Please use a PC Browser to access Register-Tadawul

American Electric Power Company, Inc.'s (NASDAQ:AEP) Share Price Matching Investor Opinion

American Electric Power Company, Inc. AEP | 106.04 | +1.24% |

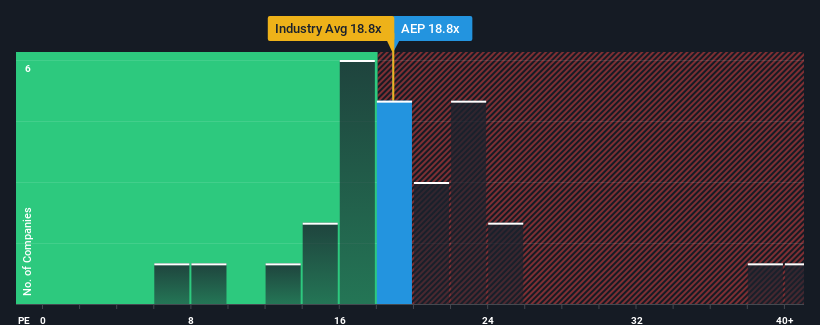

There wouldn't be many who think American Electric Power Company, Inc.'s (NASDAQ:AEP) price-to-earnings (or "P/E") ratio of 18.8x is worth a mention when the median P/E in the United States is similar at about 17x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

American Electric Power Company has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for American Electric Power Company

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like American Electric Power Company's is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 9.5%. Regardless, EPS has managed to lift by a handy 11% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 12% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 13% each year, which is not materially different.

In light of this, it's understandable that American Electric Power Company's P/E sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that American Electric Power Company maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You need to take note of risks, for example - American Electric Power Company has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

You might be able to find a better investment than American Electric Power Company. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.