Please use a PC Browser to access Register-Tadawul

Franklin Resources' (NYSE:BEN) Dividend Will Be Increased To $0.31

Franklin Resources, Inc. BEN | 24.18 24.18 | -0.04% 0.00% Pre |

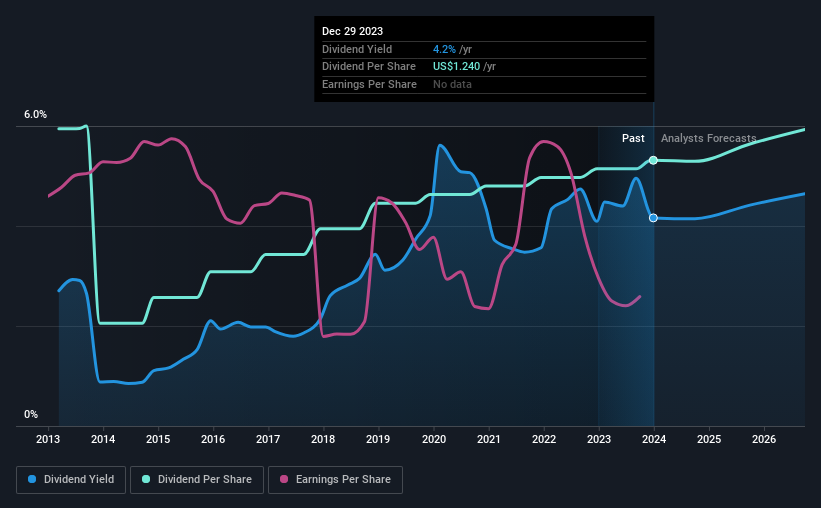

The board of Franklin Resources, Inc. (NYSE:BEN) has announced that it will be paying its dividend of $0.31 on the 12th of January, an increased payment from last year's comparable dividend. This takes the dividend yield to 4.2%, which shareholders will be pleased with.

Check out our latest analysis for Franklin Resources

Franklin Resources' Dividend Is Well Covered By Earnings

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. Based on the last payment, Franklin Resources was quite comfortably earning enough to cover the dividend. This indicates that quite a large proportion of earnings is being invested back into the business.

The next year is set to see EPS grow by 58.9%. If the dividend continues on this path, the payout ratio could be 49% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The dividend has gone from an annual total of $1.39 in 2013 to the most recent total annual payment of $1.24. Doing the maths, this is a decline of about 1.1% per year. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend's Growth Prospects Are Limited

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Earnings per share has been crawling upwards at 4.2% per year. Franklin Resources is struggling to find viable investments, so it is returning more to shareholders. This could mean the dividend doesn't have the growth potential we look for going into the future.

In Summary

In summary, it's great to see that the company can raise the dividend and keep it in a sustainable range. The dividend has been at reasonable levels historically, but that hasn't translated into a consistent payment. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 3 warning signs for Franklin Resources that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.