Please use a PC Browser to access Register-Tadawul

Insights Before The Bell | Wedbush Is Bullish on Consumer Internet Platforms in 2024; JD Wins Antitrust Lawsuit Against Alibaba

Apple Inc. AAPL | 262.53 | +0.06% |

Masimo Corporation MASI | 136.57 | -0.02% |

Amazon.com, Inc. AMZN | 243.07 | +0.89% |

Meta Platforms META | 655.00 | -0.85% |

Booking Holdings Inc. BKNG | 5416.96 | +1.28% |

Key Takeaways

- A New High for S&P 500 Could Signal a Winning Year Ahead, History Says;

- Forecast for a Weaker Dollar in 2024 Amid Lowered Interest Rates;

- Analysts Differ on US Bond Yields Amid Fed Policy Shift in 2024;

- NVIDIA Launches Special Edition RTX 4090D for China;

- JD.com Wins Antimonopoly Lawsuit Against Alibaba;

I. Market Report

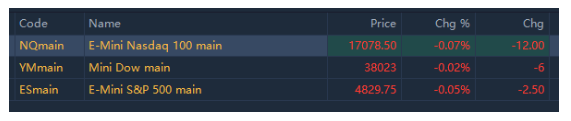

Stock futures were little changed on Friday as Wall Street looks to end a winning year on a high note and possibly a new milestone.

As of 08:11 am, EST (or 4:11 pm in Riyadh), S&P 500 futures were flat, while the Dow Jones Industrial Average futures ticked down 2.5 points. Nasdaq-100 futures inched slightly lower.

II. Flash Headlines

A New High for S&P 500 Could Signal a Winning Year Ahead, History Says

Fresh record highs for the S&P 500 have historically been quite a good omen, according to Carson Group chief market strategist Ryan Detrick.

The strategist said that since 1950, when the S&P 500 hit a record high for the first time in over a year, the next 12 months have seen positive returns 13 out of 14 times. The S&P 500 is within 14 points of its record close of 4,796.56, set on Jan. 3, 2022.

“To put a bow on this, new highs are bullish when you go awhile without one. It still could be a pretty good market next year for investors,” Detrick said on “Closing Bell.”

Stock Market 'Arguably' Overbought, Warns Yardeni

Stocks have been in tears recently, but they may be due for a pullback shortly, according to Ed Yardeni of Yardeni Research.

“Arguably, the bull market is overbought, and there are too many bulls,” Yardeni wrote. “However, meltups can go on for a while until, like Icarus, they get too close to the sun. In other words, they can lead to meltdowns if they rise too far too fast.”

Forecast for a Weaker Dollar in 2024 Amid Lowered Interest Rates

Most analysts surveyed by Bloomberg anticipate a weaker dollar in 2024, with expectations that the Federal Reserve will take the lead among affluent nations in reducing interest rates. This, coupled with predictions of a soft landing in the US economy, is likely to prompt investors to seek risk outside of the country. However, strategists at JPMorgan Chase and HSBC believe that the greenback could still strengthen, as other nations may need to implement more significant rate reductions to support their economies. Currency watchers are also expressing confidence in the potential rise of the Japanese yen, as they foresee the Bank of Japan finally raising rates.

Analysts Differ on US Bond Yields Amid Fed Policy Shift in 2024

Following the Federal Reserve's December shift towards a more lenient monetary policy in 2024, bond analysts are adjusting their projections, anticipating better performance for US debt in the coming year. The projected figure for the 10-year Treasury yield one year from now is expected to drop to 3.98%. Yet, opinions differ. TD Securities anticipates that yields could reach 3% in one year, following the Fed's initiation of 200 basis point rate cuts starting in May. Even though Goldman Sachs and Barclays Capital have retraced their initial stance that rate cuts before the final quarter were improbable, they predict yields ending in 2024 at 4% and 4.35% respectively. As they seek profitable returns, some investors are turning their attention to Austria's hundred-year bonds and supra-national debt among other non-traditional options.

Oil Prices Recover but Set to End Year at Lowest Levels Since 2020

Oil prices ticked higher on Friday, recovering from previous losses, but are poised to finish the year near their lowest levels since 2020. At 15:30 Saudi Arabia time, U.S. crude futures rose 0.1% to $71.84 a barrel, while the Brent contract increased 0.23% to $77.33 per barrel. Thursday saw a 3% drop in prices as major shipping firms resumed operations in the Red Sea, alleviating concerns about supply disruptions. The U.S. Energy Information Administration's report of a larger-than-expected draw in crude inventories, with stockpiles falling by 7.1 million barrels, contributed to price recovery. However, despite production cuts by major producers, the slowing global economy and aggressive interest rate hikes to combat inflation have weighed on crude benchmarks, leading to an expected year-end decline of around 10%.

