يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look at Air Products and Chemicals’s Valuation Following Analyst Recognition and New Industrial Gas Initiatives

Air Products and Chemicals, Inc. APD | 242.70 | -0.12% |

Air Products and Chemicals (APD) has been added to Goldman Sachs’ US Conviction List, as expectations rise for growth in industrial gas demand. The company is also preparing to highlight new industrial gas solutions at a major industry conference.

Momentum in Air Products and Chemicals has been mixed lately, with the stock seeing some near-term volatility as investors digest both industry headwinds and an active pipeline of high-return projects. Despite recent challenges, its 3-year total shareholder return of 22.3% reflects underlying resilience and long-term value creation. Slower economic recovery in China has briefly weighed on sentiment.

If you're curious about what else is gaining traction in industrials, it's a great moment to discover fast growing stocks with high insider ownership.

With shares trading nearly 20% below Goldman Sachs’ price target and long-term growth projects underway, is Air Products now undervalued, or has the market already accounted for its next wave of expansion?

Most Popular Narrative: 16.5% Undervalued

Air Products and Chemicals is currently trading at $270.60, which stands notably below the most widely tracked narrative fair value of $324.14. This sets up major anticipation as the market looks ahead to the company's pivotal growth initiatives and efficiency drives.

Heavy investments in large-scale hydrogen, blue/green ammonia, and carbon capture projects, supported by multi-decade power and supply agreements in growth regions (e.g., Middle East, Asia, U.S. Gulf Coast), are set to come online over the next several years. These developments are expected to provide robust and stable earnings while supporting a trajectory of consistently higher operating margins.

Want to see what’s fueling this high valuation? Secrets lie in the projected surge in profit margins and bold assumptions about future earnings power. Don’t miss the full reveal; these financial leaps are far from average.

Result: Fair Value of $324.14 (UNDERVALUED)

However, persistent high capital expenditures and uncertain helium market dynamics could present challenges to Air Products' margin recovery and long-term growth outlook.

Another View: Pricing Through Multiples

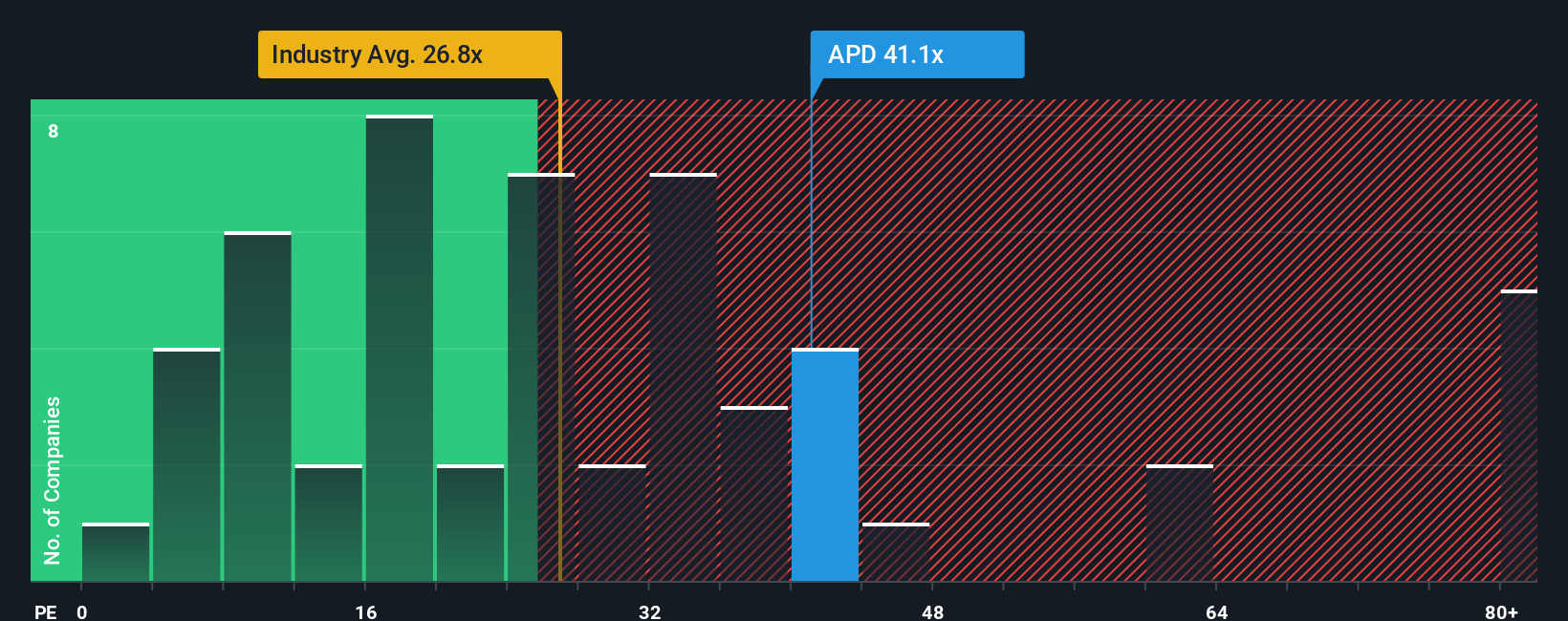

While the analyst consensus suggests Air Products and Chemicals is undervalued, a look at its price-to-earnings ratio paints a tougher picture. The company's P/E is 38.3x, which is much steeper than the US Chemicals industry average of 25.9x and above the peer average, as well as the fair ratio of 36.6x. This premium could signal higher expectations or increased risk if performance does not keep up. Which lens best captures the company’s real value?

Build Your Own Air Products and Chemicals Narrative

If you see the story differently or prefer hands-on research, you can dive in and create a personalized viewpoint in just a few minutes. Do it your way.

A great starting point for your Air Products and Chemicals research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock your next great investment by targeting trends others overlook. With unique screeners that spotlight emerging sectors and powerful returns, you’ll keep your watchlist ahead of the curve.

- Capitalize on new waves of innovation by scanning these 24 AI penny stocks set to benefit from rapid advances in artificial intelligence capabilities.

- Secure reliable income streams and grow your wealth by picking from these 19 dividend stocks with yields > 3% consistently outperforming average market yields.

- Tap into the world’s evolving financial systems as you back these 78 cryptocurrency and blockchain stocks riding the momentum of blockchain and digital asset adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.