يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

3 Stocks Estimated To Be Undervalued In July 2025

FB Financial Corporation FBK | 58.27 | +0.30% |

As the United States stock market reaches record highs, investors are carefully navigating mixed signals from inflation data and earnings reports. In this environment, identifying undervalued stocks becomes crucial for those looking to capitalize on potential opportunities amidst fluctuating indices and economic conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| StoneCo (STNE) | $15.17 | $29.44 | 48.5% |

| Roku (ROKU) | $89.825 | $174.03 | 48.4% |

| Rapid7 (RPD) | $22.80 | $44.10 | 48.3% |

| MP Materials (MP) | $48.52 | $96.59 | 49.8% |

| Insteel Industries (IIIN) | $39.44 | $77.32 | 49% |

| Excelerate Energy (EE) | $26.68 | $51.75 | 48.4% |

| Definitive Healthcare (DH) | $4.02 | $7.82 | 48.6% |

| Carter Bankshares (CARE) | $18.35 | $35.50 | 48.3% |

| Atlantic Union Bankshares (AUB) | $33.33 | $65.45 | 49.1% |

| Acadia Realty Trust (AKR) | $18.67 | $36.68 | 49.1% |

Here's a peek at a few of the choices from the screener.

Alignment Healthcare (ALHC)

Overview: Alignment Healthcare, Inc. operates a consumer-centric healthcare platform for seniors in the United States with a market cap of $2.65 billion.

Operations: The company generates revenue of $3.00 billion from providing healthcare services to seniors in the United States.

Estimated Discount To Fair Value: 13.9%

Alignment Healthcare is trading at US$13.4, below its estimated fair value of US$15.55, suggesting potential undervaluation based on cash flows. Despite significant insider selling recently, the company demonstrates strong revenue growth prospects with a forecasted increase of 19.6% per year, outpacing the broader US market's growth rate. Recent leadership changes and raised revenue guidance for 2025 further highlight its strategic focus on enhancing financial performance and operational efficiency.

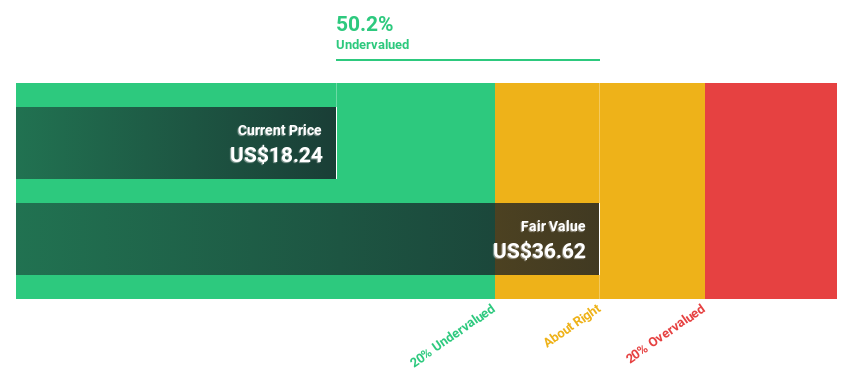

Acadia Realty Trust (AKR)

Overview: Acadia Realty Trust is an equity real estate investment trust specializing in long-term, profitable growth, with a market cap of approximately $2.51 billion.

Operations: The company generates revenue through its Core Portfolio segment, which accounts for $216.41 million, and its Investment Management segment, contributing $169.78 million.

Estimated Discount To Fair Value: 49.1%

Acadia Realty Trust, trading at US$18.67, is significantly undervalued compared to its estimated fair value of US$36.68. Despite a lowered earnings guidance for 2025 and an unstable dividend track record, the company's revenue growth forecast of 9.8% annually surpasses the US market average. Analysts project a potential stock price increase of 23.2%. However, interest payments are not well covered by earnings and there has been shareholder dilution in the past year.

