يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At DiamondRock Hospitality (DRH) Valuation After Upgrade Dividend Hike And Planned Nasdaq Move

DiamondRock Hospitality Company DRH | 9.93 | +0.51% |

Why DiamondRock Hospitality Stock Is Back on Investor Radars

DiamondRock Hospitality (DRH) is drawing fresh attention after Deutsche Bank upgraded the stock, along with a 12.5% dividend increase for 2025 and a planned move to Nasdaq's Global Select Market.

The stock has been quietly gathering momentum, with a 20.31% 90 day share price return and a 1 year total shareholder return of 8.07%. This suggests sentiment has improved alongside the dividend increase, Deutsche Bank upgrade, and upcoming Nasdaq move.

If this kind of renewed interest in a company has caught your eye, it could be a good moment to broaden your search with fast growing stocks with high insider ownership.

With shares at US$9.30, a value score of 4, an intrinsic value gap of about 49%, and only a modest discount to one analyst price target, you have to ask: is there real upside left here, or is the market already pricing in future growth?

Most Popular Narrative: 4.6% Undervalued

The most followed narrative puts DiamondRock Hospitality's fair value at US$9.75 per share, a touch above the recent US$9.30 close, and ties that gap to specific long term earnings and margin assumptions.

The analysts have a consensus price target of $9.136 for DiamondRock Hospitality based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $10.0, and the most bearish reporting a price target of just $8.0.

Curious what kind of revenue growth, margin lift and future P/E level are baked into that fair value, and how much share count shrink is assumed? The full narrative lays out a very specific earnings trajectory and the valuation multiple it would need to trade on to make the math work.

Result: Fair Value of $9.75 (UNDERVALUED)

However, the story could shift quickly if resort RevPAR softness persists or if expense pressures in key urban markets continue to squeeze hotel EBITDA margins.

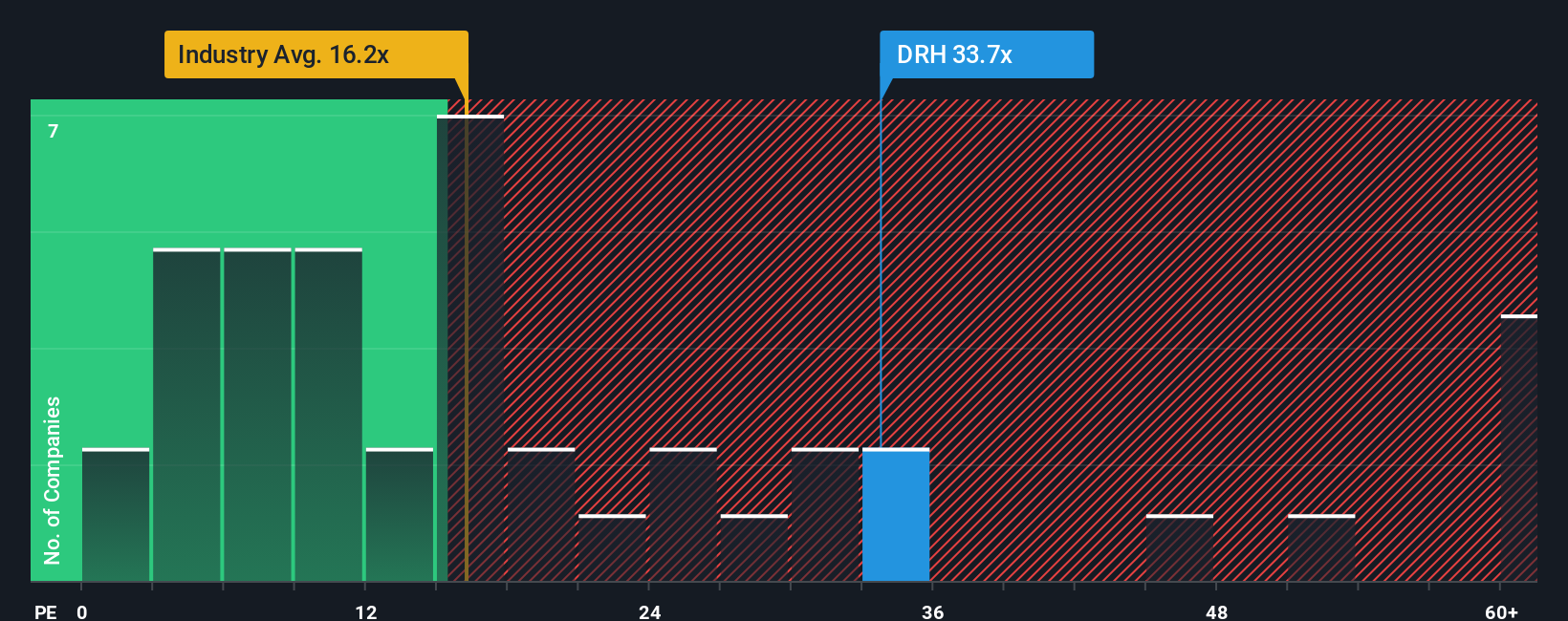

Another Check: What The P/E Ratio Is Telling You

So far the focus has been on fair value around US$9.75 per share. The P/E story is a bit less relaxed. At about 35x earnings, DiamondRock trades well above the global Hotel and Resort REITs average of 15.5x, even though its own fair ratio sits higher at 42.9x and peers average an even richer 56.2x.

That gap means the stock screens expensive against the wider industry, yet still cheaper than its closest peers and the fair ratio the market could move towards. For you, the tension is simple: is this a premium that leaves little room for error, or a middle ground that still has something left in it?

Build Your Own DiamondRock Hospitality Narrative

If you look at the numbers and reach a different conclusion, or prefer to test your own assumptions directly, you can build a personalised view in minutes with Do it your way.

A great starting point for your DiamondRock Hospitality research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If DiamondRock has you thinking harder about where to put your next dollar, do not stop here, widen your net and give yourself better options to compare.

- Spot potential value by checking out these 868 undervalued stocks based on cash flows that may offer more attractive pricing based on cash flows.

- Tap into fast moving themes with these 24 AI penny stocks that sit at the intersection of technology and growth potential.

- Strengthen your income watchlist by looking at these 12 dividend stocks with yields > 3% that already offer yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.