Please use a PC Browser to access Register-Tadawul

The InterGroup Corporation's (NASDAQ:INTG) 26% Dip In Price Shows Sentiment Is Matching Revenues

InterGroup Corporation INTG | 26.28 26.28 | -7.43% 0.00% Pre |

Unfortunately for some shareholders, the The InterGroup Corporation (NASDAQ:INTG) share price has dived 26% in the last thirty days, prolonging recent pain. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 64% loss during that time.

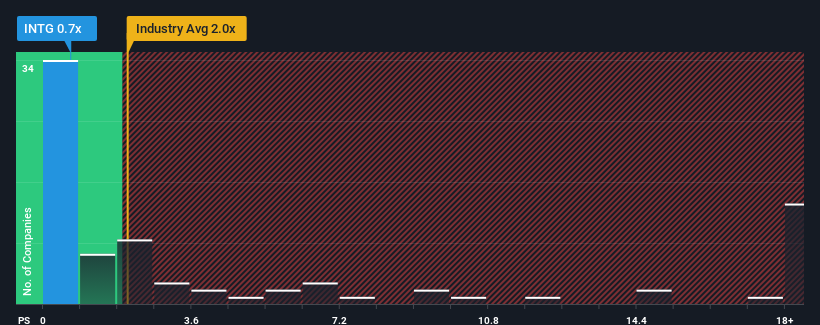

After such a large drop in price, InterGroup may be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.7x, since almost half of all companies in the Real Estate industry in the United States have P/S ratios greater than 2x and even P/S higher than 10x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for InterGroup

How Has InterGroup Performed Recently?

InterGroup has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Although there are no analyst estimates available for InterGroup, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For InterGroup?

The only time you'd be truly comfortable seeing a P/S as low as InterGroup's is when the company's growth is on track to lag the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 7.7% last year. The latest three year period has also seen a 24% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 9.9% shows it's noticeably less attractive.

In light of this, it's understandable that InterGroup's P/S sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Key Takeaway

InterGroup's recently weak share price has pulled its P/S back below other Real Estate companies. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of InterGroup revealed its three-year revenue trends are contributing to its low P/S, given they look worse than current industry expectations. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

You should always think about risks. Case in point, we've spotted 4 warning signs for InterGroup you should be aware of, and 2 of them can't be ignored.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.