يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look at Antero Midstream’s Valuation After $650 Million Debt Offering and Record Production Growth

Antero Midstream Corp. AM | 19.90 19.90 | +0.81% 0.00% Pre |

Most Popular Narrative: Fairly Valued

According to the most widely followed narrative, Antero Midstream is considered fairly valued by analysts, with only a slight difference between the current price and consensus estimates. The prevailing view is that the company’s current stock price closely reflects reasonable expectations for its future earnings and growth.

"Rising U.S. LNG export demand and expansion of Gulf Coast LNG facilities are expected to drive higher natural gas volumes from Appalachia, supporting Antero Midstream's gathering and processing volumes and underpinning sustained revenue growth. Infrastructure modernization and rising Northeast U.S. in-basin demand, particularly from data centers and industrial projects enabled by favorable regulation, should increase utilization of existing assets and provide additional fee-based revenue opportunities as new infrastructure is built to meet this demand."

Curious about how much future energy demand and asset modernization could fuel Antero Midstream’s next leap? Buried inside the full narrative are key numbers and aggressive forecasts that drive this fair value calculation. Wondering which hidden assumptions could tip the scales further? There’s more to this projection than meets the eye.

Result: Fair Value of $18.07 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, lingering regulatory hurdles or a downturn in natural gas demand could quickly challenge the current fair value outlook for Antero Midstream.

Find out about the key risks to this Antero Midstream narrative.Another View: Discounted Cash Flow Perspective

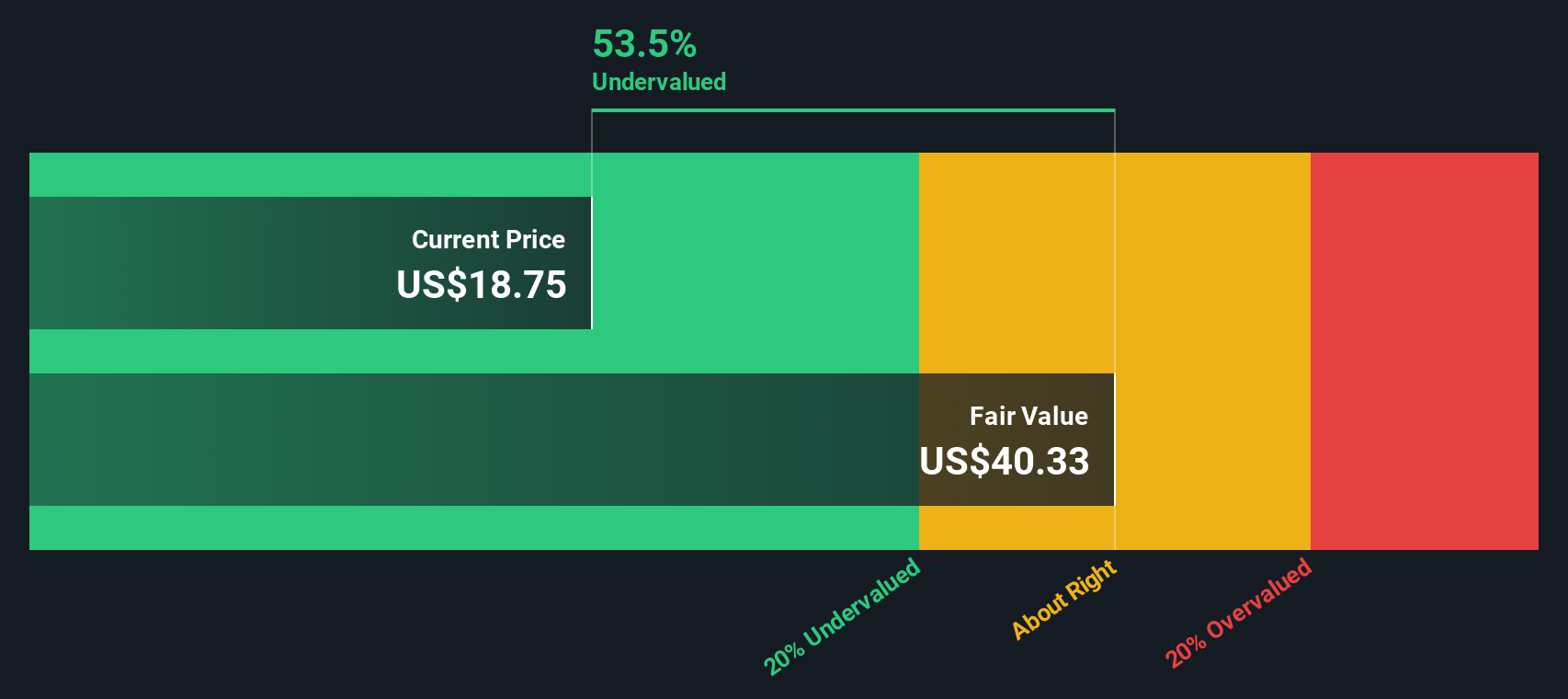

While analysts see Antero Midstream as fairly valued on forecasted earnings and multiples, our SWS DCF model provides a very different perspective. It suggests the stock could actually be trading well below its true value. Does this fundamental approach reveal a hidden opportunity?

Build Your Own Antero Midstream Narrative

If you have your own take on these numbers or want to dig deeper into the story, you can build your own narrative in just a few minutes. Do it your way.

A great starting point for your Antero Midstream research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Why limit yourself to one opportunity when there are smart ways to spot the next breakout? Let Simply Wall St’s free Screener put you ahead.

- Tap hidden value by searching for companies that are far cheaper than their fundamentals suggest with our undervalued stocks based on cash flows. Find tomorrow’s bargains before others catch on.

- Unlock steady growth potential and enjoy powerful income by targeting businesses offering reliable payout yields. Start with dividend stocks with yields > 3% for candidates delivering consistent dividends over 3%.

- Ride the wave of innovation in medicine and patient care by scanning leading-edge opportunities through our healthcare AI stocks and meet the next pioneers in healthcare AI.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.