يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Closer Look at Park Hotels & Resorts (PK) Valuation After Major Credit Agreement Overhaul

Park Hotels & Resorts, Inc. PK | 10.71 | -1.52% |

Park Hotels & Resorts (PK) just made a big move that is turning heads on Wall Street. The company has overhauled its credit agreement by expanding its senior secured revolving credit facility to $1 billion, pushing key maturity dates further out, and adding a new $800 million senior unsecured delayed draw term loan facility. For investors, the significance is clear: this financial upgrade highlights management’s emphasis on shoring up liquidity and getting ahead of some major loans coming due in 2026.

This news arrives at a moment when Park’s stock price performance reflects both promise and pressure. Shares have climbed more than 12% over the past three months, hinting at building momentum. Yet, the longer-term view remains complex, with a near 15% drop over the year but strong gains over three and five years. Investors have seen other events, such as high-profile hotel reopenings, but this latest strengthening of the balance sheet stands out for its forward-looking impact on risk and flexibility.

So after a year of ups and downs, the question remains: does this financial maneuver open up a smart buying window, or is the market already pricing in all the future growth?

Most Popular Narrative: 8.4% Undervalued

According to the most widely followed narrative, Park Hotels & Resorts (PK) is considered undervalued by 8.4% relative to its fair value, based on analysts’ projections and assumptions about its future growth and profitability. This view underpins its calculated fair value using a discount rate of 11.99% and forward-looking earnings expectations.

Significant reinvestment and renovations in key resort and urban assets (for example, Royal Palm South Beach, Hilton Hawaiian Village, Waldorf Astoria Orlando) are expected to drive outsized growth in RevPAR, occupancy, and EBITDA once projects stabilize. This leverages travelers' increasing desire for experiential and high-end accommodations and will likely support above-market revenue and net margin expansion.

Want to find out which bold moves and future forecasts drive this bullish valuation? One key variable, if it proves out, could make Park Hotels & Resorts the stealth winner among its peers. Ready to discover the assumptions that set this price target apart from the rest of the sector?

Result: Fair Value of $12.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent weak international travel or heightened refinancing risk could disrupt Park’s rebound story. This could potentially delay earnings growth and weigh on the stock’s appeal.

Find out about the key risks to this Park Hotels & Resorts narrative.Another View: Is the Market Sending a Different Signal?

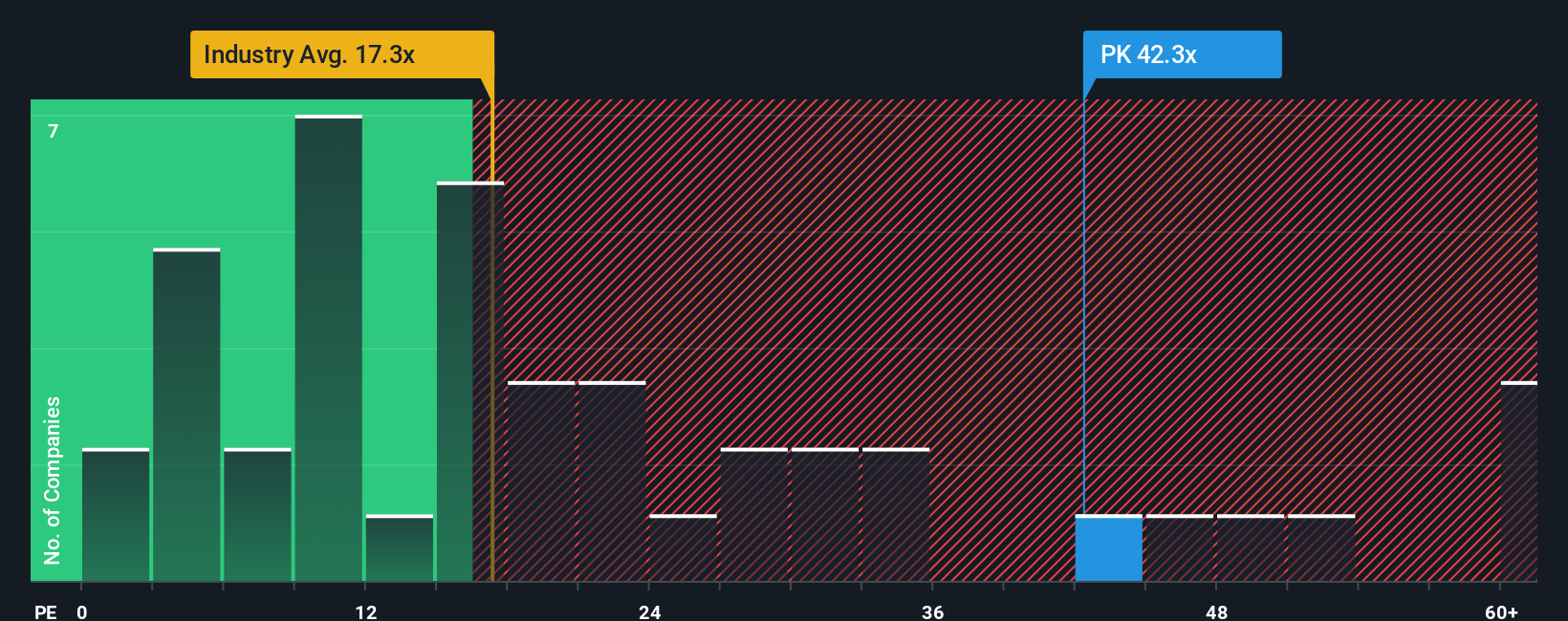

While one method suggests there is a bargain here, looking from another angle tells a different story. On this measure, Park Hotels & Resorts appears expensive compared to the industry. Could this be a warning sign, or is it just noise?

Build Your Own Park Hotels & Resorts Narrative

If you feel the story doesn’t quite fit your outlook or want to test your own assumptions, you can build a personal narrative from the data in just a few minutes. Do it your way.

A great starting point for your Park Hotels & Resorts research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Ready for More Winning Investment Ideas?

Don’t limit your strategy to just one company. Make your next move by targeting smart investment themes where real growth and opportunity await. Simply Wall Street’s tools are designed to give you an edge that others might overlook.

- Accelerate your search for high-potential upstarts boasting financial strength by targeting penny stocks with strong financials, which are poised to make a mark beyond the headlines.

- Tap into the momentum of bleeding-edge innovation with AI penny stocks, where artificial intelligence fuels new market leaders at the crossroads of technology and profits.

- Boost your passive income game by focusing on dividend stocks with yields > 3% and find companies offering robust yields and a record of reliable performance, potentially outperforming traditional choices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.