يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At BankUnited (BKU) Valuation After Raymond James Initiates Coverage With Outperform Rating

BankUnited, Inc. BKU | 50.07 | +2.20% |

BankUnited (BKU) drew fresh attention after Raymond James initiated coverage with an Outperform rating, coinciding with a 3.1% intraday move and a new 52 week high that has sharpened investor focus on the stock.

The Raymond James initiation has come after a strong run, with a 90 day share price return of 27.52% and a 1 year total shareholder return of 22.23%. This is signaling momentum that investors are treating as increasingly backed by improving sentiment around BankUnited and regional banks more broadly.

If this kind of move has caught your eye, it could be a good moment to widen your search with fast growing stocks with high insider ownership and see what other fast moving names meet your criteria.

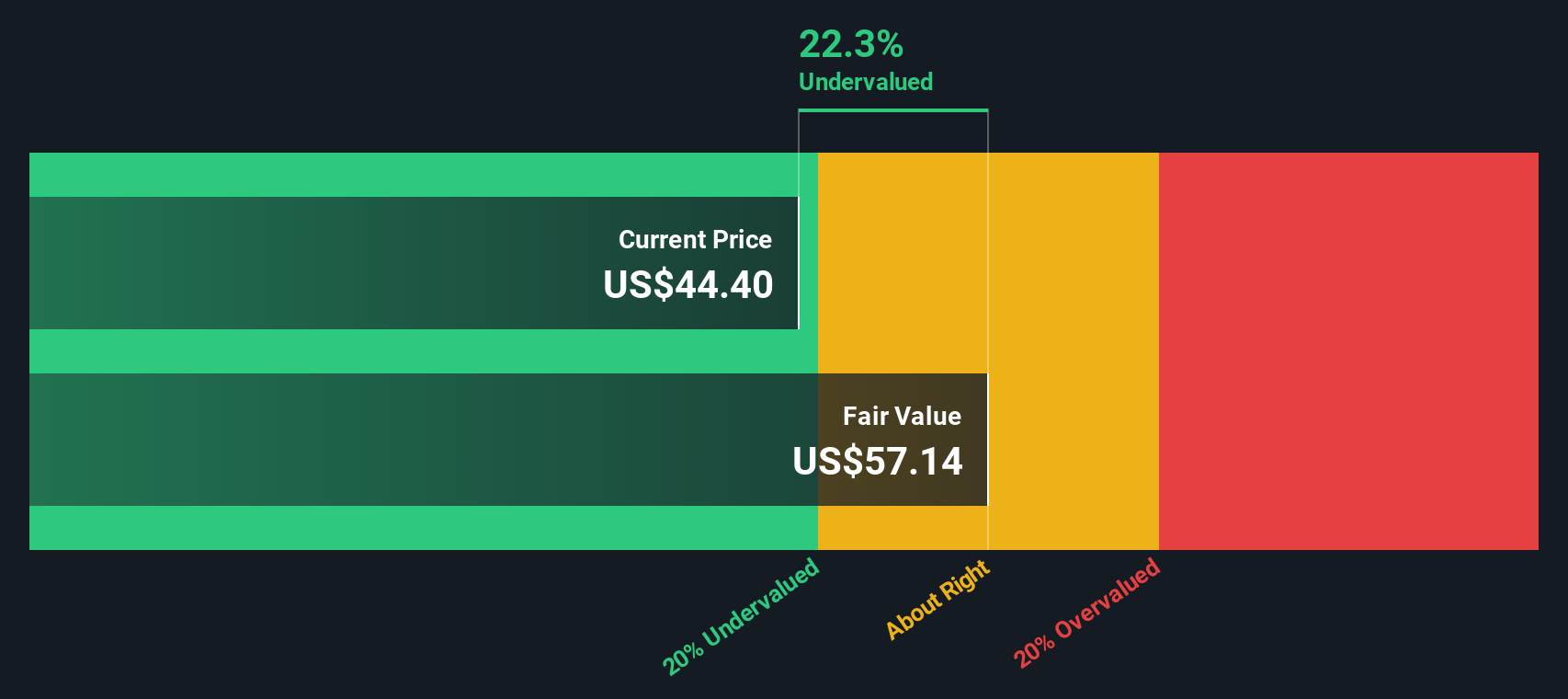

With BankUnited trading close to recent analyst targets and carrying an indicated intrinsic discount of about 22%, the key question is whether the recent rally still leaves room for upside or if the market is already pricing in future growth.

Most Popular Narrative: 2.6% Overvalued

Compared with BankUnited's last close at US$47.08, the most widely followed narrative points to a fair value of about US$45.90, suggesting the current price sits slightly ahead of that estimate.

Bullish analysts see the updated fair value estimate of about $45.90 as still above the recent US$40 price target. They view this as leaving some room for upside if execution improves.

Want to see what kind of earnings power would justify paying above a recent target price? The narrative leans on richer margins and a higher future P/E. Curious which assumptions really move that valuation number?

Result: Fair Value of $45.90 (OVERVALUED)

However, the story could change quickly if credit issues in office-related commercial real estate deepen or if nonperforming assets keep building and pressure provisions.

Another Angle on Value

The narrative model pegs BankUnited about 2.6% above its US$45.90 fair value, yet our DCF model points the other way, with an estimate of about US$60.12. One approach calls the shares slightly rich, while the other sees a discount. Which assumptions feel closer to how you think the next few years play out?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out BankUnited for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 871 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own BankUnited Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to rely on your own work, you can build a fresh view in just a few minutes with Do it your way.

A great starting point for your BankUnited research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

If you are serious about finding your next opportunity, casting a wider net with focused stock screens can help you quickly spot ideas that fit your style.

- Scan for potential value opportunities by checking out these 871 undervalued stocks based on cash flows that might align with your return and risk expectations.

- Capitalize on trends in digital assets by reviewing these 80 cryptocurrency and blockchain stocks that are tied to cryptocurrency and blockchain themes.

- Strengthen your income focus by pinpointing these 12 dividend stocks with yields > 3% that could complement a portfolio built around regular cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.