III. Stocks To Watch

Apple Is Redeveloping Software to Resolve the Apple Watch Patent Dispute

Apple Inc.(AAPL.US) plans to make a long-term software fix to sell certain Apple Watch models in the US, amidst an ongoing patent dispute with Masimo Corporation(MASI.US). The tech giant’s plan includes submitting redesigned software to US customs, potentially allowing sales of non-infringing versions by January 12th next year. The company is also appealing to the US International Trade Commission (ITC) while a temporary sales ban has been halted by a US appeals court.

Wedbush Is Bullish on Consumer Internet Platforms in 2024

Investment bank Wedbush has expressed optimism for consumer internet platforms in 2024, with top preferences including Amazon.com, Inc.(AMZN.US), Meta Platforms(META.US), Booking Holdings Inc.(BKNG.US), and Uber Technologies,Inc.(UBER.US). Wedbush believes that the growth rate of digital advertising and e-commerce will accelerate in 2024, with a projected increase of 99 basis points in the penetration rate of online shopping and a 230% basis point growth in digital advertising spending. The bank expects retail media to lead the growth of digital advertising, with a projected growth rate of 22%, with Amazon’s advertising revenue growing faster than the overall industry.

Boeing Discovers Defects in 737 Max Bolts

The Federal Aviation Administration (FAA) in the United States issued a statement on December 28th, stating that it is closely monitoring targeted inspections of the Boeing Company(BA.US) 737 MAX aircraft to look for possible loose bolts in the elevator control system. Following consultations with the FAA, Boeing has urged operators of the new single-aisle aircraft to inspect specific hardware in the control surface movement mechanism for potential loosening. Prior to Boeing’s recommendation for the inspections, an international operator discovered a missing bolt and nut during routine maintenance of the elevator control linkage. The FAA will consider taking additional action if further instances of hardware loosening or loss are discovered.

Ford’s F-Series Trucks: Best-Selling for 47th Year, Over 700,000 Units Sold

Despite labor union strikes and reduced electric vehicle demand, Ford Motor Company(F.US) sold over 700,000 F-Series trucks in the U.S. this year, maintaining its position as the country’s best-selling truck for 47 years. CEO Jim Farley highlighted the success of the F-150 Lightning as the top-selling full-size electric truck and the F-150 Hybrid as the best-selling full-size hybrid pickup.

NVIDIA Launches Special Edition RTX 4090D for China

NVIDIA Corporation(NVDA.US) has released the GeForce RTX 4090D, a special edition graphics card for the Chinese market, to comply with US export regulations. It addresses the issue of the RTX 4090 not being able to be sold in China. The RTX 4090D will have a reduced number of CUDA cores but an improved core frequency compared to the original version. It will be launched in January next year.

JD.com Wins Antimonopoly Lawsuit Against Alibaba

Chinese e-commerce giant JD.com, Inc. Sponsored ADR Class A(JD.US) announced on Friday that it emerged victorious in a lawsuit against rival Alibaba Group Holding Ltd. Sponsored ADR(BABA.US), resulting in a 1 billion yuan fine for Alibaba due to monopolistic practices. The High People's Court of Beijing ruled that Alibaba and its affiliates had engaged in "choosing one from two" practices, causing severe damage to JD.com. In response, JD.com hailed the ruling as a significant moment in China's anti-monopoly legal process. Alibaba, fined a record $2.75 billion in 2021 for similar violations, acknowledged and respected the court's decision. This legal battle reflects the ongoing rivalry and anti-competitive allegations between the two major players in the Chinese e-commerce market.

IV. Upcoming Events

Economic Calendar

| Date | Market | Events | Forecast | Previous |

| Fri Dec 29 | US | Chicago PMI DEC | 51 | 55.8 |

| US | U.S. Baker Hughes Oil Rig Count | - | - |

Earnings Calendar

| Date | Market | Company |

| Fri Dec 29 | US | Eaton Vance Tax-Advantaged Global Dividend Income Fund(ETG.US) |

| US | Eagle Pharmaceuticals, Inc.(EGRX.US) |

[This newsletter is written and edited by Selena from Sahm News Team]