يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At Construction Partners (ROAD) Valuation After Recent Share Price Softness

Construction Partners, Inc. Class A ROAD | 131.90 | +0.53% |

Why Construction Partners Is On Investors’ Radar

Construction Partners (ROAD) has drawn attention after recent trading saw the stock close at $110.97, with short term returns across the past week and month modestly negative, while the past year and multi year picture looks different.

Recent trading has cooled, with a 1 day share price return decline of 2.84% and softer short term moves, while multi year total shareholder returns above 290% highlight the strength of the longer term trend.

If ROAD has you looking at construction and infrastructure names, it could be a good moment to broaden your search with fast growing stocks with high insider ownership.

With ROAD delivering strong multi year returns but recent trading turning softer, and with analyst targets sitting above the current US$110.97 price while one intrinsic model points to a premium, is there still a buying opportunity here or is the market already pricing in future growth?

Most Popular Narrative: 12.2% Undervalued

The most followed narrative for Construction Partners pegs fair value around $126.43, above the last close at $110.97, and rests heavily on long term funding and integration themes.

Construction Partners is set to benefit from sustained increases in federal, state, and local infrastructure funding, supported by the Infrastructure Investment and Jobs Act (IIJA) and robust state programs, leading to multi-year growth in backlog and long-term visibility on revenue.

The company's concentration in high-growth Sunbelt regions, particularly with recent transformative acquisitions like Lone Star in Texas and Durwood Greene in Houston, aligns with continued migration and urbanization trends that will drive outsized growth in contract awards, organic revenue, and market share.

Curious how this story gets to a higher fair value than today’s price? The narrative leans on faster revenue expansion, fatter margins, and a richer future earnings multiple. The exact mix of those moving parts is where it gets interesting.

Result: Fair Value of $126.43 (UNDERVALUED)

However, that upside story could unravel if public infrastructure budgets tighten, or if higher labor and material costs squeeze Construction Partners’ margins more than expected.

Another View On Valuation

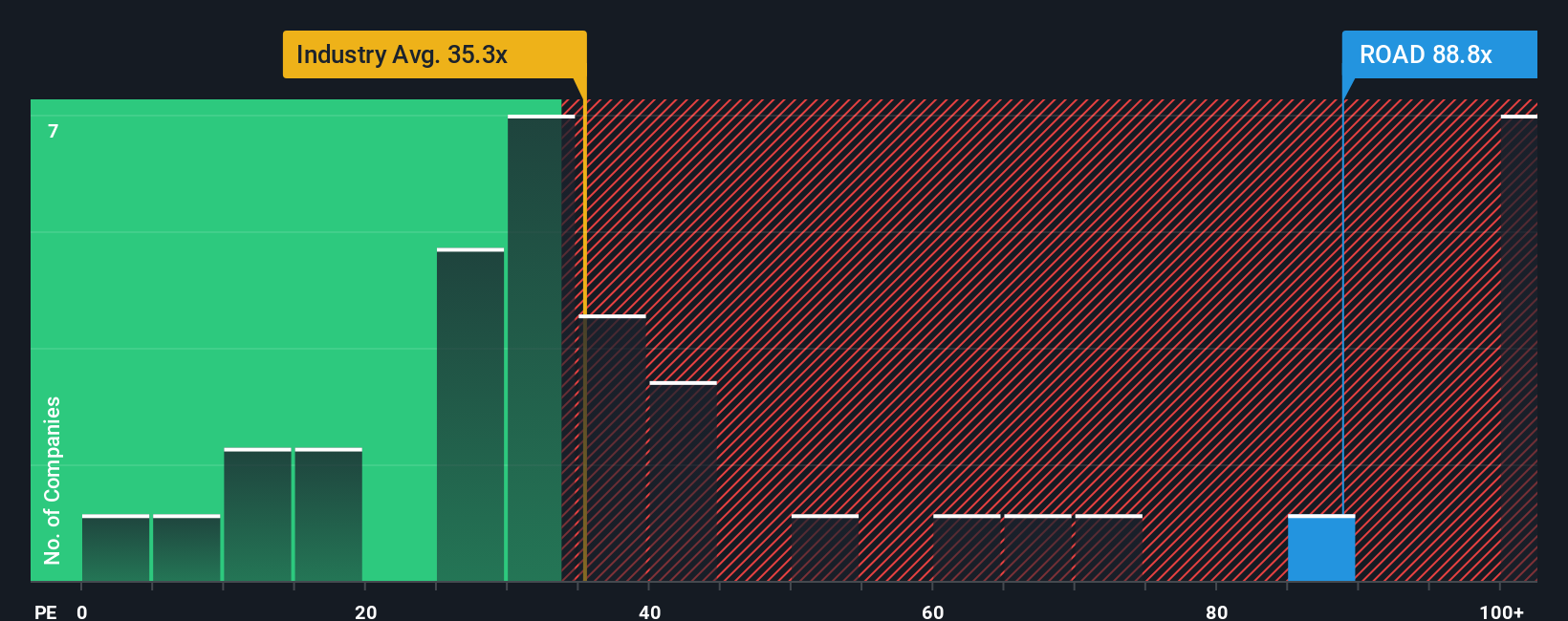

That 12.2% undervalued call sits awkwardly next to the current P/E of 61.6x, which is well above the US Construction industry at 37.6x, the peer average at 34.7x, and a fair ratio of 29.8x. Is the market paying up too much for ROAD’s growth story?

Build Your Own Construction Partners Narrative

If you see the numbers differently or prefer to weigh the assumptions yourself, you can create a custom ROAD story in just a few minutes with Do it your way.

A great starting point for your Construction Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready For More Investment Ideas?

Do not stop at one stock when you can scan whole pockets of the market in minutes. Use the Simply Wall St Screener to spot new angles.

- Zero in on potential mispricings by checking these 864 undervalued stocks based on cash flows that might offer more attractive entry points than well known names.

- Review these 24 AI penny stocks to assess companies involved in technologies that affect how data, automation, and software-driven businesses create value.

- Add a different growth and risk profile by reviewing these 18 cryptocurrency and blockchain stocks linked to blockchain, digital assets, and next generation payment infrastructure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.