Please use a PC Browser to access Register-Tadawul

Dar Al Arkan Real Estate Development (TADAWUL:4300) shareholders have earned a 17% CAGR over the last three years

DAR ALARKAN 4300.SA | 15.81 | +1.35% |

Dar Al Arkan Real Estate Development Company (TADAWUL:4300) shareholders might be concerned after seeing the share price drop 12% in the last quarter. But don't let that distract from the very nice return generated over three years. In fact, the company's share price bested the return of its market index in that time, posting a gain of 61%.

So let's investigate and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for Dar Al Arkan Real Estate Development

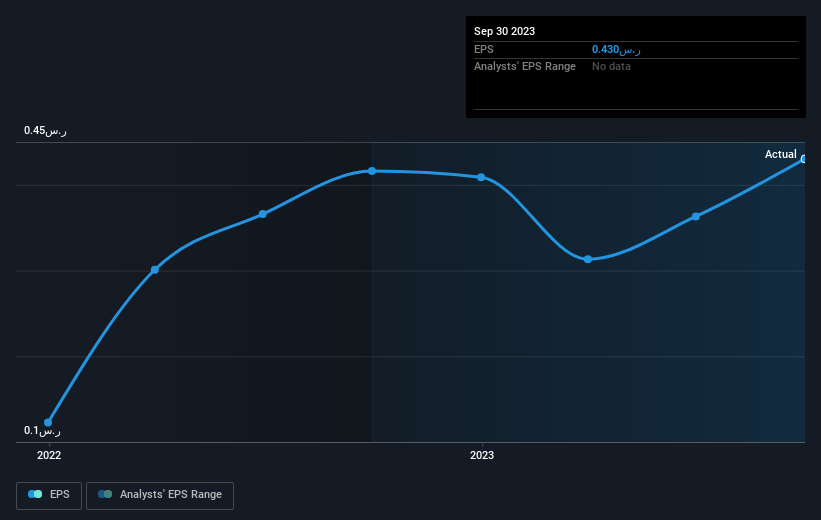

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During three years of share price growth, Dar Al Arkan Real Estate Development achieved compound earnings per share growth of 85% per year. The average annual share price increase of 17% is actually lower than the EPS growth. Therefore, it seems the market has moderated its expectations for growth, somewhat.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We know that Dar Al Arkan Real Estate Development has improved its bottom line over the last three years, but what does the future have in store? It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's nice to see that Dar Al Arkan Real Estate Development shareholders have received a total shareholder return of 20% over the last year. That's better than the annualised return of 9% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Before deciding if you like the current share price, check how Dar Al Arkan Real Estate Development scores on these 3 valuation metrics.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Saudi exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.