يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At Phibro Animal Health (PAHC) Valuation After Strong Recent Shareholder Returns

Phibro Animal Health Corporation Class A PAHC | 52.80 | +1.83% |

Phibro Animal Health (PAHC) has been catching investor attention after a period of strong longer term total returns, alongside steady reported revenue of US$1.4b and net income of US$67.8m.

Recent trading has reflected growing interest, with the latest share price at US$39.72 and a 90 day share price return of 9.15%, while the 1 year total shareholder return of 87.89% points to strong momentum building over time.

If Phibro’s performance has you looking at the wider animal health and pharma space, it could be a good time to scan other pharma stocks with solid dividends for comparison.

With Phibro trading at US$39.72, an intrinsic value estimate suggesting a sizeable discount and analyst targets a little higher, the key question is whether the stock is still undervalued or if the market is already pricing in future growth.

Most Popular Narrative: 7.6% Undervalued

With Phibro Animal Health recently closing at US$39.72 against a narrative fair value of about US$43, the current pricing sits below that anchor while analysts frame a specific earnings path behind it.

The analysts have a consensus price target of $35.75 for Phibro Animal Health based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $45.0, and the most bearish reporting a price target of just $27.0.

Want to see what is driving that valuation gap? The narrative focuses on a specific revenue trajectory, a step up in margins, and a future earnings multiple that all have to align.

Result: Fair Value of $43 (UNDERVALUED)

However, that gap could close quickly if margin expansion stalls or regulatory shifts in antibiotic use and livestock emissions change the long term earnings path.

Another View: Market Multiple Flags a Richer Price

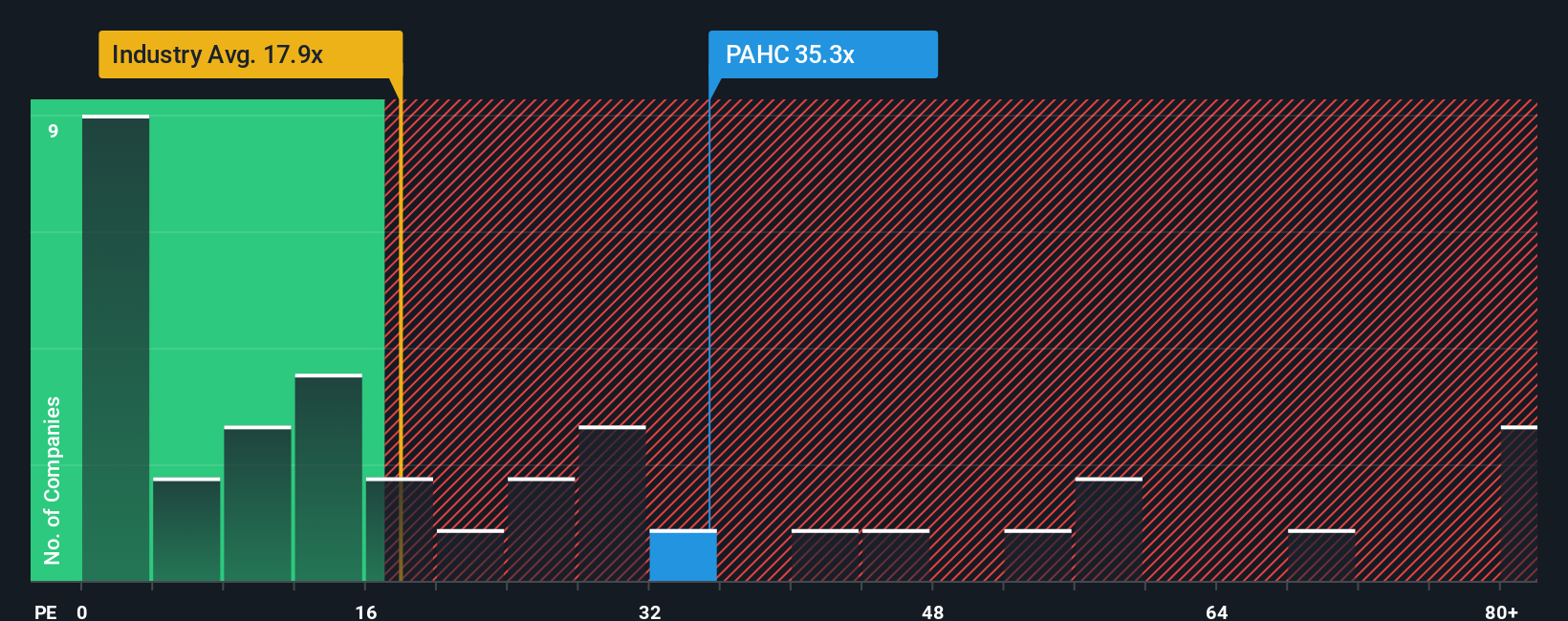

While the narrative fair value points to Phibro as 7.6% undervalued, the current P/E of 23.7x tells a different story. It sits above the US pharmaceuticals industry at 19.9x, the peer average at 13.4x, and even the 19.6x fair ratio our model suggests the market could move toward.

That gap means investors today are paying a premium compared with both peers and the fair ratio, which can limit room for error if earnings or sentiment soften. The question is whether you think Phibro’s earnings path justifies staying above those benchmarks for long.

Build Your Own Phibro Animal Health Narrative

If you see the numbers differently or simply prefer to weigh the data yourself, you can shape a fresh story in minutes using Do it your way.

A great starting point for your Phibro Animal Health research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with a single stock, you might miss opportunities that fit your style even better, so widen your search with a few focused screeners today.

- Spot potential bargains early by scanning these 100+ penny stocks with strong financials where smaller companies can offer different risk and reward profiles to larger names.

- Position yourself in trends shaping the future of technology by checking out these 28 AI penny stocks that concentrate on businesses tied to artificial intelligence.

- Hunt for potential value ideas with these 879 undervalued stocks based on cash flows which filters companies priced below what their cash flows might suggest.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.