Please use a PC Browser to access Register-Tadawul

Smith-Midland Corporation's (NASDAQ:SMID) P/S Is Still On The Mark Following 26% Share Price Bounce

Smith-Midland Corporation SMID | 35.20 | +2.10% |

Despite an already strong run, Smith-Midland Corporation (NASDAQ:SMID) shares have been powering on, with a gain of 26% in the last thirty days. The last 30 days bring the annual gain to a very sharp 87%.

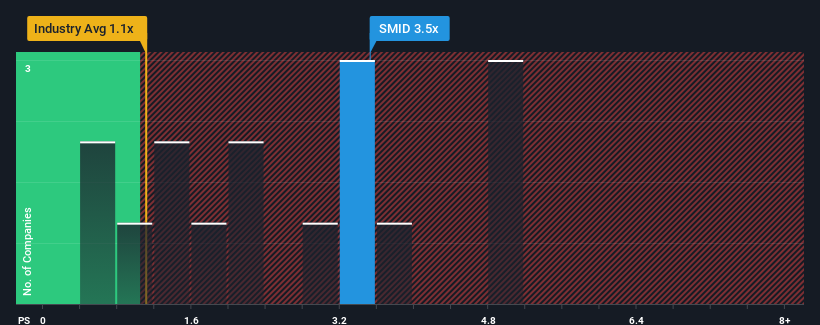

Even after such a large jump in price, there still wouldn't be many who think Smith-Midland's price-to-sales (or "P/S") ratio of 3.5x is worth a mention when the median P/S in the United States' Basic Materials industry is similar at about 3.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Smith-Midland

What Does Smith-Midland's Recent Performance Look Like?

The revenue growth achieved at Smith-Midland over the last year would be more than acceptable for most companies. Perhaps the market is expecting future revenue performance to only keep up with the broader industry, which has keeping the P/S in line with expectations. Those who are bullish on Smith-Midland will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Smith-Midland will help you shine a light on its historical performance.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Smith-Midland's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 26%. As a result, it also grew revenue by 28% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 10% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this in consideration, it's clear to see why Smith-Midland's P/S matches up closely to its industry peers. Apparently shareholders are comfortable to simply hold on assuming the company will continue keeping a low profile.

What Does Smith-Midland's P/S Mean For Investors?

Smith-Midland appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It appears to us that Smith-Midland maintains its moderate P/S off the back of its recent three-year growth being in line with the wider industry forecast. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless the recent medium-term conditions change, they will continue to support the share price at these levels.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Smith-Midland that you should be aware of.

If these risks are making you reconsider your opinion on Smith-Midland, explore our interactive list of high quality stocks to get an idea of what else is out there.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.