يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look at Corebridge Financial’s (CRBG) Valuation Following CEO Transition Announcement

Corebridge Financial, Inc. (SAFG Retirement Services) CRBG | 30.52 30.52 | -3.93% 0.00% Pre |

When a company like Corebridge Financial (CRBG) announces a change at the very top, investors sit up and take notice. The recent news that Marc Costantini will take over as President and CEO effective December 1, 2025, while outgoing CEO Kevin Hogan steps down but remains through a transition phase, could have big implications. Leadership shake-ups at this level tend to spark questions about the company’s strategy, stability, and future direction, especially when the incoming executive brings a track record from industry giants like Manulife Financial, Munich Re, and Guardian Life.

This leadership transition lands in the midst of Corebridge Financial’s steady climb over the past year, with shares up 26% over that period. Despite some recent softness in the past month, momentum has generally been building, helped by strong annual net income growth figures. Investors have also seen the company navigating market shifts and sector headwinds, making this change in leadership an even more crucial moment for the stock’s narrative.

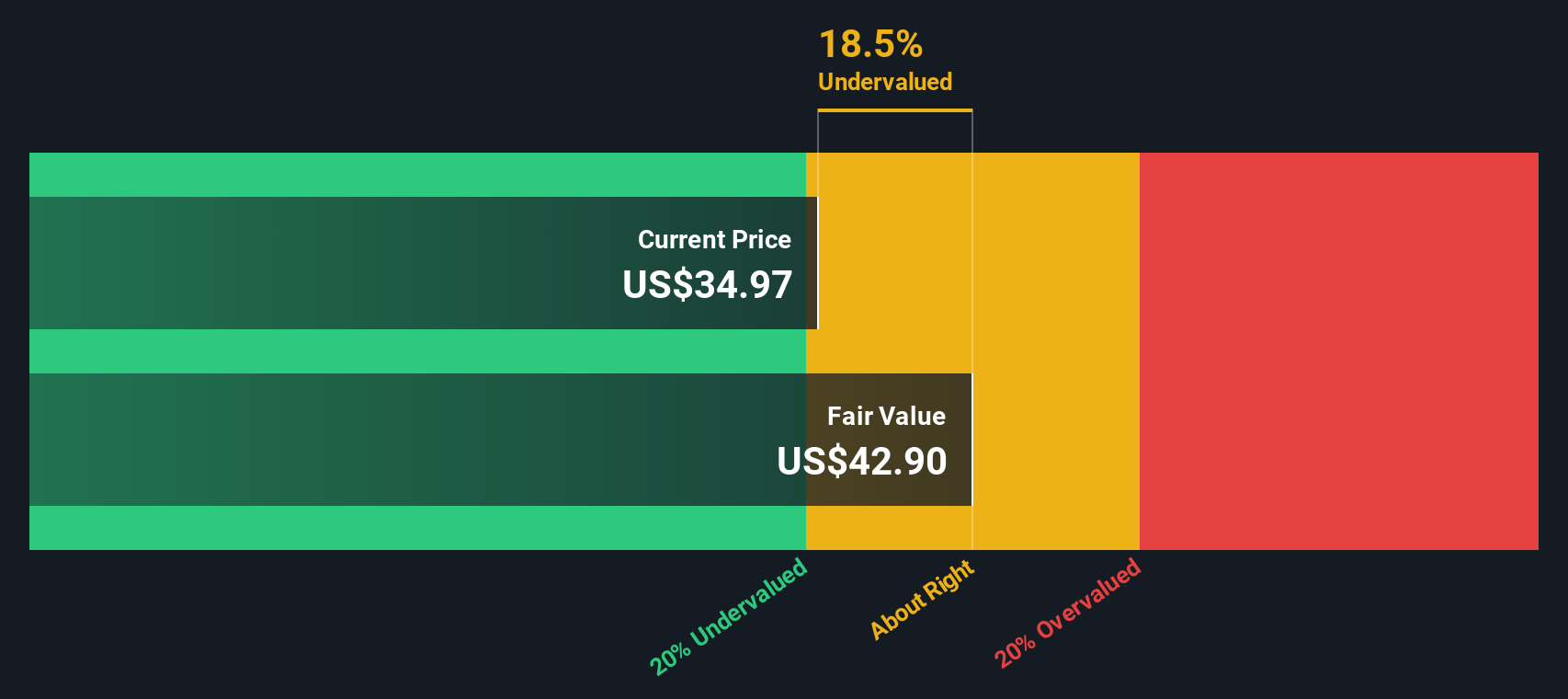

With the CEO change set and the stock’s recent gains, the question for investors now is whether Corebridge Financial is trading at a bargain, or if the recent outperformance already reflects all the good news on the horizon.

Most Popular Narrative: 18.8% Undervalued

The prevailing narrative views Corebridge Financial as significantly undervalued, highlighting robust growth potential and an attractive discount compared to estimated fair value.

"Corebridge is set to benefit from robust growth in individual retirement and annuities sales as the aging U.S. population turns 65 in record numbers. This is fueling increased demand for guaranteed income products and supporting long-term revenue and AUM expansion.

Ongoing shifts from defined benefit pensions to IRAs and 401(k)s are creating sustained secular tailwinds for lifetime income and insurance solutions. This positions Corebridge's broad, innovative annuity and retirement product suite for above-market sales growth and improved future earnings."

Curious about why analysts see so much upside for this stock? The combination of aggressive profit turnaround forecasts and market-beating growth expectations forms the foundation of this bullish narrative. Explore the key financial projections and find out what could drive Corebridge to exceed its fair value estimates.

Result: Fair Value of $41.08 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent low interest rates or lost key distribution partnerships could dampen Corebridge's impressive growth and challenge the company's undervalued story.

Find out about the key risks to this Corebridge Financial narrative.Another View: What Does Our DCF Model Say?

While analyst targets and multiples point to Corebridge as a bargain, our DCF model also suggests the shares are trading well below their estimated fair value. This may support the bullish thesis, but are expectations too rosy?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Corebridge Financial Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can build and share your own narrative in just a few minutes. Do it your way.

A great starting point for your Corebridge Financial research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t just watch from the sidelines while others find the next breakout stars. Make your portfolio stand out by tapping into innovative, undervalued, or income-focused ideas shaping tomorrow’s markets. Take action with these powerful tools:

- Uncover tomorrow’s tech giants by targeting quantum computing stocks in fields such as quantum computing, security, and high-speed data processing.

- Maximize your income stream with dividend stocks with yields > 3%, which offers robust yields above 3 percent for steady, reliable returns in any market.

- Seize undervalued gems by using smart filters to identify undervalued stocks based on cash flows that could offer exceptional upside potential based on their cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.