يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At Century Aluminum (CENX) Valuation As Volatility And Institutional Options Activity Intensify

Century Aluminum Company CENX | 47.23 | +0.48% |

Heightened volatility in Century Aluminum (CENX) has been sparked by sharp swings in global metals markets and a cluster of large options trades from institutional investors, leaving sentiment split on the stock’s near term direction.

Those abrupt swings sit on top of a strong run, with a 35.88% 1 month share price return and a one year total shareholder return of 124.63%. This suggests that momentum has been building even as short term price moves reflect shifting risk perceptions.

If sharp moves in commodities are on your radar, it could be a good moment to widen your watchlist and check out fast growing stocks with high insider ownership.

With Century Aluminum trading at $42.23 against a $40.00 analyst target, yet flagged with a 47.20% intrinsic discount, you have to ask: is this a genuine value gap, or is the market already pricing in future growth?

Most Popular Narrative Narrative: 5.6% Overvalued

With Century Aluminum last closing at US$42.23 against a narrative fair value of US$40, the current price sits slightly above that modeled estimate, putting extra focus on the earnings and margin assumptions behind the gap.

The expansion and restart of Mt. Holly, along with progress on a new U.S. smelter, positions Century Aluminum to meaningfully increase U.S. primary aluminum production, capturing rising domestic demand driven by reshoring of supply chains and incentivized by government tariffs and trade protections. This is expected to support future revenue growth and improved fixed cost absorption, thus enhancing net margins.

Curious how double digit revenue growth, wider margins and a lower future P/E all fit together here. The core inputs are bolder than they look at first glance.

Result: Fair Value of $40 (OVERVALUED)

However, the story could change quickly if U.S. aluminum tariffs or Midwest premiums are cut, or if power and raw material costs move against Century Aluminum.

Another View: DCF Points the Other Way

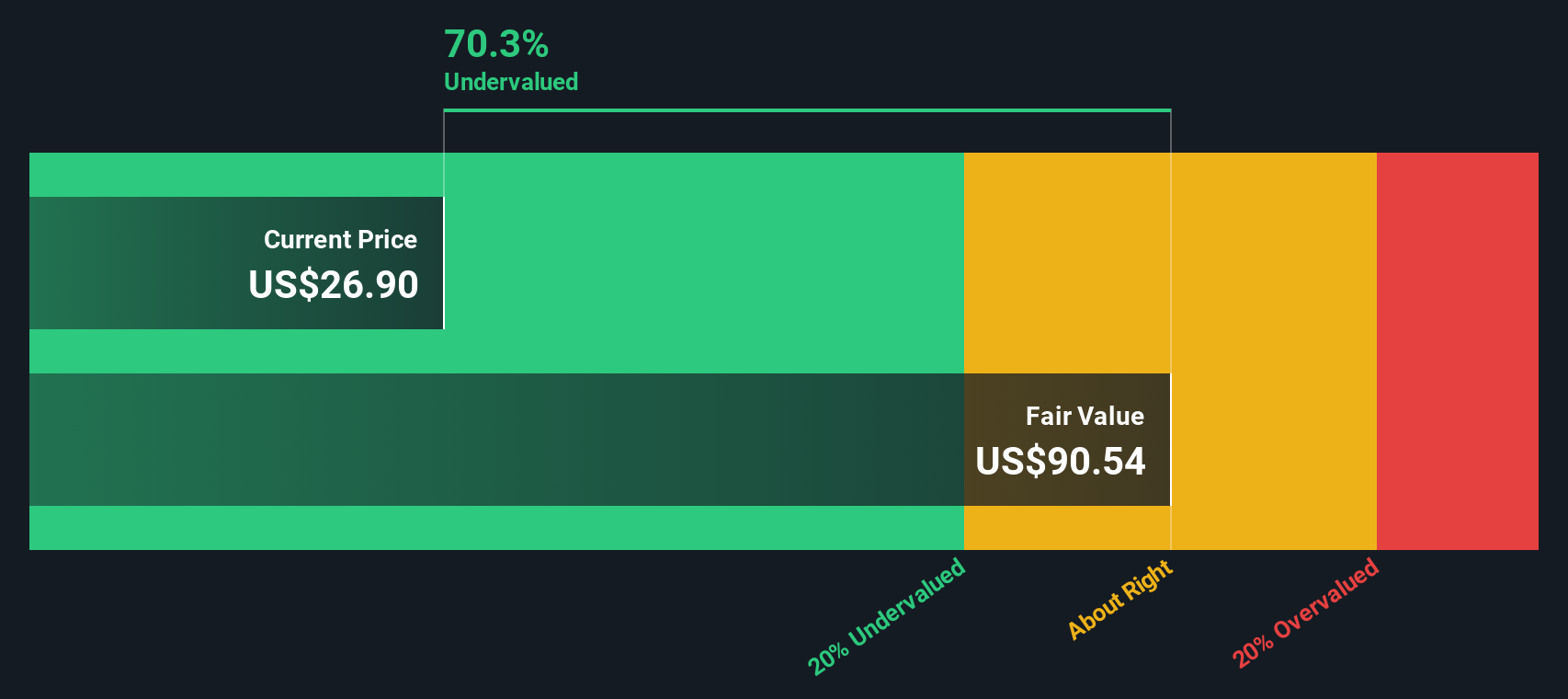

While the narrative model suggests Century Aluminum looks about 5.6% overvalued at US$42.23 versus a US$40 fair value, our DCF model implies something very different, with the shares trading around 47.2% below an estimated fair value of US$79.98. Which story do you find more convincing?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Century Aluminum for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Century Aluminum Narrative

If you are not on board with these assumptions, or prefer to test the numbers yourself, you can build a custom view in a few minutes by starting with Do it your way.

A great starting point for your Century Aluminum research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Century Aluminum is on your radar, do not stop there. Use this momentum to scan for other opportunities that could fit your style and risk tolerance.

- Spot potential turnaround candidates by checking out these 3555 penny stocks with strong financials that pair smaller share prices with balance sheets and cash flows you can actually assess.

- Target the intersection of healthcare and machine learning by reviewing these 29 healthcare AI stocks that focus on real revenue drivers, not just buzzwords.

- Zero in on cash flow focused opportunities by using these 875 undervalued stocks based on cash flows to find companies where market prices and modeled value are pointing in different directions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.