Please use a PC Browser to access Register-Tadawul

Even after rising 17% this past week, Y-mAbs Therapeutics (NASDAQ:YMAB) shareholders are still down 85% over the past three years

Y-mAbs Therapeutics YMAB | 4.52 | +1.80% |

Y-mAbs Therapeutics, Inc. (NASDAQ:YMAB) shareholders will doubtless be very grateful to see the share price up 36% in the last quarter. But only the myopic could ignore the astounding decline over three years. To wit, the share price sky-dived 85% in that time. So we're relieved for long term holders to see a bit of uplift. But the more important question is whether the underlying business can justify a higher price still. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

While the stock has risen 17% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

Check out our latest analysis for Y-mAbs Therapeutics

Given that Y-mAbs Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

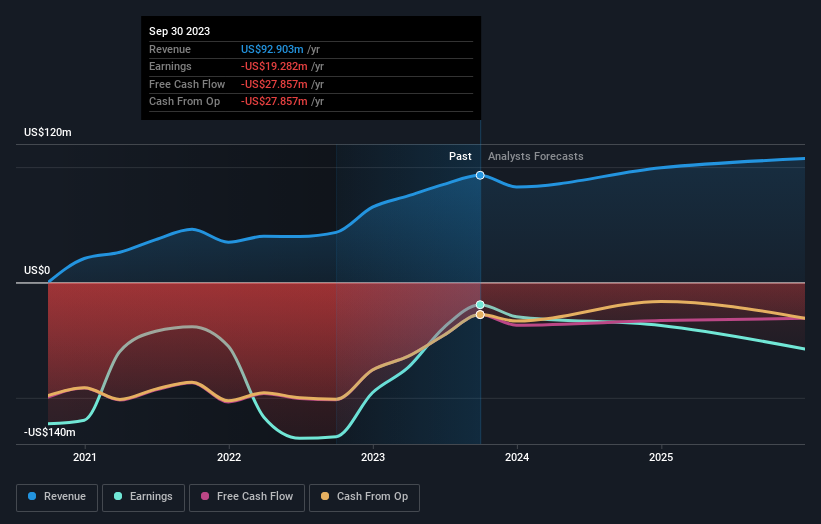

In the last three years, Y-mAbs Therapeutics saw its revenue grow by 55% per year, compound. That's well above most other pre-profit companies. So why has the share priced crashed 23% per year, in the same time? You'd want to take a close look at the balance sheet, as well as the losses. Sometimes fast revenue growth doesn't lead to profits. If the company is low on cash, it may have to raise capital soon.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

It's good to see that Y-mAbs Therapeutics has rewarded shareholders with a total shareholder return of 57% in the last twelve months. That certainly beats the loss of about 10% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Y-mAbs Therapeutics better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Y-mAbs Therapeutics you should be aware of, and 1 of them shouldn't be ignored.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.