Please use a PC Browser to access Register-Tadawul

A Look Into Haleon Inc's Price Over Earnings

Haleon plc American Depositary Shares (Each representing two Ordinary Shares) HLN | 10.10 | -0.10% |

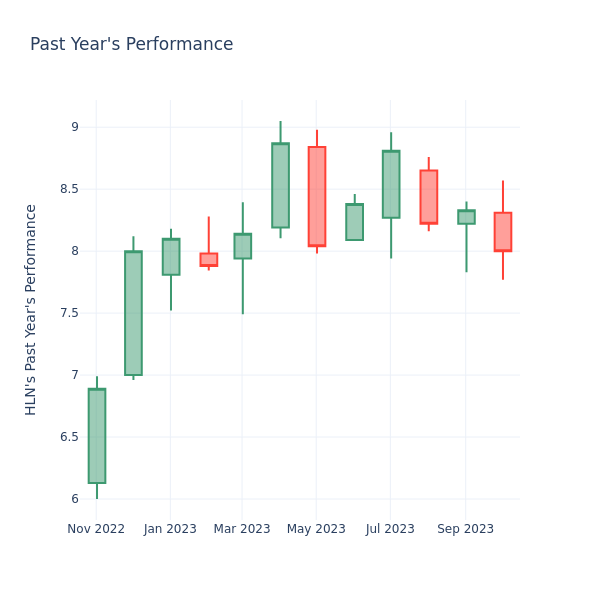

In the current market session, Haleon Inc. (NYSE:HLN) share price is at $8.00, after a 2.83% increase. Moreover, over the past month, the stock decreased by 3.61%, but in the past year, spiked by 30.29%. Shareholders might be interested in knowing whether the stock is overvalued, even if the company is performing up to par in the current session.

Haleon P/E Ratio Analysis in Relation to Industry Peers

The P/E ratio is used by long-term shareholders to assess the company's market performance against aggregate market data, historical earnings, and the industry at large. A lower P/E could indicate that shareholders do not expect the stock to perform better in the future or it could mean that the company is undervalued.

Compared to the aggregate P/E ratio of the 37.27 in the Personal Products industry, Haleon Inc. has a lower P/E ratio of 24.13. Shareholders might be inclined to think that the stock might perform worse than it's industry peers. It's also possible that the stock is undervalued.

In conclusion, the price-to-earnings ratio is a useful metric for analyzing a company's market performance, but it has its limitations. While a lower P/E can indicate that a company is undervalued, it can also suggest that shareholders do not expect future growth. Additionally, the P/E ratio should not be used in isolation, as other factors such as industry trends and business cycles can also impact a company's stock price. Therefore, investors should use the P/E ratio in conjunction with other financial metrics and qualitative analysis to make informed investment decisions.