Please use a PC Browser to access Register-Tadawul

The Market Doesn't Like What It Sees From SMART Global Holdings, Inc.'s (NASDAQ:SGH) Revenues Yet

SMART Global Holdings, Inc. SGH | 20.85 20.85 | 0.00% 0.00% Post |

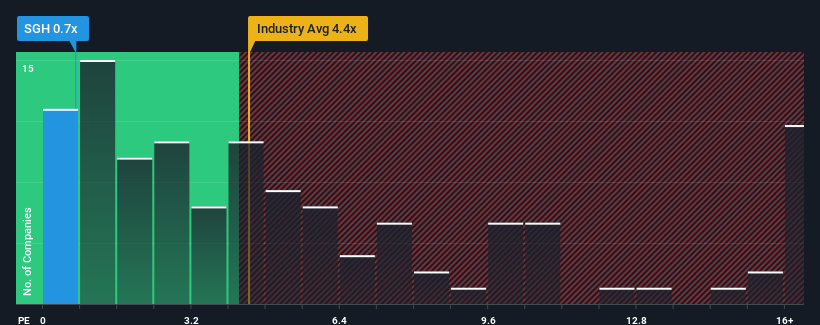

SMART Global Holdings, Inc.'s (NASDAQ:SGH) price-to-sales (or "P/S") ratio of 0.7x might make it look like a strong buy right now compared to the Semiconductor industry in the United States, where around half of the companies have P/S ratios above 4.4x and even P/S above 9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

See our latest analysis for SMART Global Holdings

What Does SMART Global Holdings' Recent Performance Look Like?

Recent times haven't been great for SMART Global Holdings as its revenue has been rising slower than most other companies. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Keen to find out how analysts think SMART Global Holdings' future stacks up against the industry? In that case, our free report is a great place to start.Is There Any Revenue Growth Forecasted For SMART Global Holdings?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like SMART Global Holdings' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.9% last year. The solid recent performance means it was also able to grow revenue by 28% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Looking ahead now, revenue is anticipated to slump, contracting by 16% during the coming year according to the five analysts following the company. Meanwhile, the broader industry is forecast to expand by 40%, which paints a poor picture.

In light of this, it's understandable that SMART Global Holdings' P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

It's clear to see that SMART Global Holdings maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

Having said that, be aware SMART Global Holdings is showing 5 warning signs in our investment analysis, and 1 of those is concerning.

If you're unsure about the strength of SMART Global Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.