يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At Cavco Industries (CVCO) Valuation After Earnings, American Homestar Deal And Share Buybacks

Cavco Industries, Inc. CVCO | 595.80 | +2.95% |

Cavco Industries (CVCO) is back in focus after reporting third quarter and nine month results, closing the American Homestar acquisition, and updating investors on recent share repurchases that collectively shape the current stock story.

The recent earnings release, the American Homestar acquisition and ongoing share repurchases come against a mixed price backdrop. The company has reported a strong 17.56% 7 day share price return alongside a 15.02% 30 day share price decline and a 6.89% 1 year total shareholder return that builds on very large 3 and 5 year total shareholder returns.

If Cavco’s latest moves have you thinking about where else capital could work hard, this might be a good moment to check out 23 top founder-led companies as a fresh source of ideas.

With the stock trading at $567.38, an indicated intrinsic discount of about 30%, and only a small gap to the current analyst price target, you have to ask yourself: is there still a buying opportunity here, or is the market already pricing in future growth?

Most Popular Narrative: 3.4% Undervalued

With Cavco Industries last closing at $567.38 against a widely followed fair value narrative of about $587.50, the current setup hinges on how future growth, margins, and capital allocation play out over time.

Cavco's strategy of acquisitions (e.g., American Homestar) and national expansion enhances production scale, increases geographic market share, and is expected to deliver cost synergies and product optimization, supporting not just revenue growth but also margin improvement over time.

Curious what kind of revenue path and profit profile need to materialize for that fair value to hold up? The core of this narrative leans on steady top line expansion, firming margins, and a future earnings multiple that asks you to decide whether factory built housing deserves a premium. The full story spells out exactly how those pieces are expected to fit together.

Result: Fair Value of $587.50 (UNDERVALUED)

However, there are still pressure points to watch, particularly tariff costs on imported components and demand that is sensitive to interest rates, which could challenge margins and shipment volumes.

Another Angle On Cavco’s Valuation

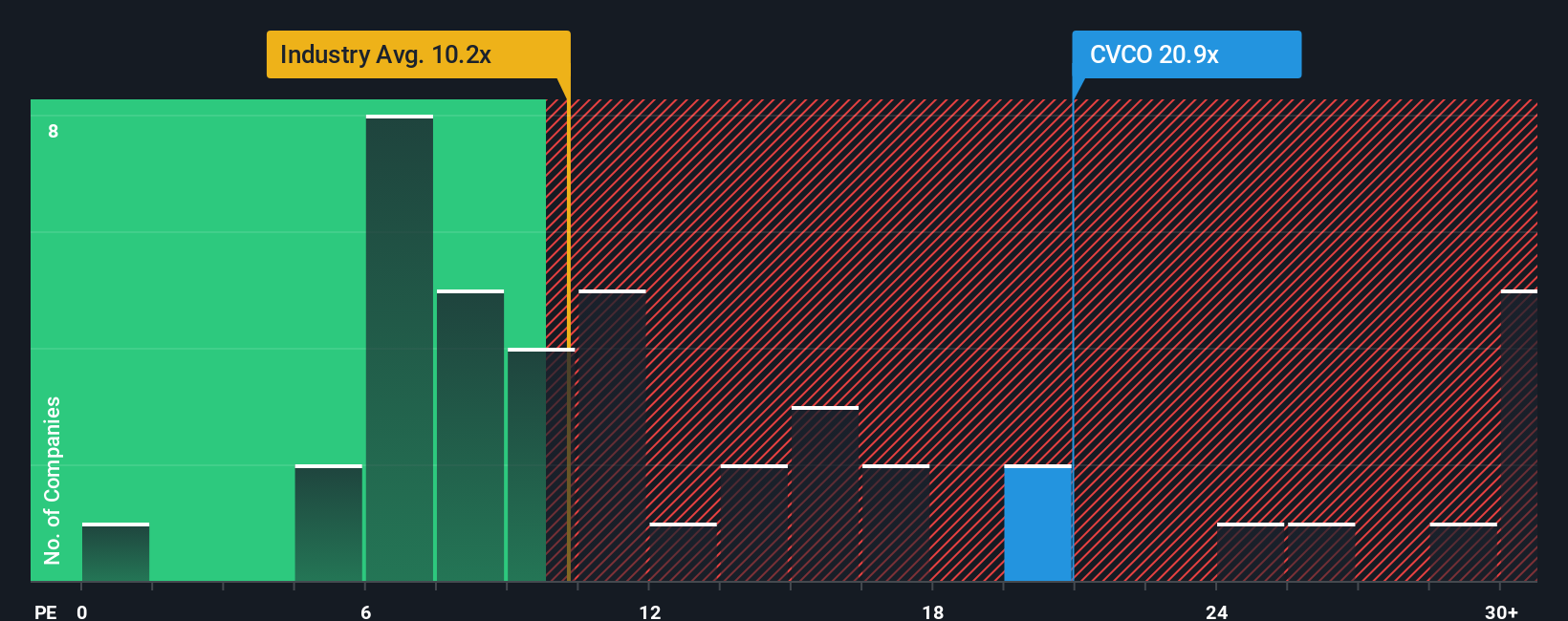

The fair value narrative points to Cavco trading at about a 30.3% discount to modeled cash flows, but the current P/E of 23.9x tells a different story. It sits well above the US Consumer Durables industry at 13.3x, the peer average at 13.5x, and even the fair ratio of 15.7x. That gap suggests investors are already paying up for quality. The key question is whether the business can keep justifying that premium.

Build Your Own Cavco Industries Narrative

If you see the numbers differently or prefer to rely on your own work, you can build a personalized Cavco view in just a few minutes, starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Cavco Industries.

Looking for more investment ideas?

If Cavco has sharpened your thinking, do not stop here. Use this momentum to quickly scan other opportunities and keep your watchlist working for you.

- Spot potential value opportunities early by running through 51 high quality undervalued stocks that currently combine strong fundamentals with pricing that may not fully reflect them yet.

- Strengthen the defensive side of your portfolio by checking out 83 resilient stocks with low risk scores that score well on stability, financial health, and downside protection.

- Get ahead of the crowd by reviewing our screener containing 24 high quality undiscovered gems that pair solid numbers with relatively low attention from the wider market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.