يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At Navios Maritime Partners (NMM) Valuation After Strong Q3 2025 Beat And Leadership Changes

Navios Maritime Partners LP NMM | 59.51 | -0.51% |

Why Navios Maritime Partners is in focus after Q3 2025

Navios Maritime Partners (NMM) hit a 52 week high after reporting Q3 2025 results that topped analyst expectations for earnings and revenue, alongside senior leadership promotions tied to a broader corporate restructuring.

The stock’s 8.7% 7 day share price return and 26.3% 90 day share price return suggest momentum has been building ahead of and around the Q3 2025 earnings beat and leadership changes, while the 1 year total shareholder return of 22.2% and 5 year total shareholder return above 3x highlight how recent gains fit into a much longer run of value creation for investors.

If strong shipping results have your attention, this could be a good moment to broaden your watchlist with fast growing stocks with high insider ownership and see what else is moving.

With Navios Maritime Partners now at a 52 week high and trading at a discount to the average analyst price target, the key question is whether there is still a buying opportunity or if the market is already pricing in future growth.

Most Popular Narrative: 23.9% Undervalued

With Navios Maritime Partners closing at US$55.57 versus a narrative fair value of US$73.00, the current price sits well below that reference point.

The company's successful strategy of selling older ships at favorable prices while investing in newbuilds and securing long-term charters contributes to both predictable cash flows and enhanced asset values. This approach may help mitigate earnings volatility and improve future returns on equity.

Curious what earnings profile could justify that gap to fair value? Revenue growth, margin expansion and a re rated profit multiple all sit at the core. Want to see how those moving parts connect across the next few years and into that valuation?

Result: Fair Value of $73 (UNDERVALUED)

However, those assumptions could be challenged if weaker freight markets persist, or if heavy capex and a US$2.2b debt load squeeze cash flow and margins.

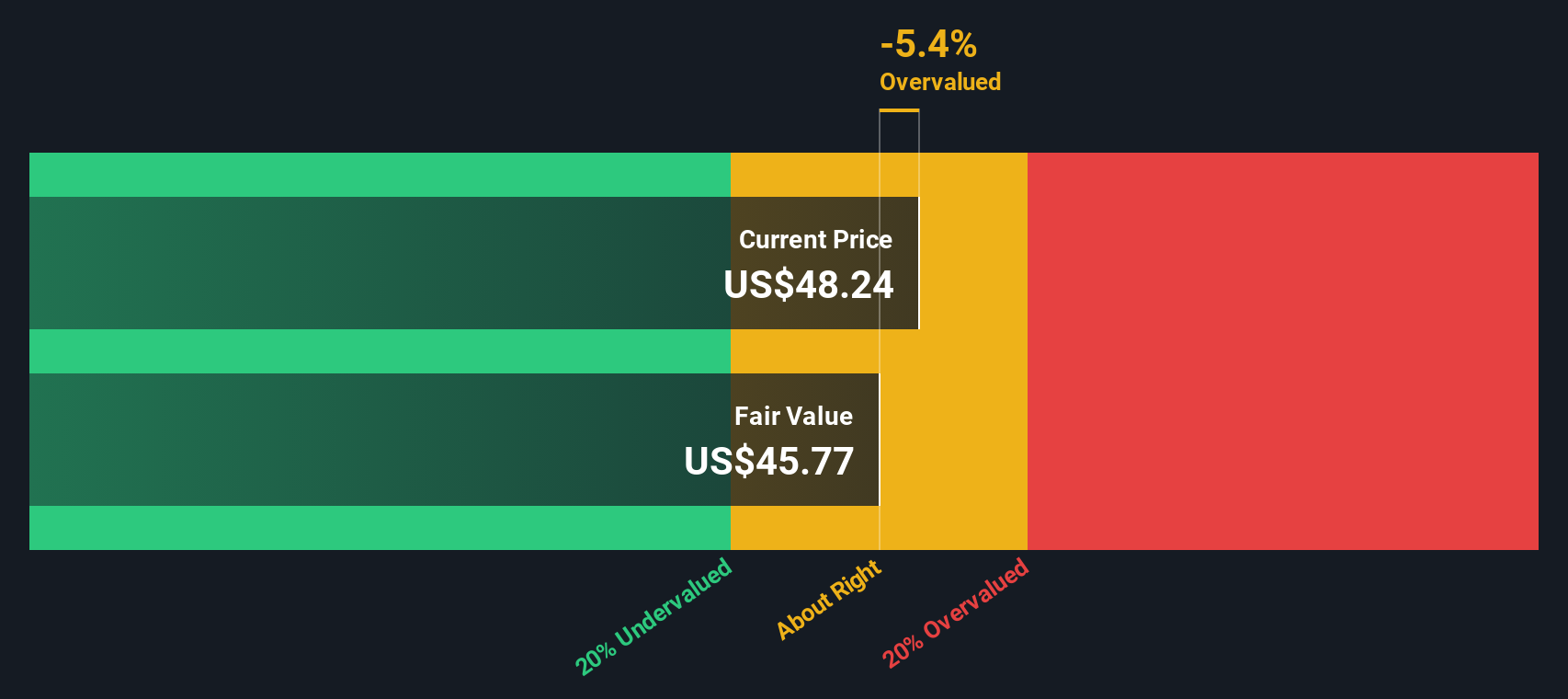

Another View: DCF Flags a Very Different Story

While the narrative fair value sits at US$73.00 and suggests upside, our DCF model points the other way. On those cash flow assumptions, Navios Maritime Partners' current price of US$55.57 sits above an estimated fair value of US$38.14, which implies limited cushion if expectations slip.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Navios Maritime Partners for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 100+ undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Navios Maritime Partners Narrative

If you see the numbers differently, or prefer to test your own assumptions, you can build a custom thesis in a few minutes: Do it your way.

A great starting point for your Navios Maritime Partners research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready to hunt for your next idea?

If Navios Maritime Partners is on your radar, do not stop there. Broaden your search now so you do not miss the next opportunity setting up.

- Spot potential bargains early by checking these 100+ undervalued stocks based on cash flows that may be trading below what their cash flows suggest.

- Ride powerful tech trends by scanning these 27 AI penny stocks tied to artificial intelligence themes across different industries.

- Target income ideas by reviewing these 12 dividend stocks with yields > 3% that offer yields above 3% alongside equity exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.