Please use a PC Browser to access Register-Tadawul

Ionis Pharmaceuticals, Inc. (NASDAQ:IONS) Investors Are Less Pessimistic Than Expected

Ionis Pharmaceuticals, Inc. IONS | 77.08 | -1.65% |

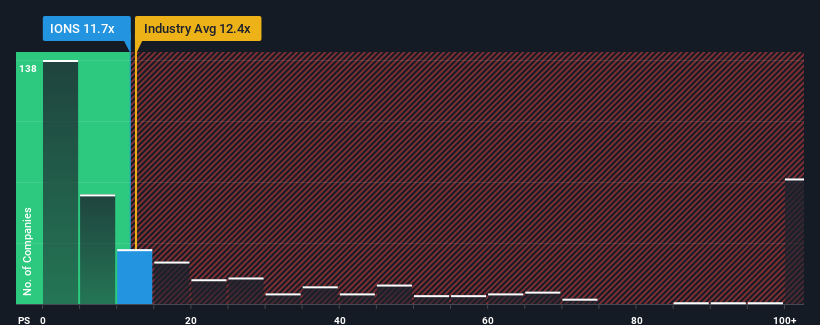

With a median price-to-sales (or "P/S") ratio of close to 12.4x in the Biotechs industry in the United States, you could be forgiven for feeling indifferent about Ionis Pharmaceuticals, Inc.'s (NASDAQ:IONS) P/S ratio of 11.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Ionis Pharmaceuticals

What Does Ionis Pharmaceuticals' Recent Performance Look Like?

Ionis Pharmaceuticals could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Ionis Pharmaceuticals.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Ionis Pharmaceuticals' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 30% decrease to the company's top line. As a result, revenue from three years ago have also fallen 34% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 20% per annum during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 249% per year, which is noticeably more attractive.

With this in mind, we find it intriguing that Ionis Pharmaceuticals' P/S is closely matching its industry peers. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

When you consider that Ionis Pharmaceuticals' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Ionis Pharmaceuticals, and understanding should be part of your investment process.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.