يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At CMS Energy’s (CMS) Valuation After Earnings Beat Outlook Upgrade And Dividend Raise

CMS Energy Corporation CMS | 75.86 | +0.01% |

Why CMS Energy’s latest earnings and dividend move matter

CMS Energy (CMS) combined its fourth quarter and full year 2025 earnings release with a higher 2026 outlook, a refreshed five year capital plan, and an increase in its quarterly dividend.

The recent earnings beat, higher 2026 outlook and dividend increase appear to line up with improving sentiment, with a 7 day share price return of 4.1% and a 1 year total shareholder return of 10.4%, while 3 and 5 year total shareholder returns of 33.0% and 54.4% suggest momentum has been building over time.

If utilities and income stocks are on your radar after this update, it could also be worth broadening your search to founder led businesses by checking out our 22 top founder-led companies.

With CMS Energy shares up over the past year and trading only modestly below analyst targets, the key question now is whether the recent earnings beat and dividend lift leave any mispricing on the table or if the market already reflects future growth.

Most Popular Narrative: 3.8% Undervalued

CMS Energy's most followed narrative puts fair value at about $77.46 versus the last close of $74.52, so expectations are only slightly ahead of the current price.

The accelerating demand for electricity, driven in part by large new data center projects and strong population and business growth within Michigan, is set to sustainably boost sales growth above prior forecasts, likely resulting in stronger top-line revenue and rate base expansion.

A robust $25+ billion pipeline in grid modernization and renewable investments, paired with supportive federal policies and tax credits, positions CMS Energy to capitalize on regulatory-approved projects and improve return on equity, supporting long-term earnings growth.

Want to see what this pipeline means for the numbers? Revenue, earnings, and margins are all baked into this fair value story. The precise mix may surprise you.

Result: Fair Value of $77.46 (UNDERVALUED)

However, the story could change if large expected customers like data centers scale back, or if Michigan regulators become less supportive on cost recovery and rate cases.

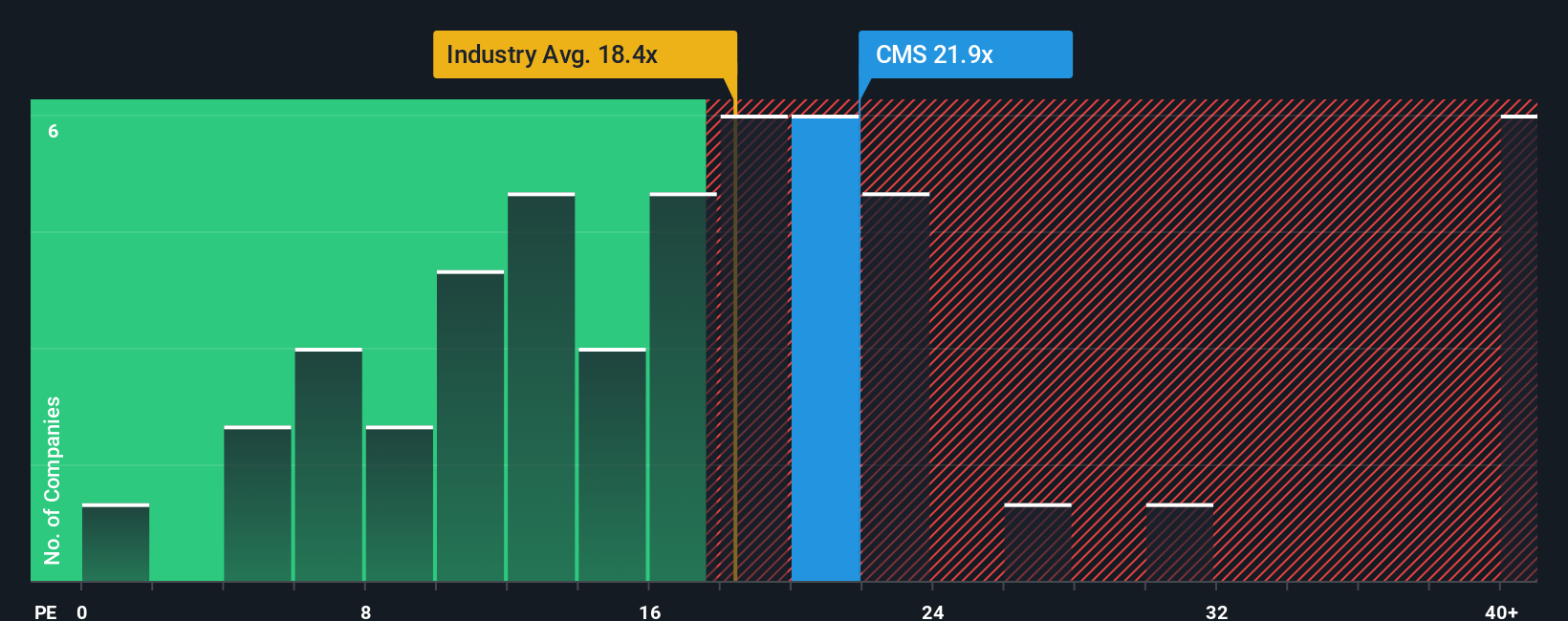

Another View: Earnings Multiple Sends A Different Signal

While the most followed narrative points to a fair value of $77.46 and labels CMS Energy as undervalued, the current P/E of 21.4x tells a more nuanced story. It sits above the global Integrated Utilities average of 19.3x, yet below the peer average of 23.4x and close to a fair ratio of 22.7x. This suggests the market may already be pricing in a lot of the expected growth. So is this a small gap worth leaning into, or a thin margin of safety if expectations slip?

Build Your Own CMS Energy Narrative

If you see the numbers differently or simply prefer to test your own view, you can build a custom narrative in just a few minutes by starting with Do it your way.

A great starting point for your CMS Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas beyond CMS Energy?

If you only stop at one company, you risk missing out on others that may fit your style even better, so keep your opportunity set wide and informed.

- Target resilient income by scanning for 13 dividend fortresses that focus on higher yields with an emphasis on stability.

- Hunt for potential mispricings using our 52 high quality undervalued stocks that filters for quality businesses trading below their assessed worth.

- Spot under the radar opportunities through a screener containing 24 high quality undiscovered gems curated to surface companies with strong fundamentals that many investors still overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.