يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At Ollie's Bargain Outlet (OLLI) Valuation As Recent Gains Cool And Premium P/E Persists

Ollie's Bargain Outlet Holdings Inc OLLI | 108.71 | -0.72% |

How Ollie's Bargain Outlet Holdings (OLLI) has been trading recently

With no single headline event driving attention today, Ollie's Bargain Outlet Holdings (OLLI) has still seen some interesting recent moves, including a small gain over the past month alongside mixed short term returns.

For context, the stock shows a 1 day return of about a 2.1% decline, a 7 day return of roughly a 3% decline, and a month gain of about 5.8%, while the past 3 months reflect around a 5.3% decline.

At a share price of $114.21, Ollie's Bargain Outlet Holdings is seeing short term momentum cool after its recent 30 day share price return of 5.8%, even as the 1 year total shareholder return of 0.5% contrasts with a much stronger 3 year total shareholder return of about 114%. This suggests that earlier enthusiasm has eased.

If Ollie's recent swings have you reassessing your watchlist, this could be a good moment to broaden your search and check out fast growing stocks with high insider ownership.

With the share price at $114.21 and a value score of 1, the key question is whether Ollie’s current valuation still leaves room for upside, or if the market is already fully pricing in its future growth potential.

Price-to-Earnings of 31.3x: Is it justified?

At a last close of $114.21 and a P/E of 31.3x, Ollie's Bargain Outlet Holdings is priced well above several reference points, including peer and industry averages and an estimated fair P/E level.

The P/E multiple compares the current share price to earnings per share, so a higher P/E usually means the market is assigning a richer price for each dollar of earnings. For a retailer like Ollie's, this often reflects expectations around earnings growth, store economics and the resilience of its discount model through different spending conditions.

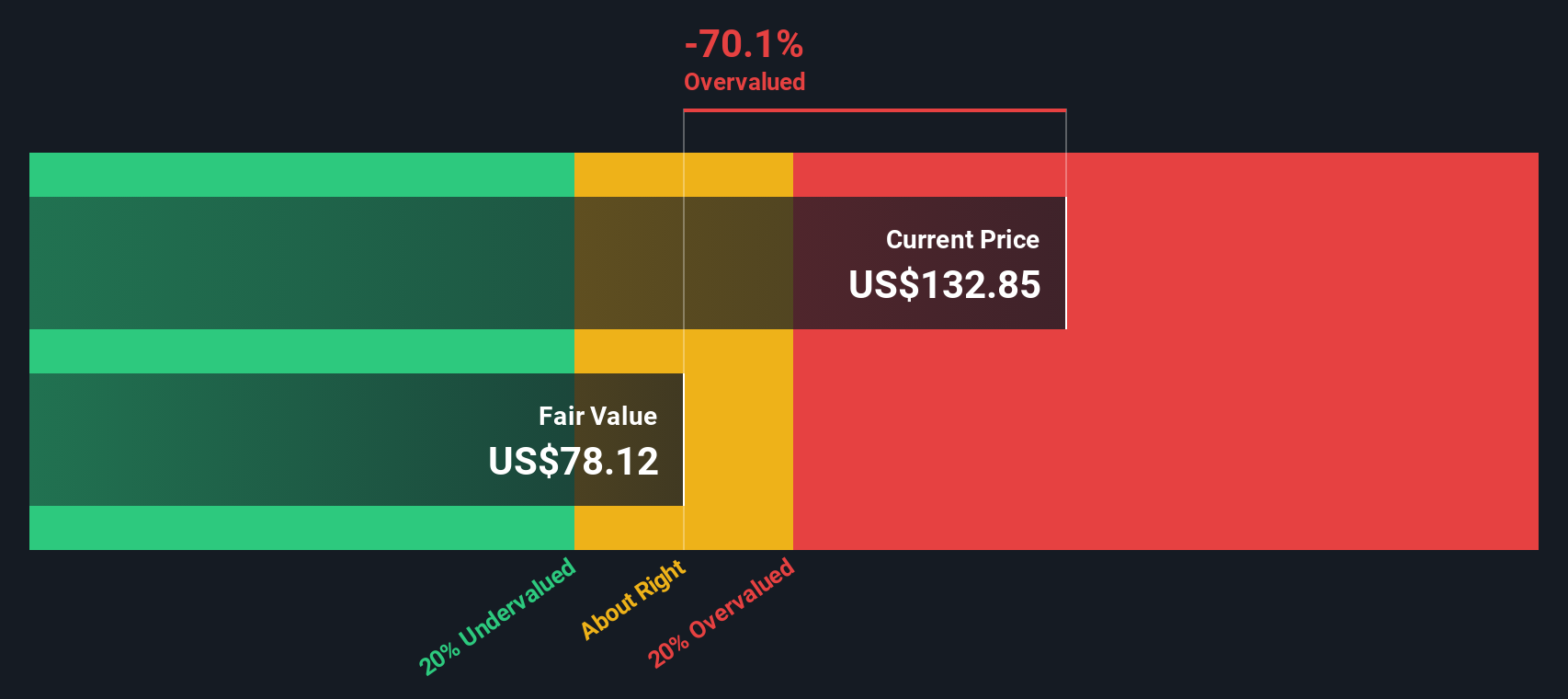

Here, the company is described as expensive versus an estimated fair P/E of 18.4x and a peer average of 17.7x. This suggests the current market price is assigning a premium. That premium sits alongside an assessment that the shares are trading above an SWS DCF fair value estimate of $79.08, pointing to a valuation level the market could move closer to if sentiment or growth expectations soften.

Compared with the global multiline retail industry average P/E of 20.1x, Ollie's 31.3x stands out as materially higher. This signals investors are currently willing to pay much more for its earnings than for the typical retailer in the sector.

Result: Price-to-Earnings of 31.3x (OVERVALUED)

However, you also need to consider risks such as a potential reset in investor expectations around its 31.3x P/E and any hit to discount retail spending behavior.

Another View: What the DCF Model Suggests

While the 31.3x P/E paints Ollie's Bargain Outlet Holdings as expensive, our DCF model points in the same direction. With the shares at $114.21 versus an estimated fair value of $79.08, the model suggests the price embeds a lot of optimism. The real question for you is whether that optimism still feels comfortable.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ollie's Bargain Outlet Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 872 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ollie's Bargain Outlet Holdings Narrative

If this take does not quite match your view or you prefer to test the numbers yourself, you can build a custom thesis in just a few minutes by starting with Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Ollie's Bargain Outlet Holdings.

Looking for more investment ideas?

Before you move on, give yourself a chance to spot fresh opportunities. A few minutes with the right screeners can surface ideas you might otherwise miss.

- Spot potential value pockets by scanning these 872 undervalued stocks based on cash flows that currently trade at prices the market may not fully appreciate.

- Tap into next generation digital trends with these 19 cryptocurrency and blockchain stocks focused on companies linked to cryptocurrencies and blockchain technology.

- Zero in on income opportunities through these 13 dividend stocks with yields > 3% that offer yields above 3% for investors who care about regular cash returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.