يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At Constellation Brands (STZ) Valuation As Mexican Brewery Expansion Nears Completion

Constellation Brands, Inc. Class A STZ | 154.85 | -0.92% |

Recent updates around Constellation Brands (STZ) focus on its Mexican brewery build out, where the company plans roughly US$2b of spending between fiscal 2026 and 2028 to add 7 million hectoliters of capacity.

Those brewery investments come as Constellation’s share price has moved sharply higher in recent months, with a 30 day share price return of 15.26% and a 90 day share price return of 29.71%, while the 1 year total shareholder return is roughly flat and the 5 year total shareholder return remains negative. This suggests that recent momentum contrasts with a weaker longer term experience for many holders.

If this expansion story has you thinking more broadly about growth, it could be worth scanning 22 top founder-led companies as another way to spot compelling businesses built for the long haul.

With shares up strongly over the past quarter and trading close to the average analyst target, the key question is whether Constellation’s future cash flow potential is still underappreciated, or if the market has already priced in the growth story.

Most Popular Narrative: 3% Undervalued

At a last close of $165.57 versus a narrative fair value of about $170.73, Constellation Brands is framed as modestly undervalued, with that gap resting on detailed long term cash flow assumptions.

The company plans to generate approximately $9 billion in operating cash flow and $6 billion in free cash flow from fiscal '26 to fiscal '28. This robust cash flow will support investment in growth initiatives, primarily the modular development of their third brewery in Veracruz and additions to existing facilities in Mexico, potentially enhancing revenue.

Curious what kind of revenue path, margin profile and earnings multiple are baked into that fair value view? The full narrative lays out the math and the trade offs in plain numbers.

Result: Fair Value of $170.73 (UNDERVALUED)

However, there is still a real risk that tariffs, inflation and softer beer demand, especially among Hispanic consumers, could pressure margins and challenge this recovery narrative.

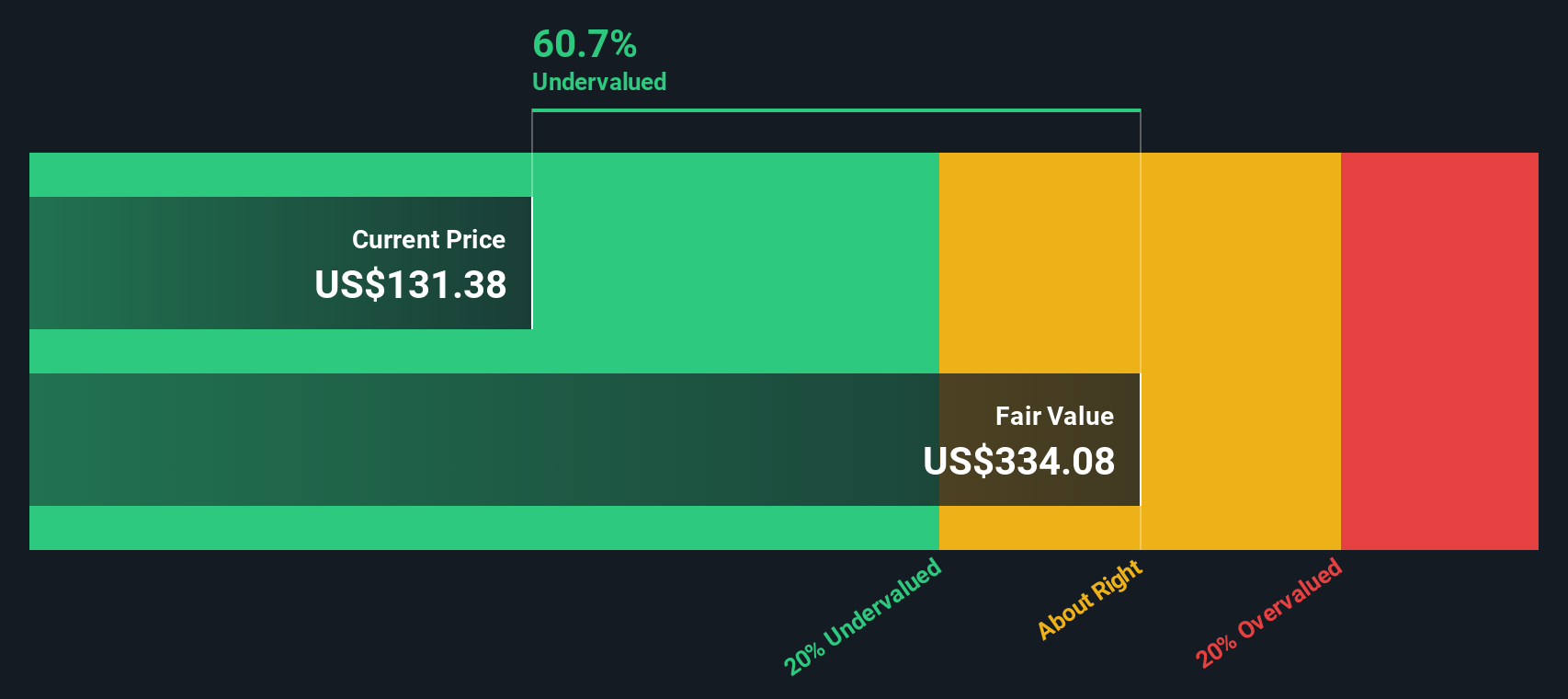

Another Way To Look At The Price

While the narrative fair value pegs Constellation Brands at about $170.73, our SWS DCF model provides a different perspective, indicating a future cash flow value of $321.34 per share, which is 48.5% above the current $165.57 price. That spread raises a simple question: which view do you trust more?

Build Your Own Constellation Brands Narrative

If the story so far does not quite match your view, or you simply want to test your own assumptions against the data, you can build a tailored thesis in just a few minutes by starting with Do it your way.

A great starting point for your Constellation Brands research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Ready To Find Your Next Idea?

If you stop your research with just one stock, you may miss other opportunities that fit your goals even better, so keep pushing your watchlist further.

- Target value by scanning companies that screen as mispriced on quality and fundamentals through our 55 high quality undervalued stocks.

- Lock in income potential by reviewing companies that feature in our 15 dividend fortresses and focus on higher yielding, sturdy payers.

- Protect your downside by filtering for resilient names using the 81 resilient stocks with low risk scores, which is built around businesses with lower risk profiles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.