يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Closer Look at KBR’s Valuation Following $175M Air Force Research Laboratory Contract Wins

KBR, Inc. KBR | 43.02 | -0.67% |

KBR (KBR) just landed three new contracts worth $175 million with the Air Force Research Laboratory, a move that instantly shines a spotlight on the company. These task orders target high-impact areas such as situational awareness technologies and C4ISR capabilities, reinforcing KBR’s strength in mission-critical government work. Given the size and scope of these agreements, it is the kind of update that can spark interest among both cautious and opportunistic investors.

To frame this news in a year-long context, it is hard to ignore the contrast between KBR’s recent contract momentum and its stock performance. Shares are down roughly 22% over the past year and have seen a steady decline since the start of this year, despite some upticks in the past three months. Imagining that future growth is already reflected in today’s prices feels less certain when major new business is hitting the books, especially against a backdrop of wider market and budget uncertainties.

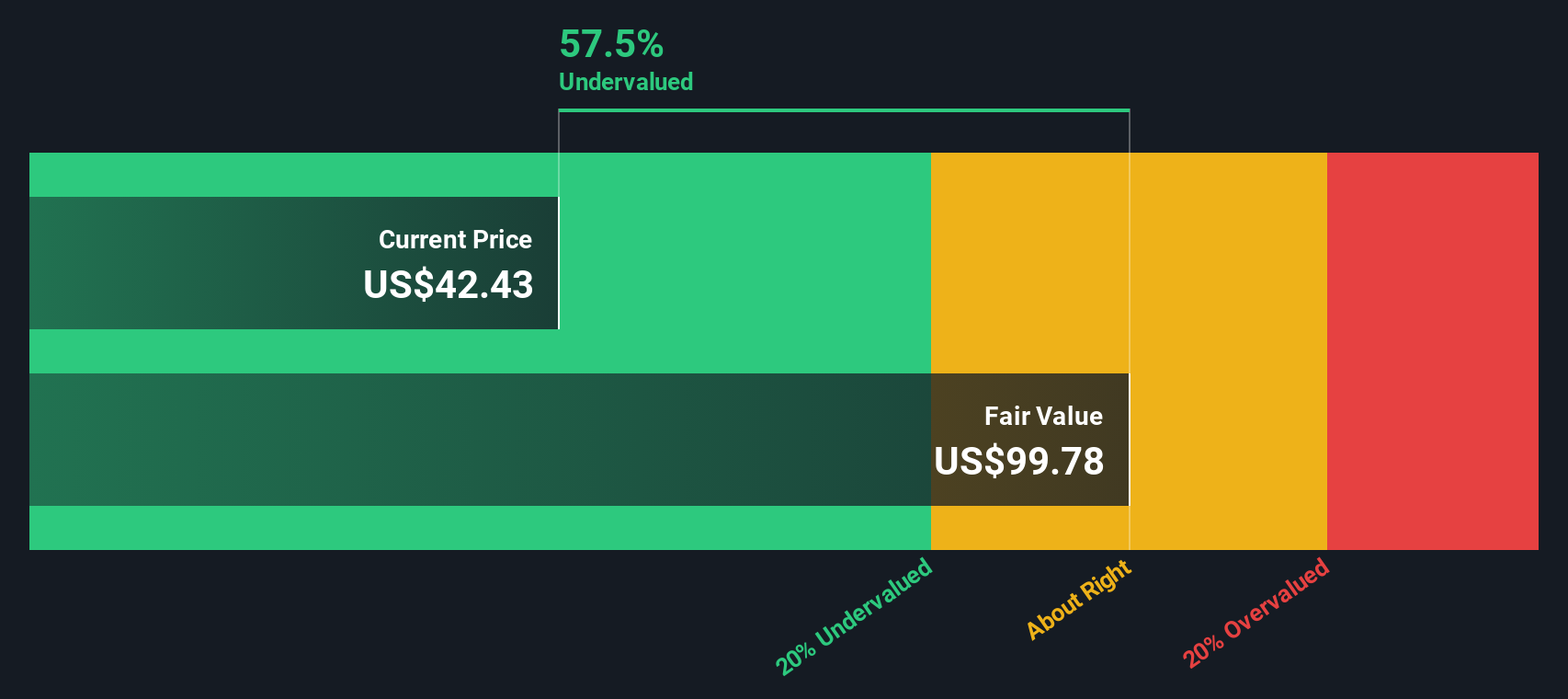

So, what does this mean for valuation? Is the market discounting KBR’s potential, or is it already factoring in plenty of upside from wins like these?

Most Popular Narrative: 19.7% Undervalued

According to the most widely followed narrative, KBR is considered substantially undervalued in the current market. Analysts see considerable upside potential if the company achieves its projected growth and profitability targets over the coming years.

The passage of the U.S. Reconciliation Act is unlocking more than $1 trillion in national security and defense spending through 2026. KBR is well-positioned to capture incremental funding due to its established positions in mission tech, advanced defense technologies, and intelligence contracts, which supports potential revenue and earnings growth.

Wondering what is fueling this bullish valuation? It comes down to bold growth assumptions, margin upgrades, and a profit path that challenges industry norms. If you want an inside look into the pivotal metrics and performance levers driving this projected fair value, the narrative has plenty of specifics, though they are not yet revealed here.

Result: Fair Value of $60.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks such as government contract delays or losses and geopolitical instability could quickly undermine the bullish outlook for KBR’s future growth and margins.

Find out about the key risks to this KBR narrative.Another View: DCF Model Results

While the market’s favorite metric paints KBR as undervalued, our DCF model points to an even deeper disconnect between today’s share price and long-term cash flow expectations. Is something significant being overlooked?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own KBR Narrative

If the numbers or outlook here do not fit your personal view, keep in mind you can dig into the data and shape your own take on KBR in just a few minutes. Do it your way.

A great starting point for your KBR research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock the next wave of smart investment opportunities today. Smart investors broaden their horizons, exploring plenty of ways to lead the pack and spot tomorrow's winners before the crowd.

- Capitalise on companies reimagining healthcare and biotech by starting with healthcare AI stocks, where artificial intelligence is powering new breakthroughs and market potential.

- Catch undervalued businesses primed for a turnaround by reviewing undervalued stocks based on cash flows, a shortcut to stocks the market might be overlooking.

- Seize the growth potential in the evolving world of digital currencies with cryptocurrency and blockchain stocks, tracking game-changers in blockchain and the future of finance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.