يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At First Financial Bankshares (FFIN) Valuation As Leadership Succession Emphasizes Continuity

First Financial Bankshares Inc FFIN | 33.33 | +0.69% |

First Financial Bankshares (FFIN) has put a long planned leadership handover into effect, with 22 year company veteran David Bailey taking over as President and CEO, while former CEO F. Scott Dueser becomes Executive Chairman.

The leadership change comes after a period where the share price has shown short term momentum, with a 30 day share price return of 6.0% and a 90 day share price return of 3.82%. However, the 1 year total shareholder return of an 11.96% decline points to weaker longer term results and mixed sentiment around future growth and risk.

If this kind of leadership transition has you reviewing your banking exposure, it can also be a good moment to widen your search using fast growing stocks with high insider ownership.

With earnings and leadership both shifting, and the share price still below its 1 year level despite recent gains, the key question now is whether FFIN trades at a discount or if the market already reflects expectations for future growth.

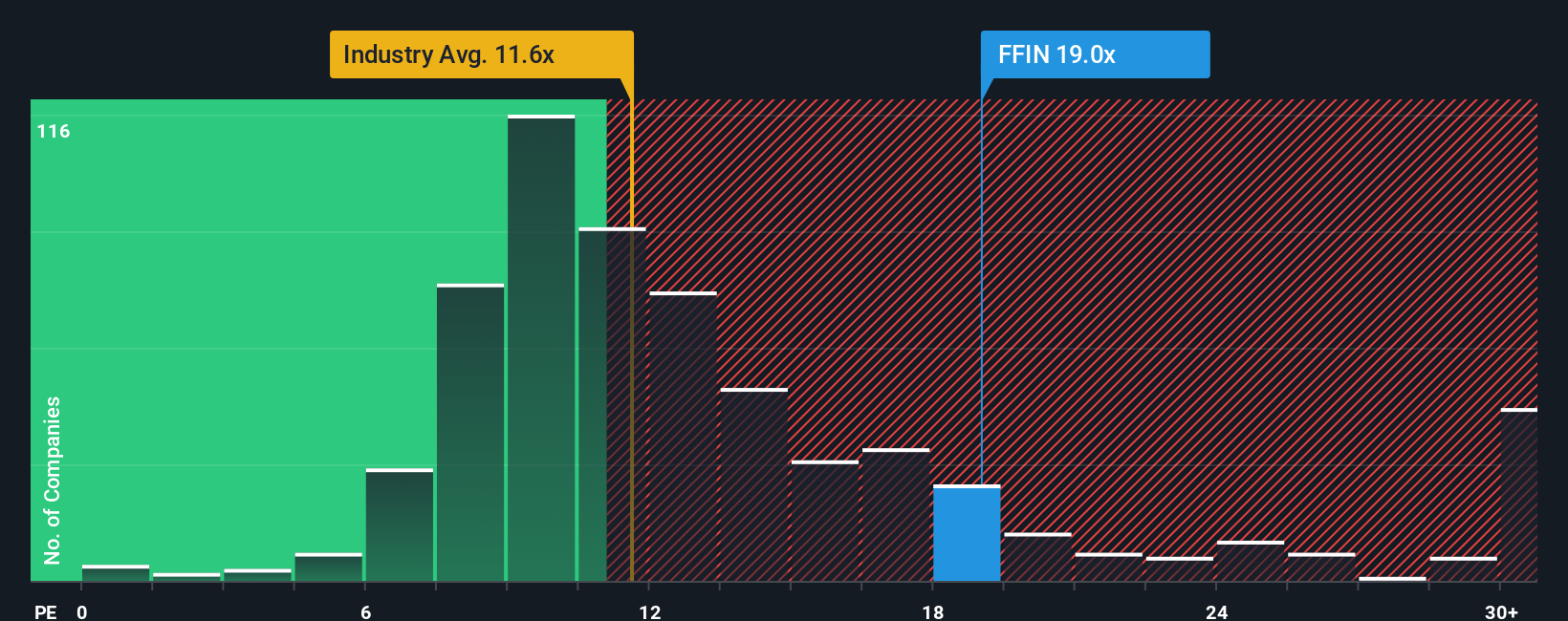

Price to Earnings of 17.9x: Is it justified?

First Financial Bankshares shares last closed at $31.82, and on a P/E of 17.9x they currently trade at a richer level than much of the US banks sector and above the company’s own estimated fair P/E.

The P/E multiple compares the current share price to earnings per share, and for banks it is a quick way to see what investors are willing to pay for each dollar of profit. A higher P/E can signal that the market is building in firmer expectations for profit growth or placing a premium on earnings quality and balance sheet strength.

For First Financial Bankshares, the picture is mixed. On one hand, the stock is described as trading at 28% below an internal fair value estimate and below the SWS DCF model future cash flow value of $44.19, which frames the shares as undervalued on a cash flow basis. On the other hand, the current 17.9x P/E is identified as expensive relative to an estimated fair P/E of 12.7x. This is a level the market could move towards if sentiment cools. Against the broader US banks industry average of 11.7x, that premium P/E suggests investors are currently willing to pay more for each dollar of FFIN earnings than for many peers.

Result: Price-to-Earnings of 17.9x (OVERVALUED)

However, those premium expectations sit alongside a 12% 1 year total return decline and a 16% 5 year total return decline, which could pressure sentiment if performance disappoints.

Another Angle on Value

So far, the P/E of 17.9x makes First Financial Bankshares look expensive next to the US banks average of 11.7x and a fair ratio of 12.7x, even with better value than the 27.6x peer average. That mix of premium and relative discount raises a simple question for you: is this price cushion enough for the risks you are taking?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out First Financial Bankshares for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 887 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own First Financial Bankshares Narrative

If you see the data differently or want to stress test these conclusions against your own view, you can build a custom FFIN story in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding First Financial Bankshares.

Looking for more investment ideas?

If you are serious about fine tuning your portfolio, use the Simply Wall St Screener to quickly surface fresh ideas before the crowd focuses on them.

- Spot potential value by checking out these 887 undervalued stocks based on cash flows that might offer more upside for each dollar you put to work.

- Ride structural themes by scanning these 111 healthcare AI stocks that blend medical expertise with real world AI use cases.

- Lean into high growth narratives with these 24 AI penny stocks that sit at the center of expanding artificial intelligence adoption.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.