Please use a PC Browser to access Register-Tadawul

Investors Aren't Entirely Convinced By VIZIO Holding Corp.'s (NYSE:VZIO) Revenues

VIZIO Holding Corp. Class A VZIO |

|

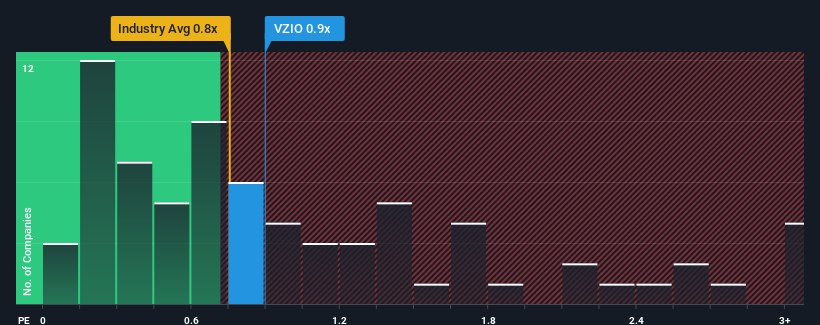

There wouldn't be many who think VIZIO Holding Corp.'s (NYSE:VZIO) price-to-sales (or "P/S") ratio of 0.9x is worth a mention when the median P/S for the Consumer Durables industry in the United States is similar at about 0.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for VIZIO Holding

How VIZIO Holding Has Been Performing

VIZIO Holding hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think VIZIO Holding's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like VIZIO Holding's is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered a frustrating 13% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 16% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 8.5% per year during the coming three years according to the twelve analysts following the company. With the industry only predicted to deliver 4.1% per annum, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that VIZIO Holding's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Despite enticing revenue growth figures that outpace the industry, VIZIO Holding's P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

And what about other risks? Every company has them, and we've spotted 1 warning sign for VIZIO Holding you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.