يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At MarketAxess Holdings (MKTX) Valuation After Q4 Miss, Buyback Completion And Dividend Increase

MarketAxess Holdings Inc. MKTX | 181.23 | +0.29% |

MarketAxess Holdings (MKTX) just delivered a busy update, with fourth quarter results, a higher regular dividend, completion of a US$300 million buyback, refreshed 2026 guidance, and extended credit facility terms.

Despite the recent flurry of announcements, including the higher dividend and completed US$300 million buyback, the short term story is mixed. The 7 day share price return is 10.49%, while the 1 year total shareholder return shows a 5.82% decline. This suggests momentum has picked up lately, while longer term holders have still experienced weaker results.

If this update has you thinking about where else growth and risk are being repriced, it could be a good moment to look at 23 top founder-led companies as potential next ideas to research.

With the share price up in the past week but longer term returns still weak, and with a higher dividend, completed buybacks and guidance all on the table, investors now have to ask: is there real value here, or is the market already paying up for expected future growth?

Most Popular Narrative: 10.4% Undervalued

At a last close of $179.36 versus a narrative fair value of $200.20, the widely followed view sees MarketAxess trading below its estimated worth, anchored to detailed assumptions about future growth, margins and risk.

The company's accelerated investments in automation, portfolio trading, and proprietary trading protocols (such as Open Trading and Mid-X) are resulting in demonstrable gains across multiple strategic channels (client-initiated, portfolio trading, dealer-initiated), creating new, higher-margin revenue streams likely to enhance net margins over time.

Curious what earnings profile and margin path sit behind that valuation gap? The narrative leans on measured revenue growth, rising profitability and a richer earnings multiple than many peers. The exact hurdle is tight. The reasoning is dense. The full story is in the numbers you have not seen yet.

Result: Fair Value of $200.20 (UNDERVALUED)

However, this depends on MarketAxess defending its core US high grade share, while fee pressure from rivals and lower margin protocols do not erode earnings power.

Another View on Valuation

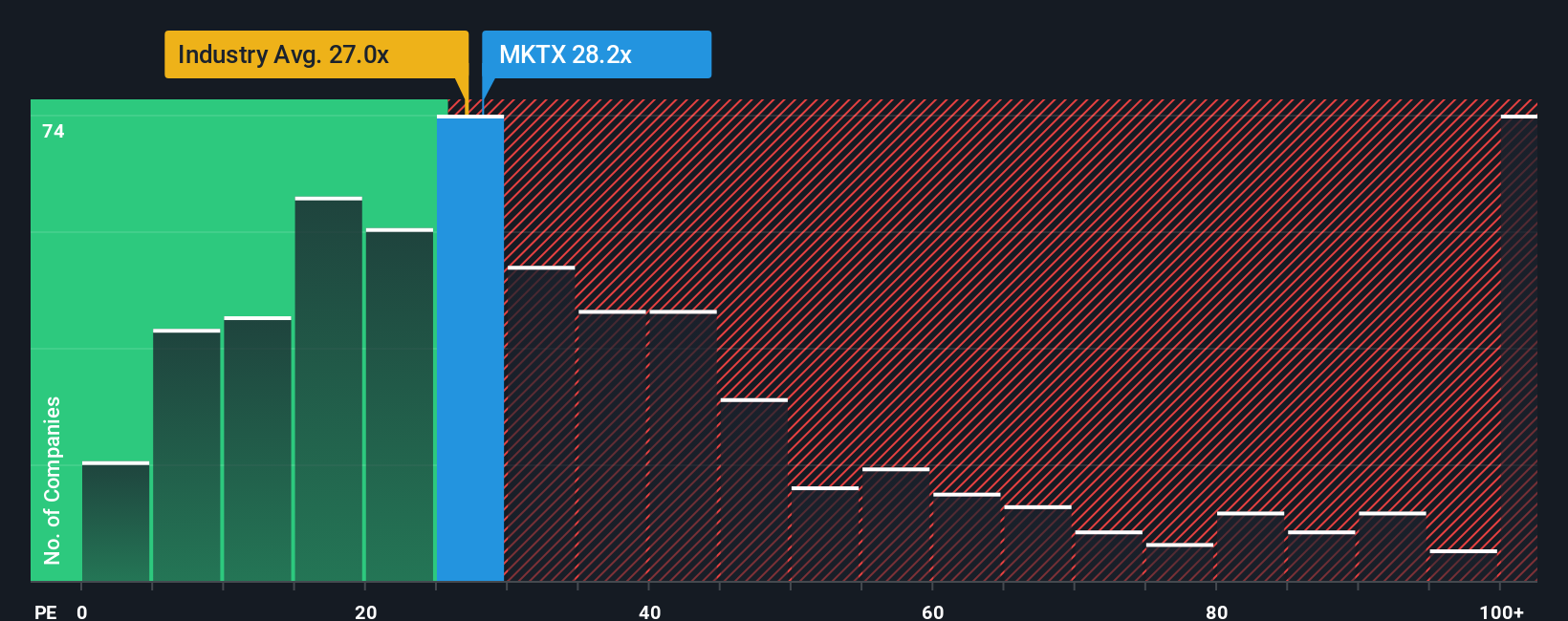

The narrative fair value and DCF work suggest upside, but the P/E ratio tells a different story. At 27x earnings versus a fair ratio of 14.7x and a peer average of 21.6x, the market is already paying a clear premium. Is that gap a cushion or a valuation risk?

Build Your Own MarketAxess Holdings Narrative

If you see the numbers differently, or you just prefer to test your own assumptions, you can shape a full MarketAxess view yourself in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding MarketAxess Holdings.

Looking for more investment ideas?

If you want a clearer view of your next move, do not stop at MarketAxess. Instead, use the screener to surface fresh ideas before others focus on them.

- Spot potential value opportunities early by checking companies our screener tags as 53 high quality undervalued stocks before they are widely discussed.

- Prioritise resilience by focusing on businesses highlighted in our 85 resilient stocks with low risk scores that score well on stability and risk metrics.

- Hunt for lesser known opportunities using our screener containing 23 high quality undiscovered gems and see which names have quality fundamentals but limited market attention so far.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.