Please use a PC Browser to access Register-Tadawul

Fewer Investors Than Expected Jumping On Global Blue Group Holding AG (NYSE:GB)

Global Blue Group Holding Ltd GB | 7.49 | Delist |

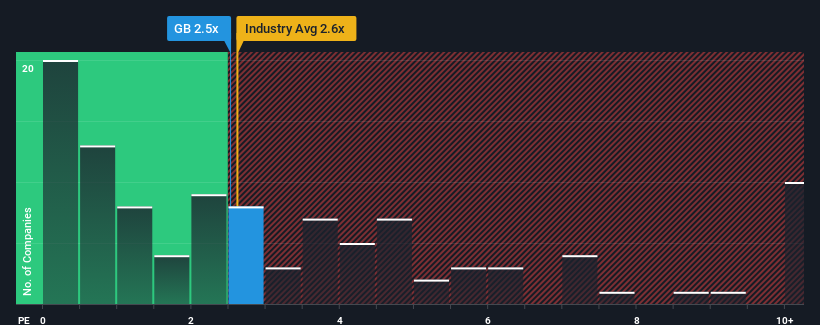

There wouldn't be many who think Global Blue Group Holding AG's (NYSE:GB) price-to-sales (or "P/S") ratio of 2.5x is worth a mention when the median P/S for the Diversified Financial industry in the United States is similar at about 2.6x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Global Blue Group Holding

What Does Global Blue Group Holding's P/S Mean For Shareholders?

Global Blue Group Holding certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Global Blue Group Holding's future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For Global Blue Group Holding?

Global Blue Group Holding's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 76%. The strong recent performance means it was also able to grow revenue by 79% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 22% as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 1.6% growth forecast for the broader industry.

With this information, we find it interesting that Global Blue Group Holding is trading at a fairly similar P/S compared to the industry. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Global Blue Group Holding's P/S?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Looking at Global Blue Group Holding's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Global Blue Group Holding (at least 1 which is significant), and understanding them should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.