يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Fresh Look at Select Medical Holdings (SEM) Valuation as Shares Decline 2% This Month

Select Medical Holdings Corporation SEM | 15.64 15.64 | -0.32% 0.00% Pre |

Shares of Select Medical Holdings have lost ground this year, as investors reassess the company’s outlook. Its 1-year share price return stands at -30.28% and total shareholder return for the same period is -33.91%. While the stock has shown slight 3-year and 5-year total returns near 6%, recent momentum hasn’t been strong, which reflects shifting sentiment around the company’s future growth and risk profile.

Curious about what else is happening in healthcare? Now’s a great moment to expand your search by checking out See the full list for free.

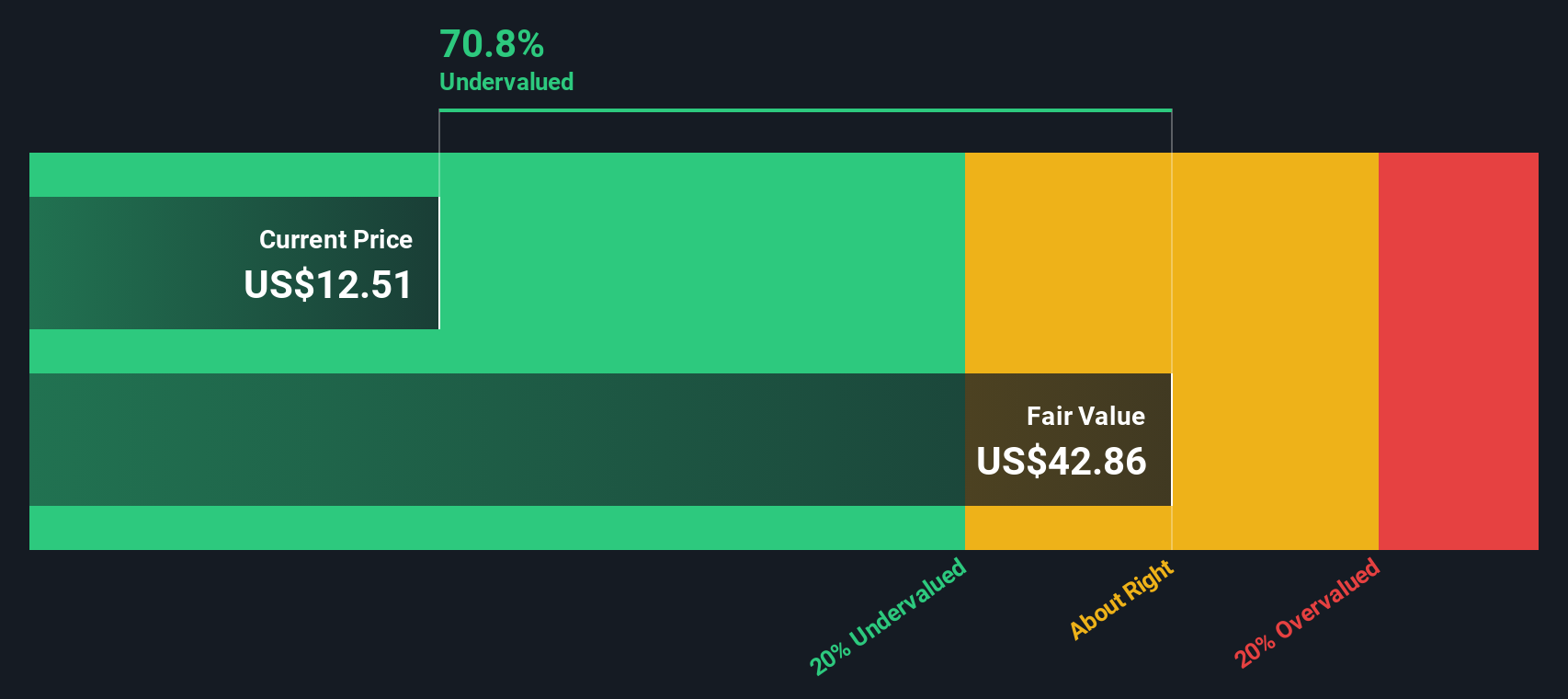

With shares trading well below analyst estimates but recent growth metrics looking mixed, the key question arises: is Select Medical Holdings undervalued right now, or is the market simply factoring in all expected gains ahead?

Most Popular Narrative: 26.5% Undervalued

Select Medical Holdings closed at $13.10, with the most popular narrative calculating a fair value over 25% higher than the current share price. This narrative sets bold expectations for the company's ability to rebound from recent weakness, rooted in its expansion and operational initiatives.

Increased consolidation of smaller providers and successful execution of joint venture strategies with large health systems position the company to grow market share and network density. This could lead to improved bargaining power, reduced referral source dependency, and more resilient earnings.

Ever wondered what assumptions are boosting this target? The full narrative dives into controversial profit projections, bold revenue targets, and margin expansion plays that could chart a new path for Select Medical. Only by reading further will you see the behind-the-scenes forecasts that drive this provocative valuation.

Result: Fair Value of $17.83 (UNDERVALUED)

However, regulatory challenges and growing industry preference for home-based care could undermine Select Medical’s growth projections and put pressure on future margins.

Another View: Our DCF Model Suggests a Different Story

While analyst price targets see Select Medical Holdings as undervalued, our SWS DCF model reaches a different conclusion. According to this cash flow based approach, the current share price is above the estimated fair value, challenging the notion of a bargain buy. Will the market move closer to this calculation, or do fundamentals truly justify higher prices?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Select Medical Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Select Medical Holdings Narrative

If you have a different perspective or want to dive deeper into the numbers, you can craft your own narrative in just a few minutes. Do it your way.

A great starting point for your Select Medical Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye out for the next big opportunity. Don’t let today’s insights be the end of your journey; find what’s truly moving the markets.

- Capture high-yield potential by targeting stable payouts through these 16 dividend stocks with yields > 3%, offering strong returns above 3% that can power up your income portfolio.

- Tap into future trends with these 32 healthcare AI stocks, where innovative healthcare companies are redefining patient care using artificial intelligence and breakthrough medical technology.

- Get ahead of market mispricings and seize value with these 886 undervalued stocks based on cash flows based on robust cash flow analysis, setting yourself up for tomorrow’s winners.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.