Please use a PC Browser to access Register-Tadawul

MercadoLibre, Inc.'s (NASDAQ:MELI) P/S Still Appears To Be Reasonable

MercadoLibre, Inc. MELI | 2005.71 | +0.38% |

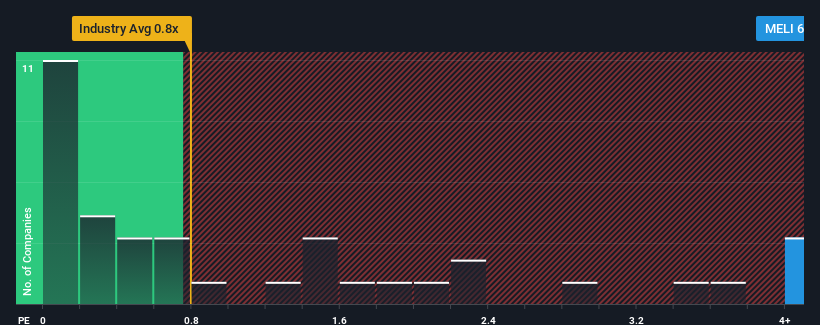

When close to half the companies in the Multiline Retail industry in the United States have price-to-sales ratios (or "P/S") below 0.8x, you may consider MercadoLibre, Inc. (NASDAQ:MELI) as a stock to avoid entirely with its 6x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for MercadoLibre

What Does MercadoLibre's P/S Mean For Shareholders?

Recent times have been advantageous for MercadoLibre as its revenues have been rising faster than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on MercadoLibre.Do Revenue Forecasts Match The High P/S Ratio?

In order to justify its P/S ratio, MercadoLibre would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 37% gain to the company's top line. Pleasingly, revenue has also lifted 298% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 23% each year over the next three years. That's shaping up to be materially higher than the 14% each year growth forecast for the broader industry.

With this information, we can see why MercadoLibre is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From MercadoLibre's P/S?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look into MercadoLibre shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for MercadoLibre with six simple checks.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.