Please use a PC Browser to access Register-Tadawul

Potential Upside For Green Plains Inc. (NASDAQ:GPRE) Not Without Risk

Green Plains GPRE | 9.88 | -1.50% |

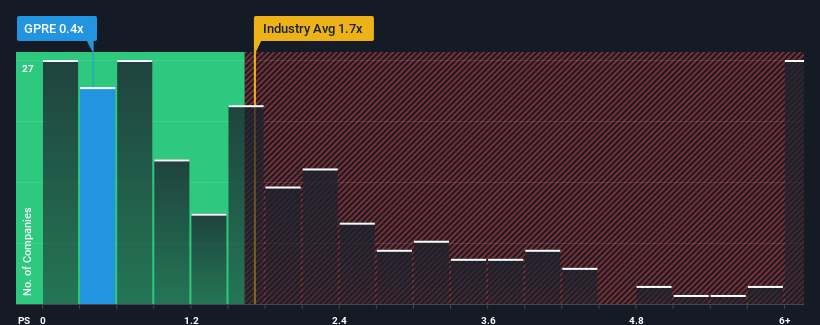

Green Plains Inc.'s (NASDAQ:GPRE) price-to-sales (or "P/S") ratio of 0.4x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Oil and Gas industry in the United States have P/S ratios greater than 1.7x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Green Plains

How Green Plains Has Been Performing

Recent times have been more advantageous for Green Plains as its revenue hasn't fallen as much as the rest of the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. You'd much rather the company continue improving its revenue if you still believe in the business. But at the very least, you'd be hoping that revenue doesn't fall off a cliff completely if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Green Plains.How Is Green Plains' Revenue Growth Trending?

Green Plains' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.5%. Even so, admirably revenue has lifted 62% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next three years should generate growth of 7.9% each year as estimated by the ten analysts watching the company. With the industry only predicted to deliver 1.0% each year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Green Plains' P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Final Word

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Green Plains' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Green Plains that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.