يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At Element Solutions (ESI) Valuation As Fair Value Edges Above Current Share Price

Element Solutions Inc ESI | 35.44 | -0.17% |

Without a specific news event driving attention today, Element Solutions (ESI) still offers investors a set of concrete reference points, including recent share performance metrics and its role as a global specialty chemicals producer.

At a share price of $29.10, Element Solutions has recently paired a 12.18% year to date share price return with a 17.83% 1 year total shareholder return, suggesting momentum has been building rather than fading over both shorter and longer horizons.

If you are comparing Element Solutions with other materials exposed companies, it can be useful to look across aerospace related names too and see how they stack up against aerospace and defense stocks.

With Element Solutions posting a 77.06% 5-year total return, annual revenue of US$2.5b and net income of US$239.4m, the key question is whether the current valuation still leaves upside or if markets are already pricing in future growth.

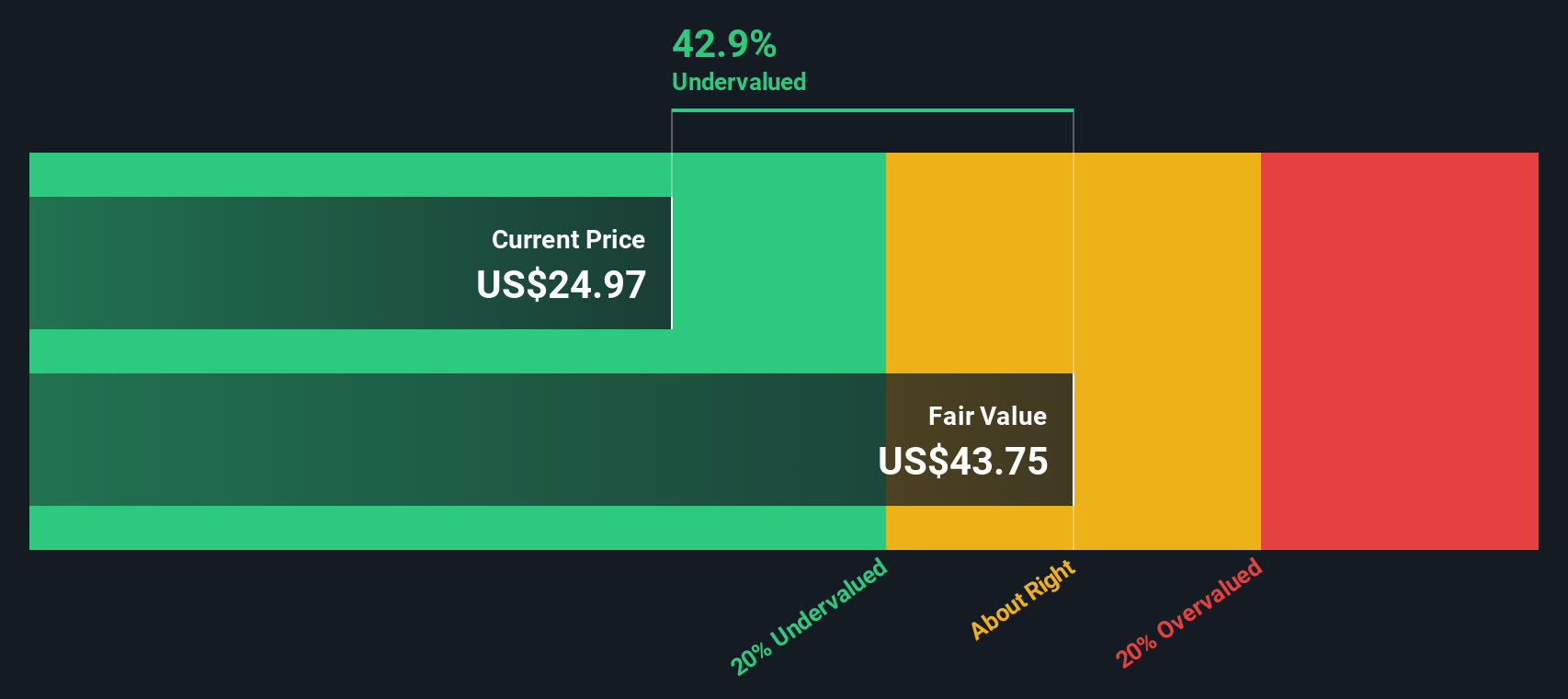

Most Popular Narrative: 11% Undervalued

With Element Solutions last closing at $29.10 against a widely followed fair value estimate of $32.70, the current narrative leans toward upside potential based on updated assumptions.

The fair value estimate has risen slightly from US$32.00 to about US$32.70 per share.

The revenue growth assumption has increased modestly from about 7.17% to about 7.36% and the net profit margin assumption has moved up from about 12.25% to about 12.57%.

Want to see what is sitting behind that higher fair value? Growth expectations, higher margins, and a future earnings multiple all play a central role.

Result: Fair Value of $32.70 (UNDERVALUED)

However, this upbeat story can be knocked off course if cyclical end markets weaken, or if competitive pressure and slower product commercialization squeeze margins more than expected.

Another View: Earnings Multiple Flags A Richer Price

Our DCF model indicates that Element Solutions is trading at about 26.9% below an estimated future cash flow value of $39.83, which suggests the shares screen as undervalued. This differs from the impression you might get from recent share price moves alone, so it may be useful to consider which signal to place more weight on.

Build Your Own Element Solutions Narrative

If you look at the numbers and come to a different view, or simply prefer to test your own assumptions, you can shape a full Element Solutions storyline in just a few minutes, starting with Do it your way.

A great starting point for your Element Solutions research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Element Solutions has caught your attention, do not stop there. Use the Simply Wall St screener to surface more focused ideas that fit your approach.

- Spot potential value candidates early by checking out these 887 undervalued stocks based on cash flows that line up current prices with underlying cash flows.

- Ride powerful technology themes by scanning these 24 AI penny stocks that are tied to artificial intelligence adoption across different sectors.

- Target higher income potential by reviewing these 12 dividend stocks with yields > 3% that offer yields above 3% alongside detailed fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.