يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Look At ServisFirst Bancshares (SFBS) Valuation After Recent Share Price Strength

ServisFirst Bancshares Inc SFBS | 86.77 | +1.74% |

Recent performance snapshot for ServisFirst Bancshares

ServisFirst Bancshares (SFBS) has drawn investor attention after a recent share price move, with the stock around $86.14 and showing mixed return patterns across the past year and multi year periods.

Recent trading has been relatively steady, with a 30 day share price return of 10.07% and a 90 day share price return of 26.27%, while the 1 year total shareholder return of 0.93% decline contrasts with a 5 year total shareholder return of 98.59%. This suggests long term holders have seen stronger results than more recent investors.

If this price action has you thinking about where else capital could work, it may be a good time to broaden your search and check out 23 top founder-led companies.

With ServisFirst Bancshares trading near $86.14, some valuation models suggest meaningful upside, while recent returns look more muted. Is the market overlooking its potential, or already pricing in the bank’s future growth?

Most Popular Narrative: 2.1% Undervalued

ServisFirst Bancshares most followed valuation narrative puts fair value at $88, slightly above the recent $86.14 close, and builds that view off detailed revenue, margin, and discount rate assumptions.

Expansion of commercial lending teams and ongoing hiring in key Southeastern markets positions the company to capitalize on robust population and business growth in the Sun Belt, supporting above average organic loan and deposit growth, which is likely to drive top line revenue and long term earnings growth.

Curious what earnings path, revenue mix, and profit margins are baked into that $88 figure, and how a single valuation model ties them together? The full narrative unpacks those assumptions step by step, including the projected earnings level and the profit multiple it would need to trade on to make that price hold up.

Result: Fair Value of $88 (UNDERVALUED)

However, that story could change if credit costs rise further in commercial real estate, or if deposit growth remains pressured and funding becomes more expensive.

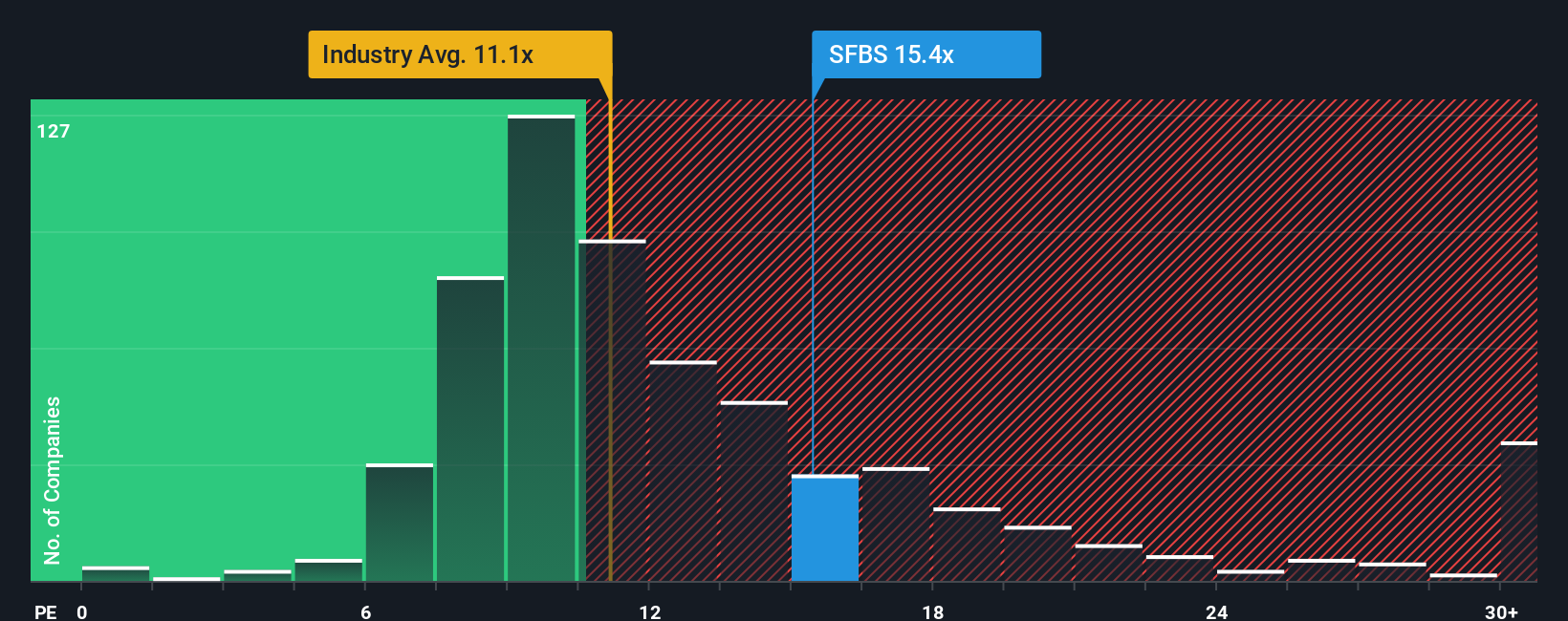

Another View: P/E Ratios Paint A Different Picture

Our DCF model suggests ServisFirst Bancshares is trading about 40.7% below an estimated fair value of $145.17. However, the market is valuing the shares at a P/E of 17x, which is higher than both the US Banks industry at 11.9x and the fair ratio of 14.7x. Is this a margin of safety, or a premium that could limit upside?

Build Your Own ServisFirst Bancshares Narrative

If you look at the numbers and reach a different conclusion, or simply prefer to build your own view from the ground up, you can shape your own narrative in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding ServisFirst Bancshares.

Looking for more investment ideas?

If ServisFirst has sharpened your thinking, do not stop here. The best portfolios usually come from comparing many solid candidates before committing fresh capital.

- Target resilient cash generators with room to rerate by checking our list of 53 high quality undervalued stocks. It is built from companies that pair quality fundamentals with compressed valuations.

- Strengthen your income stream by reviewing 12 dividend fortresses, a set of businesses offering higher yielding payouts that some investors use as a core cash return anchor.

- Add stability to your watchlist by scanning 84 resilient stocks with low risk scores, a collection of companies filtered for lower risk scores that some investors treat as a defensive core.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.