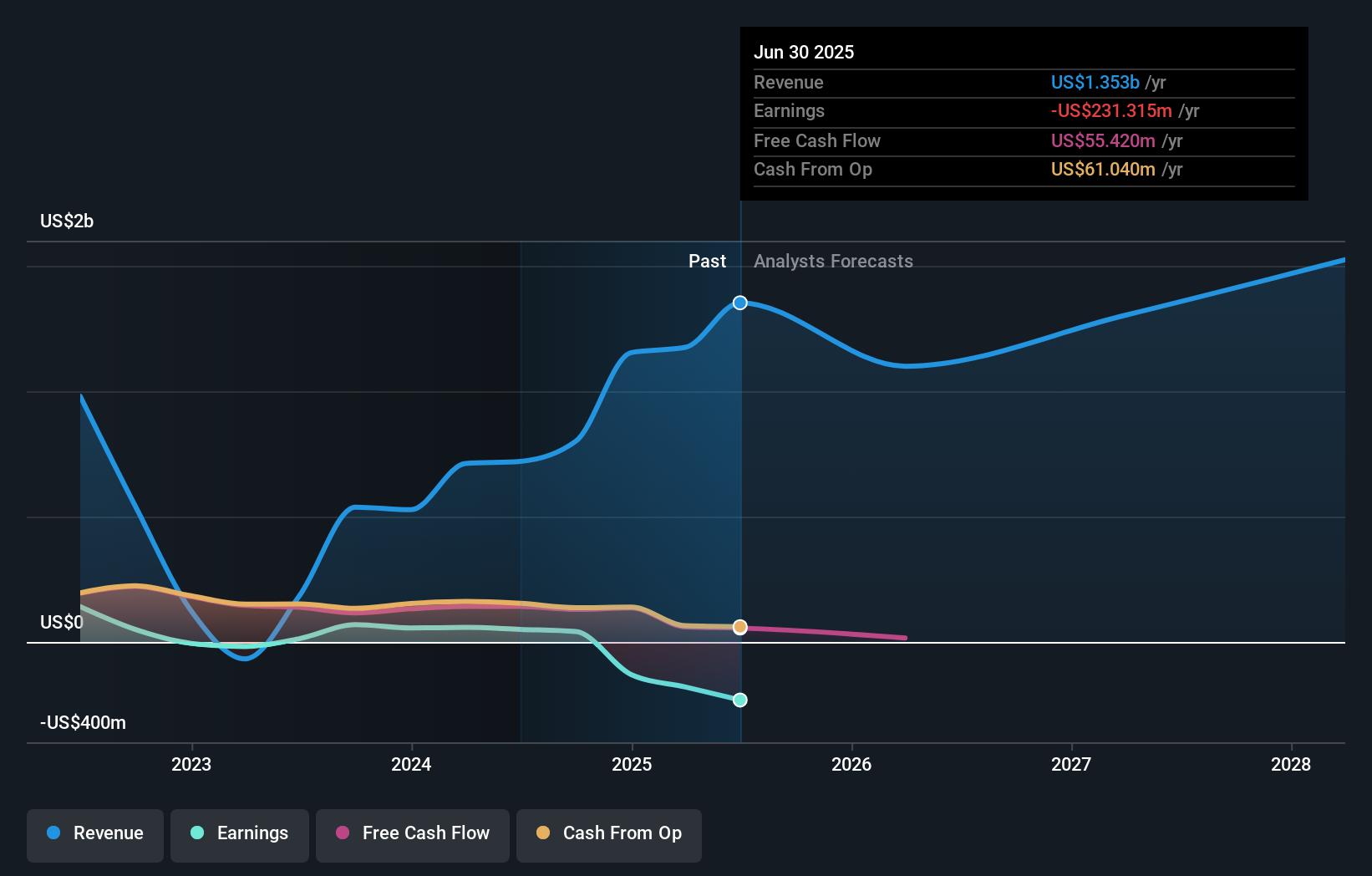

For investors considering StepStone Group, the big picture relies on confidence in the global proliferation of private markets and StepStone's position as a bridge between large institutional pools and the broader wealth management space. The company's recent expansion in Europe, opening private market strategies to individuals through semi-liquid, evergreen funds, could fuel new growth catalysts by broadening StepStone's customer base and assets under management. While this shift reflects rising demand and could address some barriers to entry, it's set against a backdrop of persistent unprofitability, recent net losses (US$38.42 million in Q1), reduced dividends, and board independence concerns. Analyst activity suggests that the market currently views these initiatives as incremental rather than transformative, price targets and share movement have stayed relatively stable. Yet, heightened competition, slow revenue growth forecasts, and lack of profit turnaround remain key risks that could impact short-term sentiment if the retail offering fails to gain meaningful traction. But with board independence below typical thresholds, governance remains an issue investors should be aware of.

StepStone Group's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on StepStone Group - why the stock might be worth less than half the current price!

Build Your Own StepStone Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your StepStone Group research is our analysis highlighting 2 important warning signs that could impact your investment decision.

- Our free StepStone Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate StepStone Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 9 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.