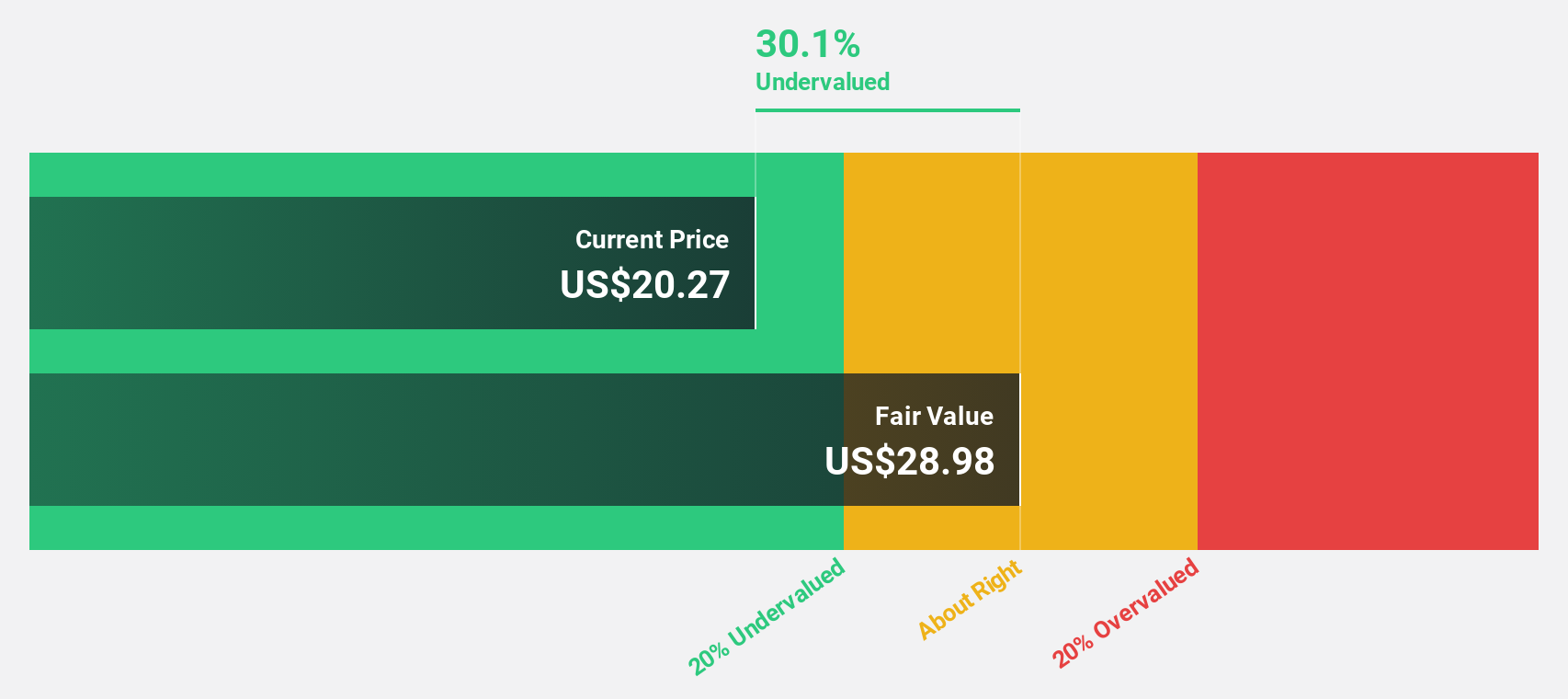

FB Financial (FBK)

Overview: FB Financial Corporation, with a market cap of $2.22 billion, operates as a bank holding company for FirstBank, offering a range of commercial and consumer banking services.

Operations: FB Financial's revenue is primarily derived from its Banking segment, which accounts for $411.54 million, and its Mortgage segment, contributing $53.74 million.

Estimated Discount To Fair Value: 26%

FB Financial Corporation is trading at US$49.21, significantly undervalued compared to its estimated fair value of US$66.51, with earnings and revenue growth forecasts outpacing the broader U.S. market. Despite recent net charge-offs of $0.5 million and a completed share buyback program totaling $57.8 million, the company's strategic merger with Southern States Bancshares could bolster future cash flows and operational efficiencies, enhancing its appeal as an undervalued investment opportunity based on cash flow metrics.

Seize The Opportunity

- Click through to start exploring the rest of the 172 Undervalued US Stocks Based On Cash Flows now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.