يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At Acadia Realty Trust (AKR) Valuation After Recent Share Price Move

Acadia Realty Trust AKR | 20.28 | +1.40% |

Why Acadia Realty Trust Is Drawing Investor Attention Now

Acadia Realty Trust (AKR) is back on the radar after a recent share price move, with the stock last closing at US$20.01 as investors reassess its long term retail property story.

The recent 1 day share price return of 1.16% at US$20.01 sits against a softer year to date share price return of a 3.05% decline. Total shareholder return over three and five years of 44.66% and 62.09% respectively points to momentum that has built over a longer horizon.

If Acadia’s retail real estate story has caught your eye, this could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership.

With Acadia trading at US$20.01, an indicated 28.57% intrinsic discount and around 12.09% below one analyst price target, you have to ask whether this represents a genuine value gap or if the market is already pricing in future growth.

Most Popular Narrative: 10.2% Undervalued

With Acadia Realty Trust’s fair value narrative sitting at $22.29 against a last close of $20.01, the current setup hinges on how urban retail plays out.

The company's outsized exposure to dense, affluent urban corridors, where urbanization trends and demographic shifts continue to drive premium consumer demand and limited new retail development, supports strong occupancy rates, rent increases, and margin expansion.

Interested in why this story supports a higher fair value than today’s price? The narrative leans on compounding revenue gains and a rich earnings multiple tied to those projections.

Result: Fair Value of $22.29 (UNDERVALUED)

However, you also have to weigh risks such as pressure from e commerce on street retail, as well as higher capital needs if acquisitions or redevelopments do not play out as expected.

Another Angle On Valuation

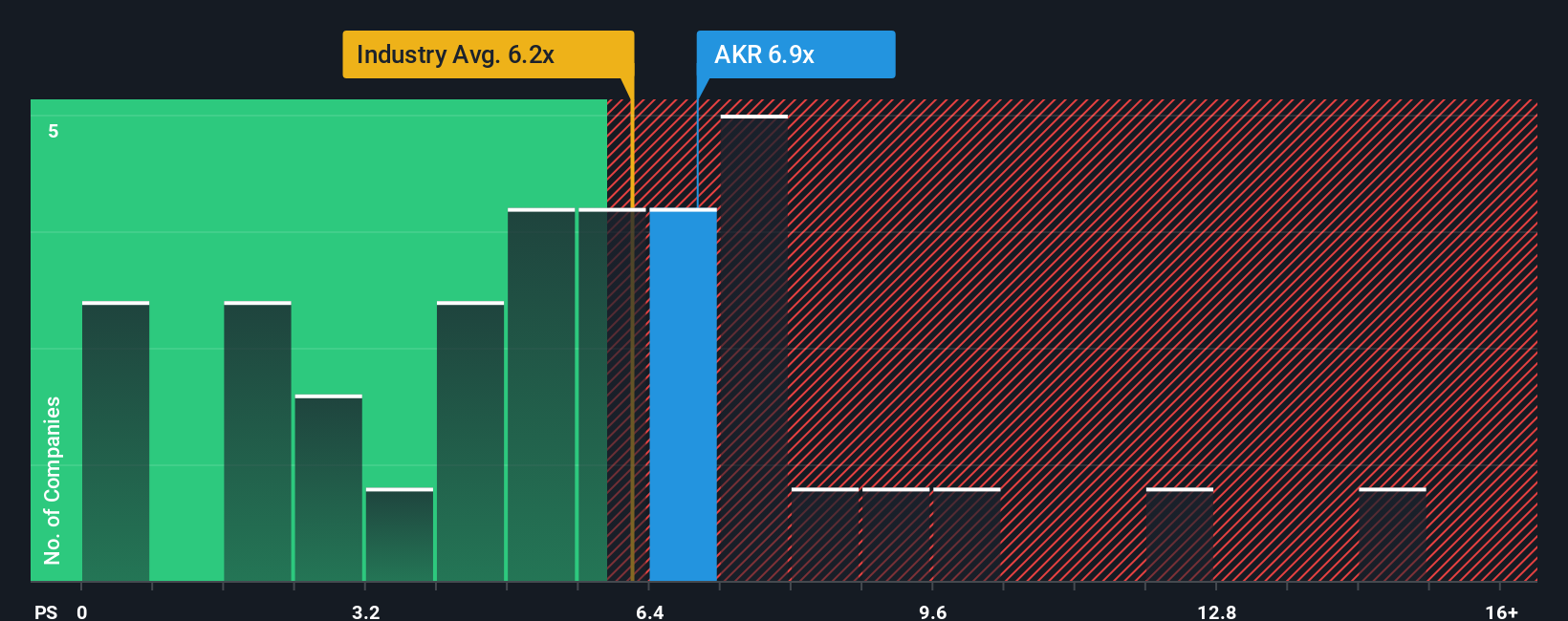

While the fair value narrative points to undervaluation, the P/S story is more cautious. Acadia trades at 6.7x P/S versus a fair ratio of 5.1x and a US Retail REITs average of 6.2x, which leans toward richer pricing. Is this a margin of safety or a premium you are willing to pay?

Build Your Own Acadia Realty Trust Narrative

If you are not fully on board with this view or simply prefer to kick the tires yourself, you can test the assumptions, plug in your own numbers, and build a version that fits your outlook with Do it your way.

A great starting point for your Acadia Realty Trust research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Acadia has sparked your interest, do not stop here. The real edge often comes from comparing several quality ideas side by side before you commit.

- Spot potential high return opportunities early by scanning these 3528 penny stocks with strong financials that already show stronger fundamentals than many expect from lower priced names.

- Ride structural themes in technology by checking out these 24 AI penny stocks that sit at the intersection of AI progress and listed equity markets.

- Stay disciplined on price by reviewing these 874 undervalued stocks based on cash flows that screens for companies trading below their estimated cash flow based value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.