يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look at Montrose Environmental Group’s (MEG) Valuation Following Growth Opportunities from New Environmental Compliance Projects

Montrose Environmental Group MEG | 26.73 | -1.00% |

Montrose Environmental Group (NYSE:MEG) has recently captured investor interest after news broke of its active role in helping chemical manufacturers gear up for the forthcoming Hazardous Organic NESHAP Maximum Achievable Control Technology (HON MACT) regulation. As deadlines for the stricter rules approach, Montrose is already working on more than 30 projects nationwide. This positions the company as a key partner for complex compliance needs. For investors, this uptick in project activity could be more than a passing headline, as it frames Montrose as a company able to convert regulatory change into business momentum.

Against the backdrop of this regulatory push, Montrose’s shares have been on the rise and are now trading near yearly highs. Short-term momentum is clearly positive, with the stock up 26% over the past 3 months and more than 6% this past month alone. While long-term returns have been mixed, with a modest 2% gain for the year and clawing back from softness in prior years, the combination of new projects and headline earnings growth projections has started to shift sentiment in a more optimistic direction.

With Montrose seemingly at an inflection point, the question is whether the recent optimism still leaves room for upside or if the market has already priced in the company’s growth story ahead of the new regulation deadlines.

Most Popular Narrative: 3.2% Undervalued

According to the most widely followed narrative, Montrose Environmental Group’s current share price reflects a modest undervaluation, with the stock trading about 3% below analyst fair value estimates.

Expansion of proprietary environmental treatment technologies and patents, particularly in PFAS and broader industrial water treatment, is growing Montrose's addressable market and enabling higher-margin, differentiated service delivery. This supports both revenue growth and continued net margin expansion.

The real engine behind this valuation is not just regulatory tailwinds. Major revenue growth ambitions, bigger profit margins, and aggressive technology bets are setting the stage for a fast-evolving earnings story. Want to know what industry averages Montrose is projected to reach, and how much its future profit margins are expected to leap? The full narrative breaks down the financial leaps and the bold assumptions that drive this price target.

Result: Fair Value of $30.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, it is important to note that reliance on large one-off emergency projects, along with a pause in acquisitions, could bring future earnings volatility.

Find out about the key risks to this Montrose Environmental Group narrative.Another View: Discounted Cash Flow Approach

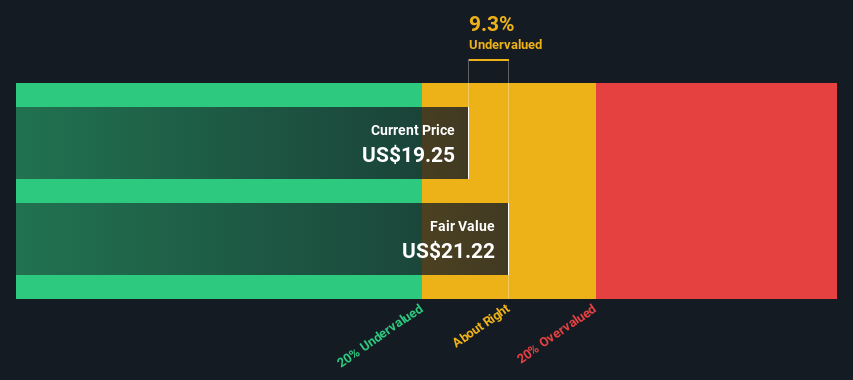

Taking a step back from the analyst consensus, our DCF model provides a different angle. This approach suggests Montrose shares are still undervalued and casts new light on the earlier fair value discussion. But will market sentiment or fundamentals drive the next move?

Build Your Own Montrose Environmental Group Narrative

If these perspectives do not fully align with your view or you would rather draw your own conclusions, you can shape your own narrative in just a few minutes. Do it your way

A great starting point for your Montrose Environmental Group research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. With the right tools, you can uncover stocks that match your investment style and spot tomorrow’s winners today.

- Tap into rapid tech transformation by tracking companies accelerating breakthroughs in artificial intelligence through our curated AI penny stocks selection.

- Lock in reliable income by finding businesses offering stable cash flows and attractive yields. Get started with our trusted dividend stocks with yields > 3% resource.

- Seize value now by targeting shares trading below intrinsic worth, all conveniently listed in our focused undervalued stocks based on cash flows screen.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.